Bitcoin “HODL wave” patterns signal potential FOMO-driven price climbs

Bitcoin “HODL wave” patterns signal potential FOMO-driven price climbs Quick Take

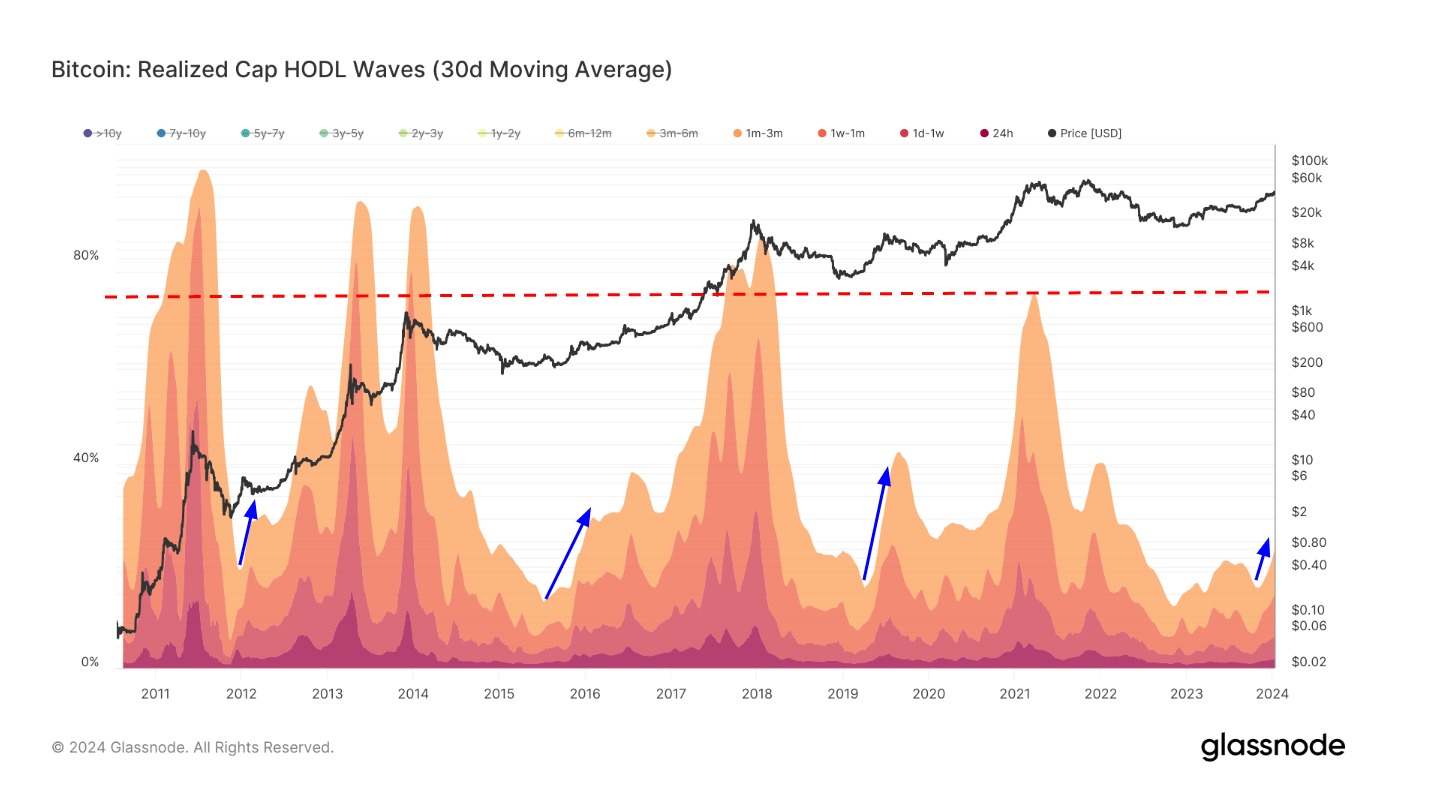

HODL waves, a visual depiction of Bitcoin’s supply based on when it last moved, are revealing a budding cohort in the digital asset domain.

Short-term holders, defined as those retaining Bitcoin for a maximum of 155 days. Looking specifically at investors who have held for three months or less are increasing in number and currently account for 14% of the Bitcoin supply. These investors, often speculative, hold the potential to either liquidate their positions after a few months or mature into long-term holders, retaining their Bitcoin for 155 days or longer.

An interesting trend emerges as we delve deeper into the HODL waves. When the short-term holder percentage reaches certain levels, these investors often metamorphose into longer-term holders, a pattern indicated by previous cycles. This transformation results in a larger proportion of Bitcoin supply being held by these investors.

Nevertheless, the cycle peak occurs when short-term holders become the dominant investors, controlling about 80% of the supply. This typically corresponds with market tops, as these investors tend to drive the price up in a ‘Fear of Missing Out’ (FOMO) euphoria, with long-term holders offloading their holdings.