Ethereum (ETH) Transaction Fees Now Below One Cent

Photo by Filip Mroz on Unsplash

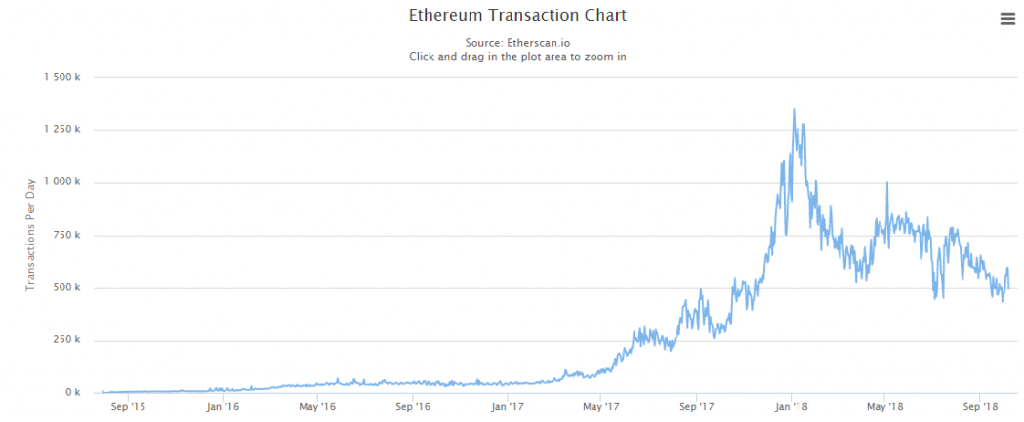

On Oct. 6, Ethereum transactions reached a daily average of 600,000 as network fees and ETH prices decreased. Just last month, the network saw faltering transaction rates and the drop of a yearly-low of 434,000, reported Trustnodes on Oct. 7.

Increasing Interest

A look at ether’s (ETH) transactional history chart indicates falling ETH prices made holders wary about using the digital currency as a medium-of-exchange. The prices have since stabilized at the $200-$225 range and transactions have gained steam comparable to when ETH was hovering around the $300 mark in early-September.

The increased activity can also be attributed to Ethereum running at just 50 percent of its daily capacity–which, in turn, has caused network fees to fall below one cent (USD) even as 600,000 transactions were processed last week.

For ETH traders in cryptocurrency communities, transaction density is observed as a sentiment indicator for deciding mid-term price action, with the two moving in tandem. However, a general consensus on such analysis has failed to pinpoint transactional numbers as a leading or lagging indicator.

A look at the two charts below–the transactional rates and price action–show the extent of similarity between the two variables:

The sharp surge in transactional history immediately indicates a price move for ETH may be observed shortly. The fall in transactions at the beginning of last month caused prices to plunge to $167 on Sept. 12, with the price steadily recovering since.

Exploring the Why

The rise in ETH transactions can be attributed to the network’s newly available capacity, freeing up much of Ethereum’s daily gas limit of 8 million GAS a day. On average, a single ETH transaction via smart contract requires 21,000 GAS units. For the uninitiated, GAS acts as “fuel” for the Ethereum network and is independent of volatile ETH prices as the latter is traded against hundreds of millions of dollars each day.

Smart contracts consume more GAS than a transfer, which was partly why Ethereum transactions reached ostentatious amounts in December 2017; thousands of ICO tokens at the time ate up much of the network’s computational resources upon release.

Another possible explanation for increasing transactions is that investors may have accumulated the digital currency given the relatively low prices. As more ETH equates to more token usage; the two charts are evident of user behavior.

Ethereum Market Data

At the time of press 2:44 am UTC on Nov. 7, 2019, Ethereum is ranked #2 by market cap and the price is up 1.25% over the past 24 hours. Ethereum has a market capitalization of $23.44 billion with a 24-hour trading volume of $1.47 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 2:44 am UTC on Nov. 7, 2019, the total crypto market is valued at at $220.77 billion with a 24-hour volume of $12.3 billion. Bitcoin dominance is currently at 52.13%. Learn more about the crypto market ›