Bitcoin ETFs experience fifth consecutive trading day of outflows

Bitcoin ETFs experience fifth consecutive trading day of outflows Quick Take

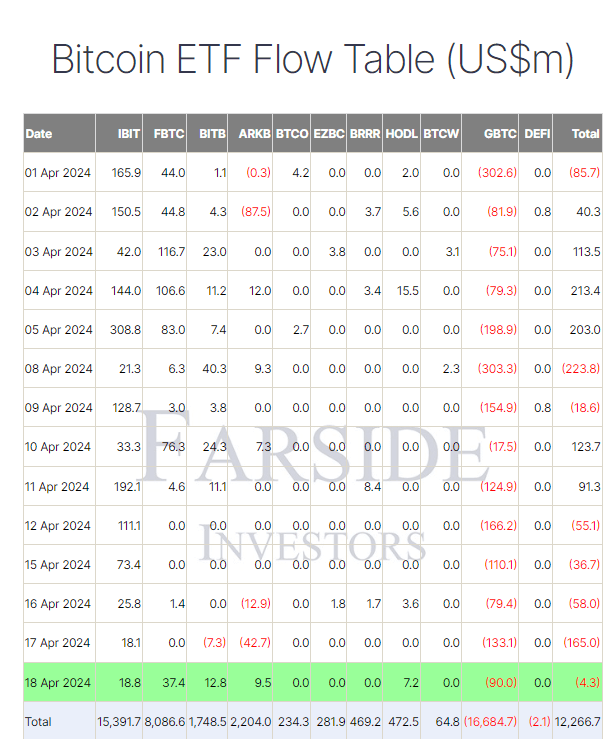

Farside data shows that on April 18, Bitcoin (BTC) exchange-traded funds (ETFs) experienced a small outflow of $4.3 million, marking the fifth consecutive trading day of outflows. However, this was the smallest outflow among the previous five trading days, suggesting a potential shift in sentiment.

Farside data reports that Grayscale GBTC saw outflows of $90 million, bringing its total outflows to $16.6 billion. The average daily outflow of GBTC, $245.4 million, hasn’t been reached since April 8, indicating a slowdown. In contrast, other ETFs experienced inflows. BlackRock IBIT and Fidelity FBTC saw inflows of $18.8 million and $37.4 million, respectively. BITB, ARKB, and HODL also witnessed inflows, demonstrating a growing breadth of interest.

Despite the mixed flows, Bitcoin ETFs have collectively attracted $12.2 billion in net inflows since their launch, according to Farside.