Ethereum fees rocket to new all-time highs as DeFi sector extends momentum

Ethereum fees rocket to new all-time highs as DeFi sector extends momentum Ethereum fees rocket to new all-time highs as DeFi sector extends momentum

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

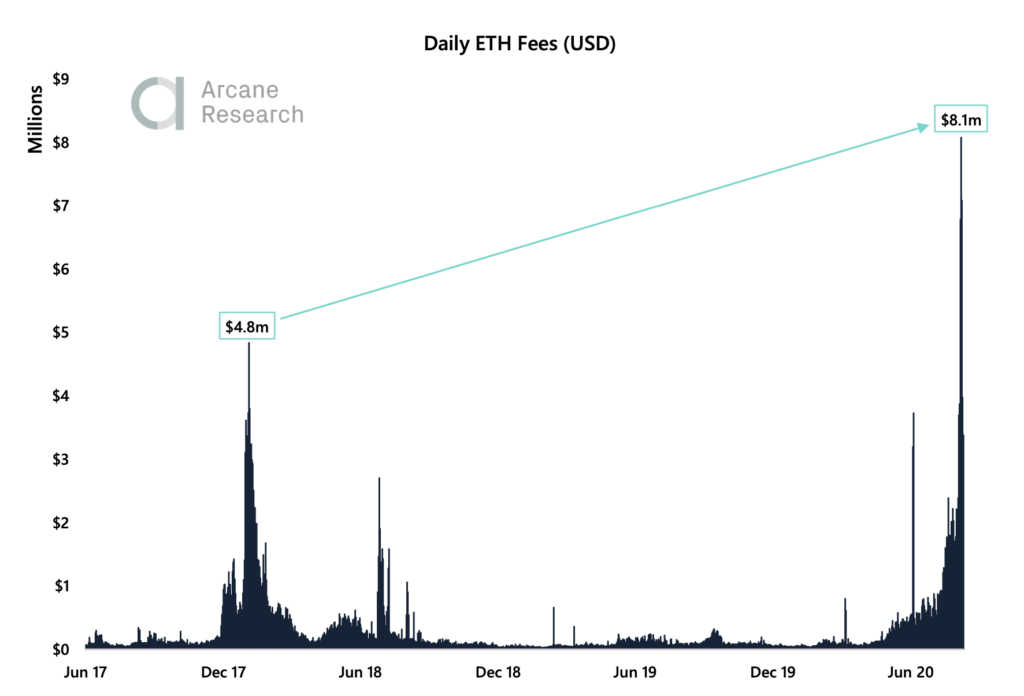

Ethereum fees have seen unprecedented growth in recent weeks, which has been driven by rocketing demand for block space on the network.

The daily fees being paid by users to transact on the Ethereum blockchain are now nearly double that seen at the peak of the ICO mania in late-2017 and early-2018, with the decentralized finance sector taking center stage during the ongoing market-wide uptrend.

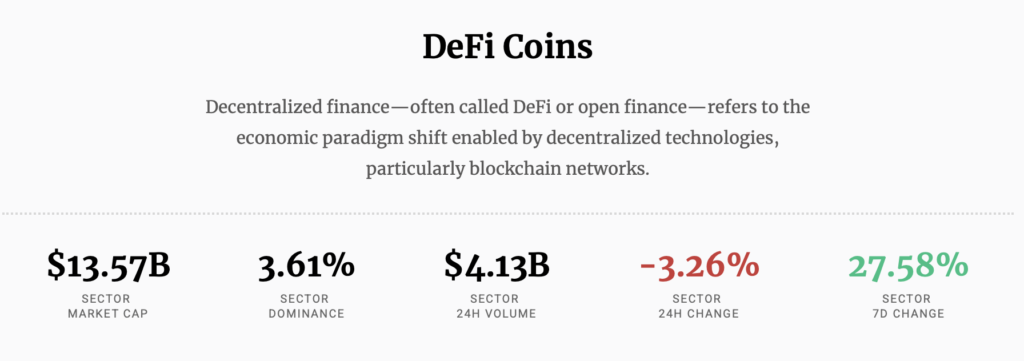

Because nearly all DeFi tokens are ERC-20s, users transacting between tokens on platforms like Uniswap are competing for block space, thus driving fees higher.

It doesn’t appear that this trend is going to let up anytime soon, as the DeFi sector’s immense growth isn’t showing any signs of faltering.

Ethereum transaction fees rocket to new highs

The ongoing crypto market uptrend first kicked off after tokens within the DeFi sector began seeing parabolic growth.

This helped drive value to Ethereum, which in turn helped lead Bitcoin higher as well.

The entire crypto market is now caught within a firm bull trend. This is particularly true for the digital assets that fall under the DeFi category.

As traders move to cash in on the strength many of these cryptocurrencies have exhibited as of late, the fees required to complete transactions on the Ethereum blockchain have surged to new highs.

According to a recent report from Arcane Research, daily ETH fees are now sitting at nearly twice what they were during the ICO mania a few years back.

“The daily Ethereum transaction fees topped out on $8.1 million last week. That is 4x the levels seen in the beginning of August, which in itself were abnormally high levels… This is 66% higher than the previous all-time high from January 2018. However, back then the ETH price was well above $1300 and just a few days away from ATH”

Here’s why fees may only go up from here

Users swapping between different ERC-20 tokens to trade tokens on Uniswap or farm yields on various protocols are the main driver behind these unprecedented ETH fees.

That being said, spiking Tether issuance is another factor contributing to this.

While looking towards the current size of the DeFi sector, it does appear that growing adoption may continue pushing Ethereum fees higher until a blockchain upgrade – like ETH 2.0 – is implemented.

According to proprietary data from CryptoSlate, the current market cap of the aggregated DeFi sector sits at $13.7 billion. This is 28 percent higher than where it was at just one week ago.

If Chainlink is excluded from this number, the current market cap is under $8 billion.

As such, this fragment of the market still has massive room for growth, which means that Ethereum transaction fees may continue rising in the months ahead.

Farside Investors

Farside Investors