Inside the black box: How centralized exchanges can provide unique intelligence about crypto-assets

Inside the black box: How centralized exchanges can provide unique intelligence about crypto-assets Inside the black box: How centralized exchanges can provide unique intelligence about crypto-assets

Image by David Schwarzenberg from Pixabay

Research by Jesus Rodriguez and Lucas Outumuro of IntoTheBlock

Wouldn’t it be interesting to know how much money is being transferred in and out of Binance? How about how many Bitcoin does Coinbase hold?

Centralized exchanges are one of the key components of the architecture of crypto markets. Despite the exciting developments taking place in the decentralized exchange ecosystem, trading volumes and traffic remain with their centralized counterparts. From that perspective, the analysis of centralized exchanges can provide unique perspectives about the behavior of crypto assets. Unfortunately, centralized exchanges are…well…centralized and most of their trading activity records are not publicly available for analysis.

However, we shouldn’t ignore the fact that centralized exchanges interact with blockchains in order to transfer funds or settle trading activities. Understanding that information can provide unique insights about crypto markets but the process of doing that is far from trivial.

Understanding how the analysis of the blockchain activity of centralized exchanges can be valuable is conceptually trivial. Centralized exchanges regularly record part of their activity in a crypto-asset in the underlying blockchain.

That information includes events such as transfers in and out of the exchange, transfers between the exchange and its custody wallets, or even internal financial activities. That information can yield insights about crypto-assets that are impossible to obtain in any other asset class. Let’s look at the following scenarios:

- Large funds transfers into exchanges could signal an intention to liquidate a position in a crypto asset resulting in higher sell order volumes in the short term.

- Funds transfers out of exchanges could signal investors capitalizing gains or simply being more risk-averse.

- The funds kept within the exchange are a strong measure of liquidity and, when analyzed in conjunction with its order book, can be used to estimate levels of risk or even unusual activity.

The previous examples could seem like a gold mine of information for investors and traders. However, extrapolating relevant intelligence from blockchain records related to exchanges is far from trivial and there are several challenges that should be considered. For starters, there is no master record of exchange addresses that can be used to obtain that information. Like any other blockchain records, the addresses belonging to centralized exchanges are anonymous and require crafty data mining processes in order to be identified.

Additionally, there is no standard way in which centralized exchanges publish information to blockchains. Quite the opposite, different exchanges implement different protocols to publish information on-chain which makes a consistent analysis very challenging. Finally, we have the usual instances of fake volumes or market manipulation that can be used to trick even the most sophisticated analytics.

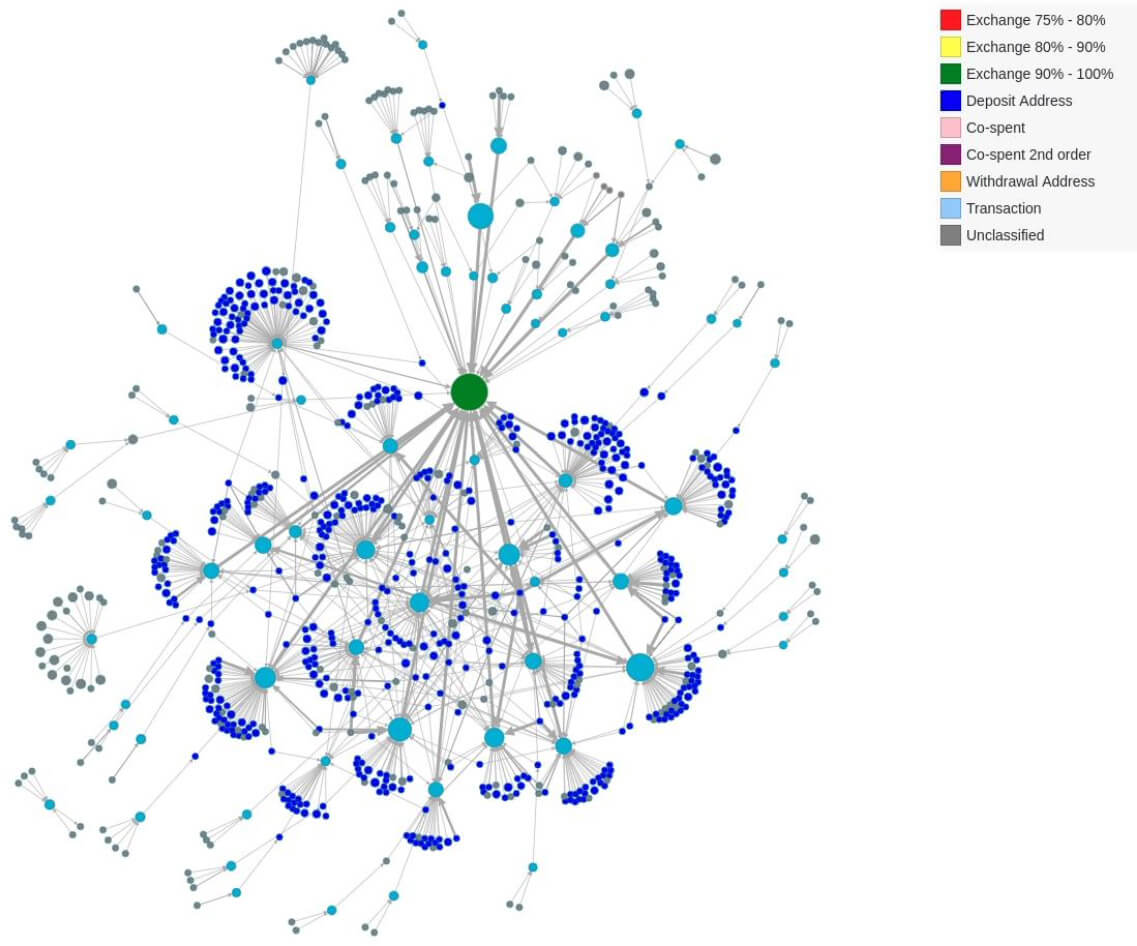

Overcoming all those challenges requires a probabilistic, not exact, solution to exchange address identification. The current architecture of centralized exchanges makes it relatively impossible to identify all exchange addresses registered in a given blockchain. However, methods such as machine learning models can infer a statistically relevant approximation that could provide valuable insights about money flows in a crypto asset.

Understanding the Architecture of Centralized Exchanges

The architecture diversity of centralized exchanges is one of the factors that makes its analysis so difficult. Different exchanges interact with the underlying blockchains in all sorts of different ways depending on their internal processes. Despite that diversity, the architecture of most centralized exchanges include four common components:

- Hot Wallets: Hot wallets are typically the main interaction point between external parties and an exchange. Exchanges use this type of wallet to make an asset available to trade.

- Cold Wallets: Exchanges use cold wallets as a secured storage of crypto-assets. This type of wallet typically hold larger amounts of assets that are not intended to be traded frequently.

- Deposit Addresses: Deposit addresses are, often temporary, on-chain addresses used to transfer funds into an exchange. The focus of this type of address is to facilitate funds flowing into the hot wallets.

- Withdrawal Addresses: Withdrawal addresses are, often temporary, on-chain addresses that are used to transfer funds out of the main exchange wallet. Sometimes withdrawal addresses can play a dual role as deposit addresses.

Those four elements constitute the core on-chain architecture of centralized exchanges. Identifying the hot and cold wallets as well as the deposit and withdrawal addresses related to a centralized exchange can provide very unique insights about the behavior of specific crypto assets. Let’s look at a few examples.

How Centralized Exchanges Reveal Unique Insights About Crypto Assets?

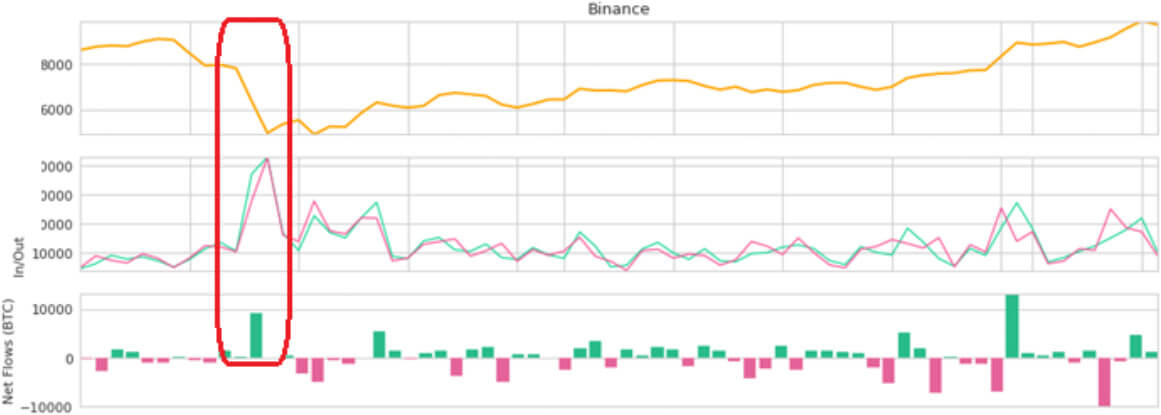

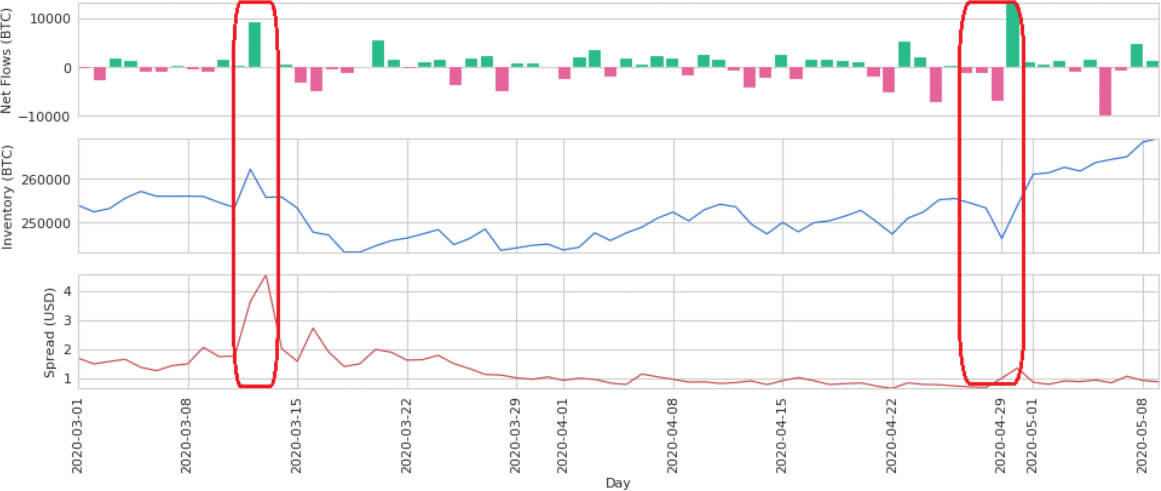

Once we know which hot wallets, cold wallets, deposit, and withdrawal addresses belong to an exchange, we can architect some interesting indicators that describe the performance of a given crypto-asset in that specific exchange. An interesting indicator to analyze are the money flows in and out of exchanges. For instance, a large inflow of funds into a centralized exchange hot wallet could signal future sell activity. This was the case during the March 11th crash in which large volumes of Bitcoin funds were regularly being transferred to exchanges like Binance in order to be sold.

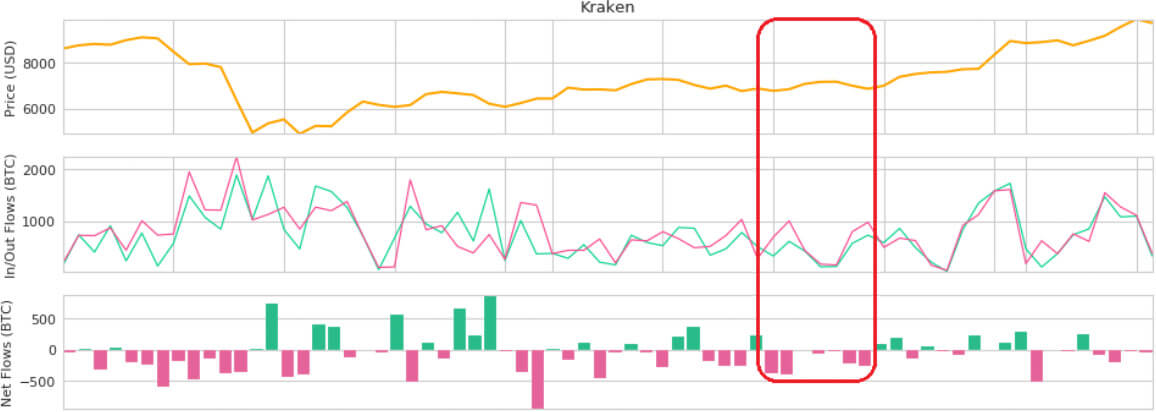

Similarly, large outflows moving from the exchange hot wallet into withdrawal addresses can signal a risk-off position or investor taking profits from trade activities. Following the March 11th crash, see the Bitcoin outflows in Kraken increase when the price starts recovering.

Another interesting metric to analyze is the funds maintained within the exchange. This goes beyond the hot wallet and should include funds kept in deposit addresses and hot wallets. This indicator, which we often refer to as “inventory”, is a measure of exchange liquidity and risk. An exchange with decreasing levels of inventory can see large variations in its order book spreads or be vulnerable to market manipulations. Even in a robust exchange like Binance, we can see how variations in the Bitcoin “inventory” levels due to larger than normal inflows regularly leads to larger spreads.

A Unique Source of Intelligence

The on-chain records of centralized exchanges represent a unique source of intelligence for understanding crypto assets. However, obtaining that intelligence requires a systematic process for classifying key elements of the on-chain architecture of centralized exchanges such as deposit addresses, withdrawal addresses, hot wallets, and cold wallets.

The challenges of understanding centralized exchanges are many across different dimensions, but the rewards can be a unique perspective about the performance of crypto-assets which have no equivalence in any other asset class.

About the authors

Jesus Rodriguez is the CEO-CTO of IntoTheBlock, a market intelligence platform for crypto assets. He is a computer scientist, a speaker, and author on topics related to crypto and artificial intelligence.

Jesus Rodriguez is the CEO-CTO of IntoTheBlock, a market intelligence platform for crypto assets. He is a computer scientist, a speaker, and author on topics related to crypto and artificial intelligence.

Lucas Outumuro is a Sr. Researcher at IntoTheBlock, a market intelligence platform for crypto assets. His areas of focus include crypto derivatives, DeFi and web 3.0 in general.

Lucas Outumuro is a Sr. Researcher at IntoTheBlock, a market intelligence platform for crypto assets. His areas of focus include crypto derivatives, DeFi and web 3.0 in general.