How this crypto exchange is already challenging BitMEX less than a year since its launch

How this crypto exchange is already challenging BitMEX less than a year since its launch How this crypto exchange is already challenging BitMEX less than a year since its launch

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

FTX—a crypto derivatives exchange invested by Binance in December 2019—is rapidly eating up the cryptocurrency futures trading and options market.

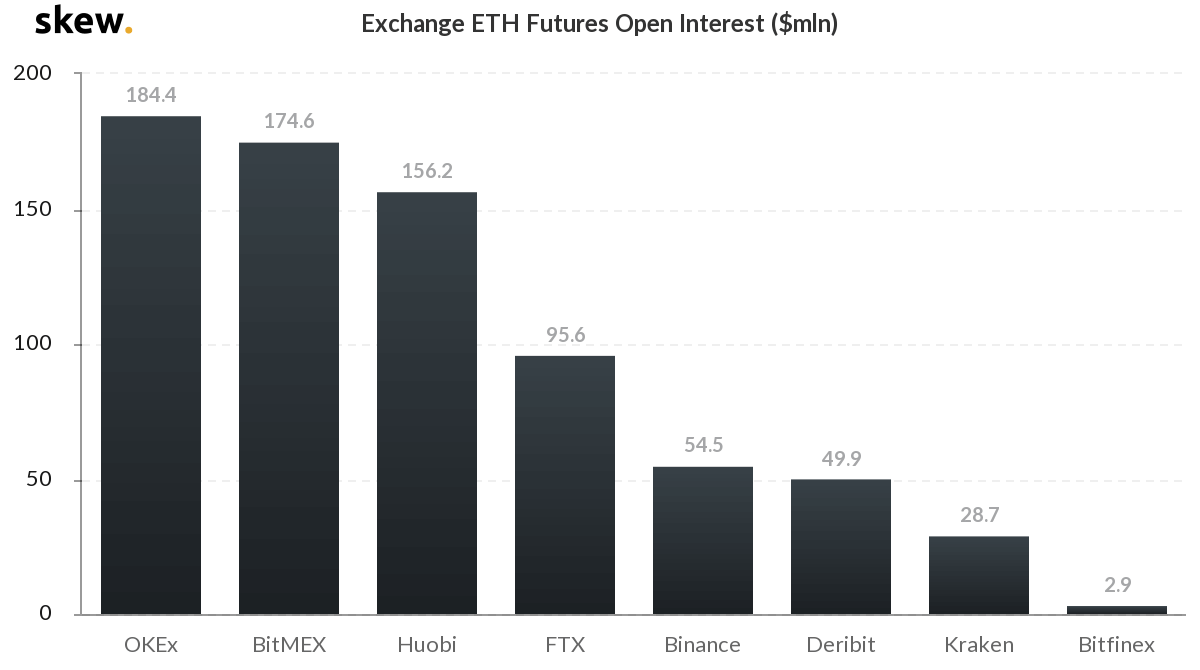

According to the data released by researchers at Skew, the open interest of Ethereum futures on FTX has hit $95.7 million. That is, more than 50 percent of the open interest of OKEx and BitMEX, two of the biggest Ethereum futures markets.

In futures trading, open interest refers to the sum of all long and short contracts that are open in the market at a certain time. As of March 8, FTX has $95.6 million worth of long and short contracts open for Ethereum.

How has it gotten so big in a short period of time?

Throughout the fourth quarter of 2019, FTX gained popularity amongst traders for its variety of derivatives products. Over time, the crypto exchange added unique futures contracts like PRESIDENT 2020, allowing users to trade in anticipation of the presidential election in 2020.

The investment of Binance into FTX on December 20, 2019 further solidified FTX as a major crypto exchange.

At the time, Binance CEO Changpeng Zhao spoke highly of the crypto exchange and the background of the management, stating:

“With their backgrounds as professional traders, we see quite a bit ourselves in the FTX team and believe in their potential in becoming a major player in the crypto derivatives markets.”

FTX continued to grow in all areas including the number of users and daily volume, seeking a billion-dollar valuation within nine months since its launch in May 2019.

Can the crypto exchange get even bigger?

Top traders have said that creating more spot markets is key for the growth of FTX in the short to medium-term, and to serve bigger traders.

With deep liquidity, more variety in spot markets, and improved user interface, one renowned crypto trader said that the exchange can continue to see strong growth in the years to come. One trader said:

“All FTX has to do: 1. More spot markets. Bigger traders don’t need leverage for alts & neither they want to risk using leverage since orderbook aren’t as thick as Bitcoin/Ethereum 2. Better user interface. Right now FTX looks like an old 2011 android application.”

All futures platforms in the crypto market have their weaknesses; some traders have expressed dissatisfaction with flash crashes, application bugs, and a lack of liquidity at across many major exchanges.

It is difficult to address all of the issues, but if a crypto exchange can start to remedy one issue after another over a long period of time and amass a loyal group of users along the way, it can gradually begin to expand its market share.

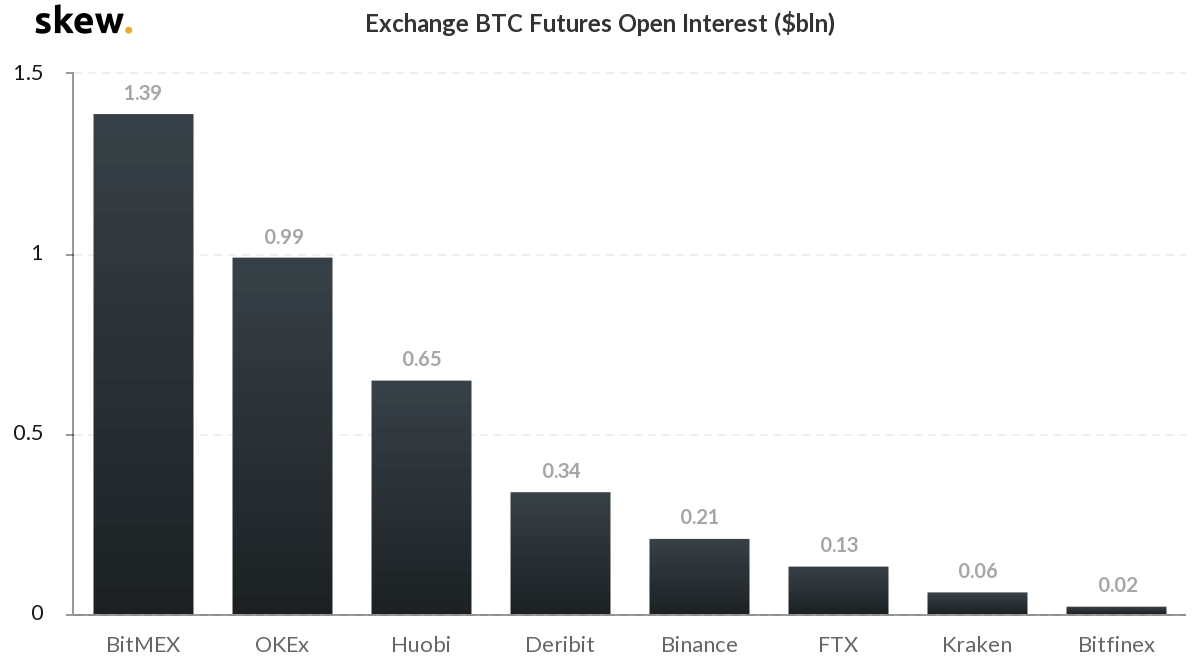

FTX still has a long road ahead to compete against BitMEX and OKEx in general terms. The Bitcoin futures market, for instance, are still heavily dominated by the two exchanges.

But, the crypto exchange is starting to see a noticeable increase in market share, volume, and user activity, raising the expectations of traders in the ecosystem.

Deribit

Deribit

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)