Bitcoin miner balance decline mirrors drop in hash rate, triggering market caution

Bitcoin miner balance decline mirrors drop in hash rate, triggering market caution Quick Take

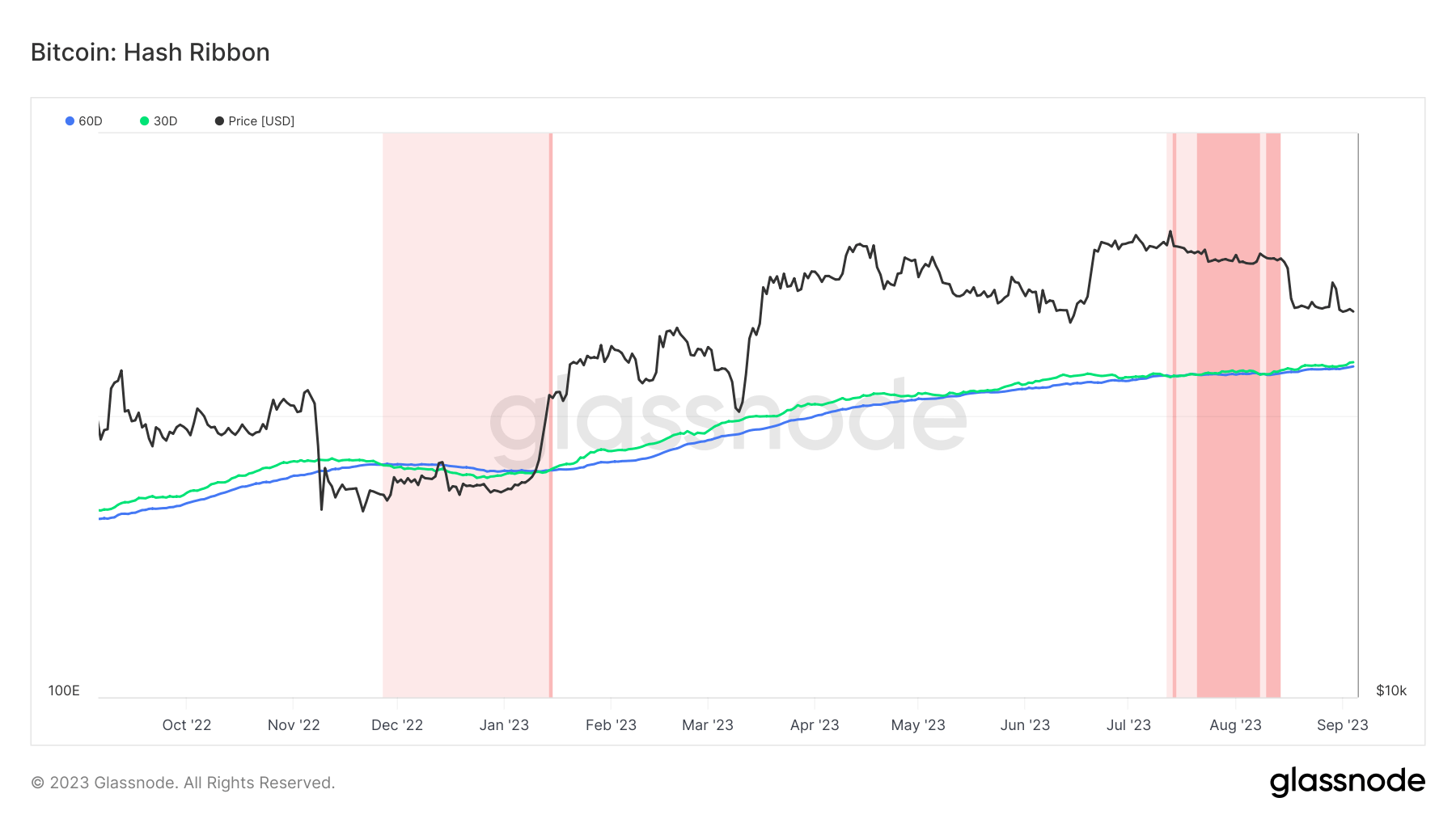

The recent downturn in Bitcoin can be seen in the fluctuations witnessed in the miner balance. Last week, the Bitcoin hash rate saw a 5% drop from its peak value of 400 eh/s. This was concurrent with an anticipated decline of around 3.5% in the difficulty adjustment, a measure of how hard it is to mine a new block for the Bitcoin blockchain.

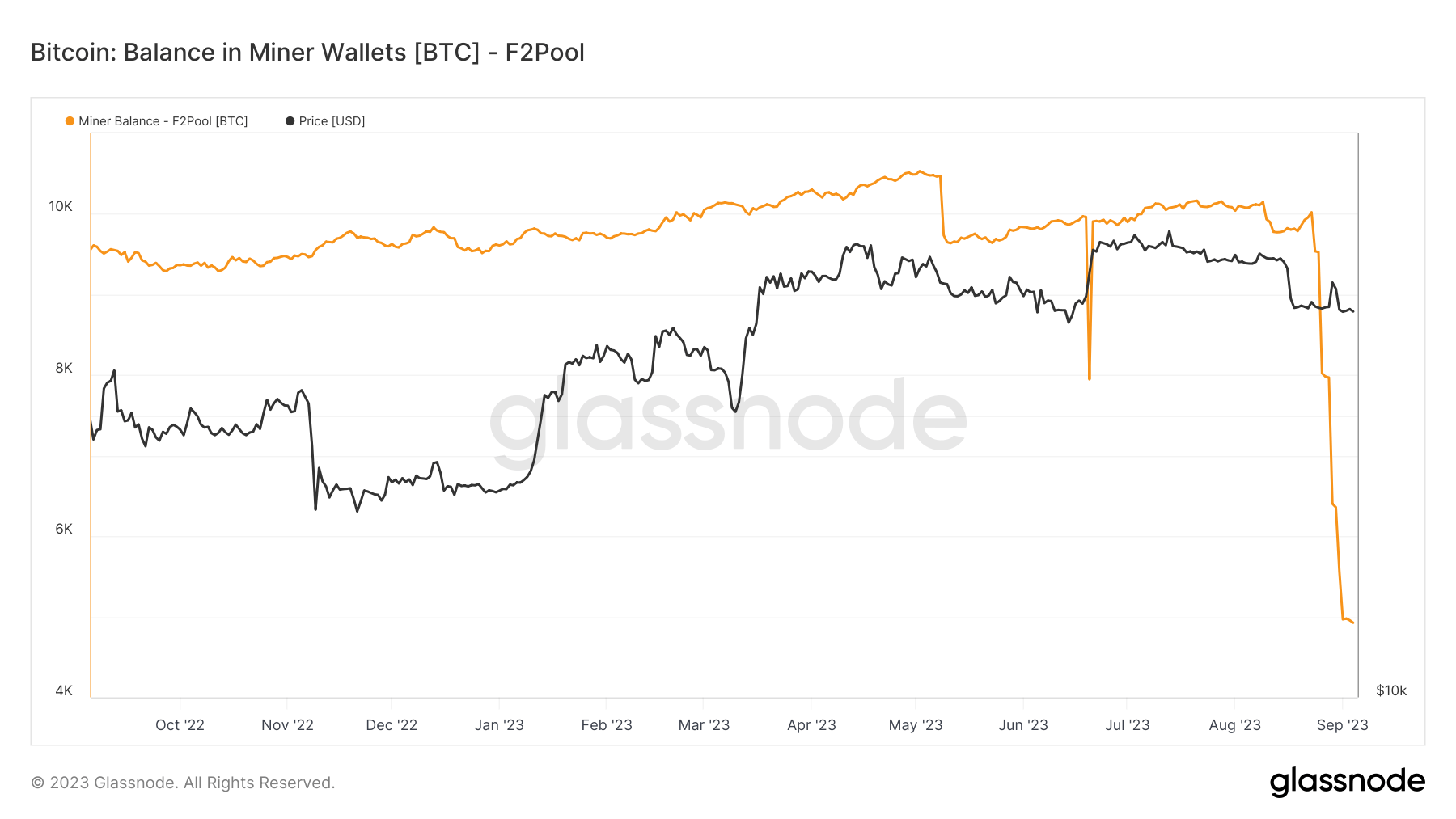

This technical shift in the Bitcoin mining landscape was reflected in the miner balance, which saw a decrease of approximately 4,000 BTC. The primary source of this sell-off was F2Pool, which witnessed a significant reduction of its BTC balance by half.

However, a subsequent minor increase in the miner balance indicates the possibility of a reduction in sell pressure, suggesting the worst could be over. However, caution must be exercised as another drop in Bitcoin’s value could potentially trigger another round of miner capitulation, further affecting the market dynamics.