Bank of England wrestles with stubborn inflation as U.S. eyes rate hikes

Bank of England wrestles with stubborn inflation as U.S. eyes rate hikes Quick Take

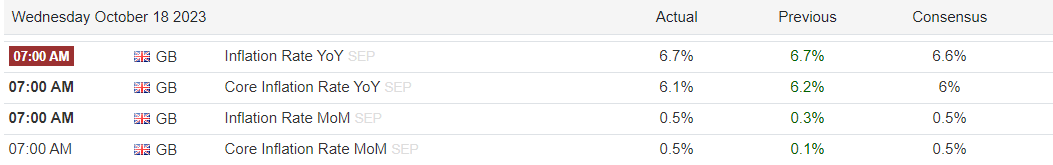

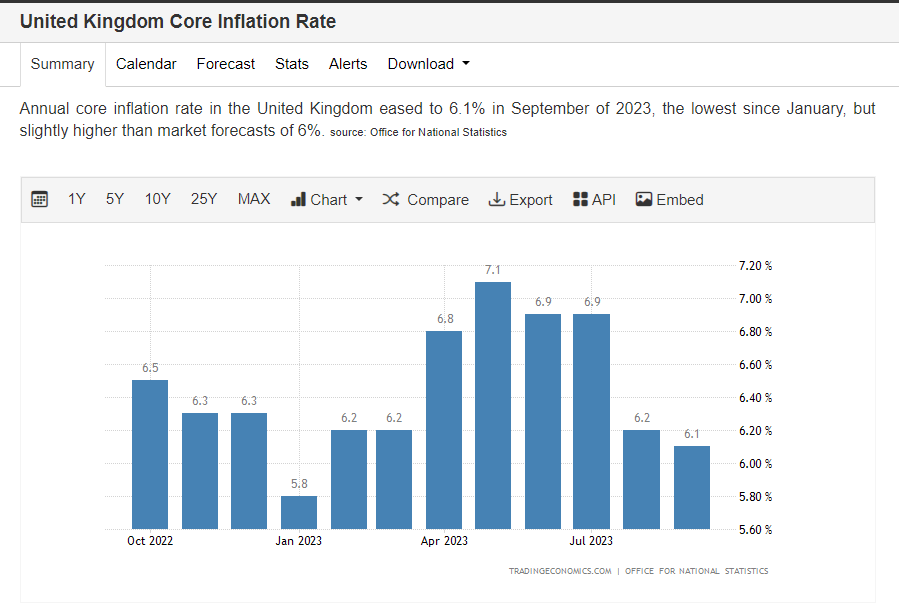

Recent data reveals a significant development in global financial markets as inflation rates in the United Kingdom have exceeded consensus predictions. Notably, the headline inflation year-over-year for September stood at 6.7%, marginally surpassing the consensus of 6.6%, while the year-over-year core inflation landed at 6.1%, against the predicted 6%.

These figures underscore the persisting challenge the Bank of England faced in its quest to stabilize the economic climate, especially given the sustained core inflation rate that has remained anchored at over 6% throughout the past year, three times the Bank Of England’s target.

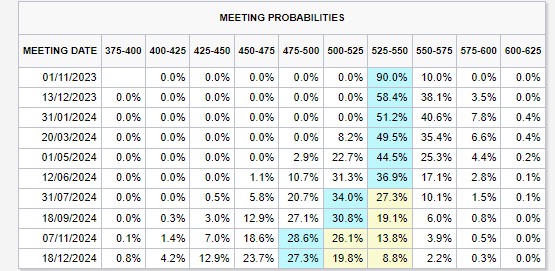

The U.S. also grapples with similar concerns on the other side of the Atlantic. The potential for further interest rate hikes looms, with probabilities increasing to 40% for a decisive move in either December or January, which would take the federal funds rate to 5.50-5.75.