Here’s why analysts say Bitcoin’s 14% drop on June 2 is actually healthy for the medium-term trend

Here’s why analysts say Bitcoin’s 14% drop on June 2 is actually healthy for the medium-term trend Here’s why analysts say Bitcoin’s 14% drop on June 2 is actually healthy for the medium-term trend

Photo by JL Lacar on Unsplash

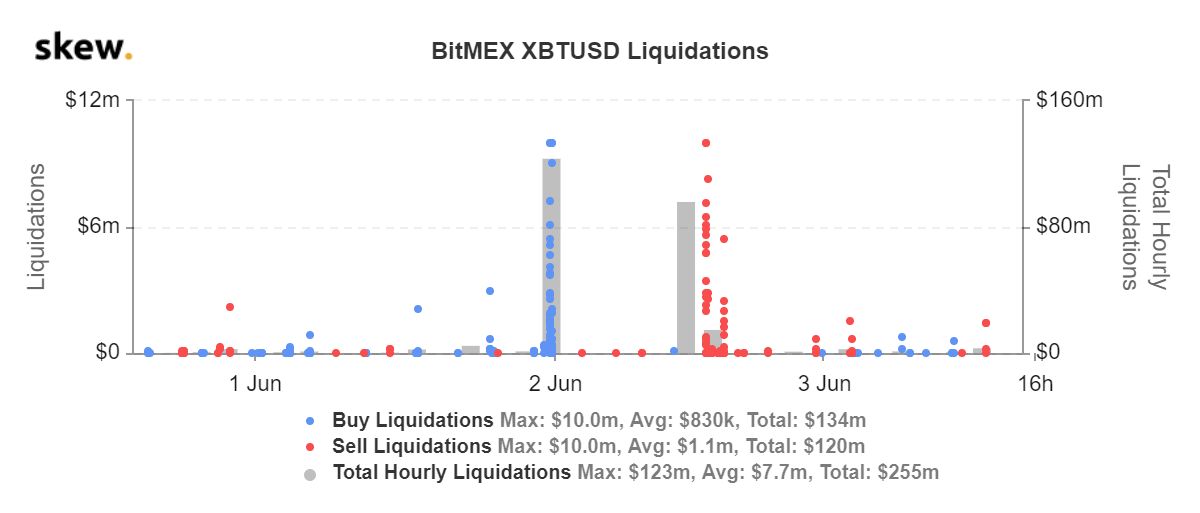

On June 2, more than $220 million worth of long and short contracts were liquidated on BitMEX. Analysts say it could be a healthy pullback for the medium-term trend of Bitcoin.

In a single day, the price of Bitcoin rose to as high as $10,440 and fell to $8,600 within several minutes. The rapid price drop led to mass liquidations of BTC futures contracts.

The Bitcoin futures market was heavily skewed towards longs

Before the sudden pullback occurred, the Bitcoin futures market was dominated by long contract holders. Simply put, there were significantly more traders bidding on the price of BTC to go up in the short-term.

When the futures market is heavily skewed to one side, it leaves Bitcoin vulnerable to either a long squeeze or a short squeeze.

A long squeeze means a cascade of long contract liquidations causing a sharp decline in the price of Bitcoin, and vice versa. Data showed that about 70 percent of the Bitcoin futures market was holding long contracts. It pushed the funding rate of BTC to rise to 0.16 percent.

The funding rate of a Bitcoin futures contract rises when there are more people expecting the price of BTC to go up. Usually, the funding rate of a BTC futures contract hovers at 0.01 percent. It was 16 times higher than usual.

The drop to $8,600 flushed the market, shaking out overleveraged traders

When the price of Bitcoin was hovering over $10,000, many long contracts were vulnerable to liquidations.

50x to 100x long contracts, which are traders who are borrowing 50 to 100 times of their funds to long Bitcoin, got liquidated at $9,900. Lower leverage long positions were liquidated in the $9,400 to $9,500 range, with BitMEX seeing liquidations of 10x longs at $8,600.

The 5-minute 14 percent drop from $10,000 to $8,600 wiped out 10x to 100x positions, flushing the market of over-leveraged trades.

The correction wiped out high leverage long contracts in the market, which are considered as liabilities by some because they raise the probability of an abrupt price drop as seen on June 2.

Here’s why it may be healthy for the market

Mohit Sorout, founding partner at Bitazu Capital, said that the liquidation of $123 million in shorts and $96 million in longs within 24 hours is a “healthy Bitcoin sentiment reset.”

Sorout said:

“A healthy BTC sentiment reset. Range a couple days, trap late bears then run it back up.”

If Bitcoin continues its upward trend with the spot and institutional markets accounting for the majority of buy volume, it will create a fundamentally stronger base for the next extended rally.

The futures market drove the rally of Bitcoin from the $8ks to $10,440 in the past two weeks. When the futures market pushes BTC upwards, it puts the dominant cryptocurrency at risk of a severe pullback.

The recent trend and liquidations of highly-leveraged positions may create a clearer path for Bitcoin towards a newfound upsurge.

Bitcoin Market Data

At the time of press 6:55 am UTC on Jun. 4, 2020, Bitcoin is ranked #1 by market cap and the price is up 1.58% over the past 24 hours. Bitcoin has a market capitalization of $177.76 billion with a 24-hour trading volume of $24.75 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 6:55 am UTC on Jun. 4, 2020, the total crypto market is valued at at $274.55 billion with a 24-hour volume of $87.12 billion. Bitcoin dominance is currently at 64.74%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)