CryptoSlate Wrapped Daily: Staked ETH soars in Q3; Bitcoin volatility causes Tesla $106M loss; Binance close to finding hacker

CryptoSlate Wrapped Daily: Staked ETH soars in Q3; Bitcoin volatility causes Tesla $106M loss; Binance close to finding hacker CryptoSlate Wrapped Daily: Staked ETH soars in Q3; Bitcoin volatility causes Tesla $106M loss; Binance close to finding hacker

Apple releases guidelines to allow in-app NFT purchases, Tesla loses $106M to Bitcoin volatility in Q3, and more in this edition of CryptoSlate Wrapped Daily.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The biggest news in the cryptoverse for Oct. 25 includes the amount of staked Ethereum surpassing 14 million year-to-date, Tesla’s $106 million loss to Bitcoin volatility, and Apple’s guidelines on how iOS developers can add in-app NFT purchase functions to their apps.

Total staked Ethereum surpasses 14 million in Q3 amid 64% decline in price

The amount of staked Ethereum (ETH) increased to 14 million since the beginning of the year. The amount equates to over $19 billion. This significant amount of Ethereum was staked even though the ETH price declined by 64% year-to-date.

Tesla reportedly lost $106M to Bitcoin volatility in Q3

In February 2021, Tesla purchased over 43,200 Bitcoin (BTC)for around $1.5 billion. At the end of June 2022, Tesla announced that it exchanged about 75% of its Bitcoin reserves for $936 million.

The math indicates that the leading electric car company lost around $106 million because of its Bitcoin investment.

Apple to allow in-app purchase of NFTs, subject to 30% tax rate

Apple’s latest announcement revealed that the company is planning to enable the direct purchase of NFTs. On Oct. 25, Apple published guidelines to show developers how they can create in-app purchases of NFTs, as well as storing, minting, listing, and transferring on their iOS apps.

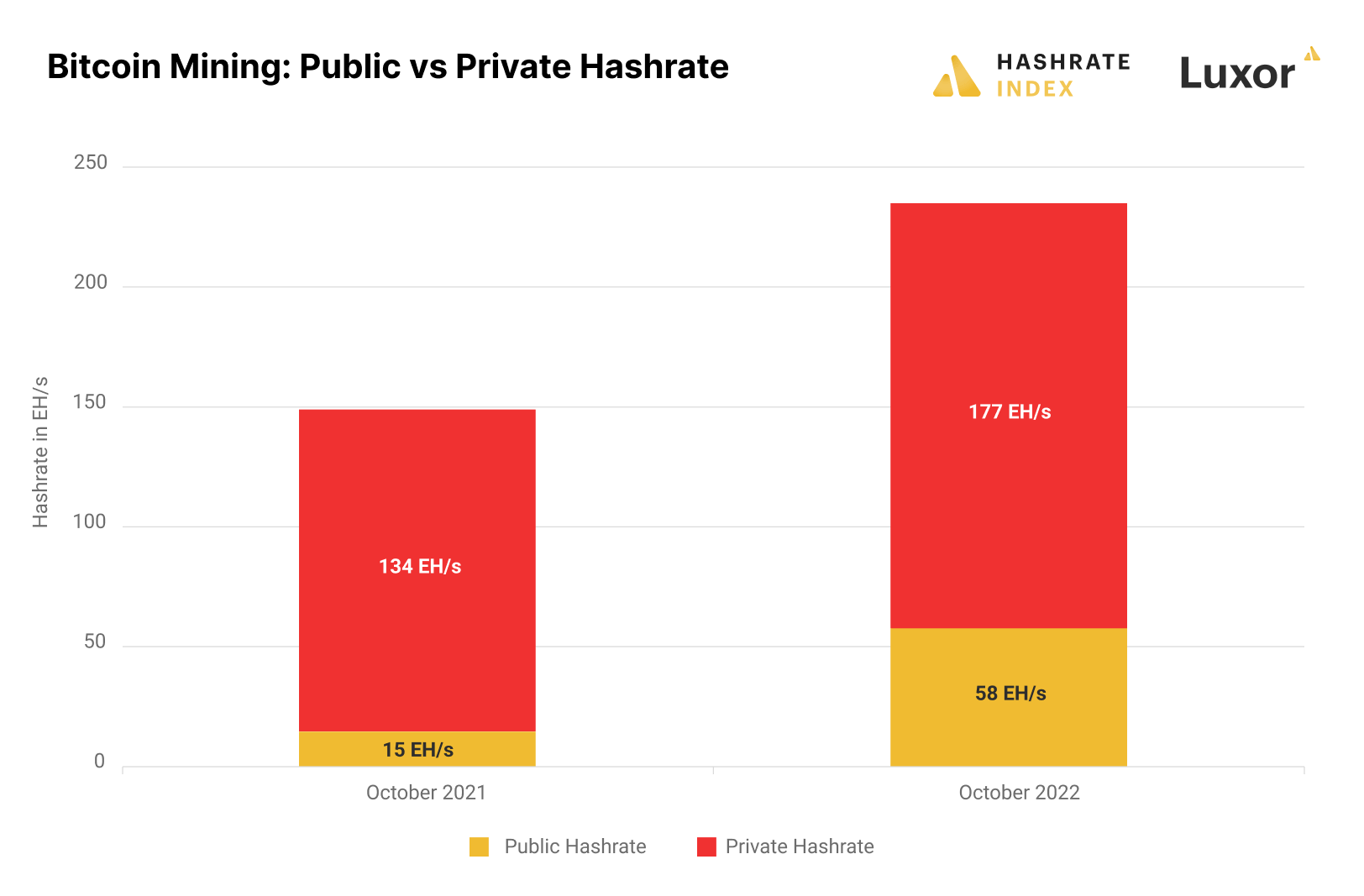

Public Bitcoin miners are expanding their hashrate share

Public Bitcoin miners’ hashrate share has grown exponentially in the last year.

As a result of the 2021 bull run, miners gained access to considerable amounts of funding, which most re-invested in themselves to enhance their mining capabilities. This development led to a continuous increase in their Bitcoin hashrate shares.

Solend founder says SBF wants to ‘profit at all costs’

Solend (SLND) founder 0xrooter referred to the FTX CEO Sam Bankman-Fried as someone who wants to profit at all costs.

SBF is a profit maxi: profit at all costs

— 🙏🚫 Rooter (hiring!) (@0xrooter) October 24, 2022

0xrooter added that he didn’t have any personal interaction with SBF but argued that the actions speak for the personality, and SBF’s character seems like a “profit maxi.”

MakerDAO MKR community approves ‘endgame’ proposal

MakerDAO (MKR) community approved the DAO’s Endgame proposal with an overwhelming majority of 80% on Oct. 25. The proposal suggested breaking the decentralized protocol into smaller units called MetaDAOs to increase decentralization.

MakerDAO founder Rune Christensen submitted the proposal, and some community members said that Christensen influenced 50% of the yes votes.

DeFi trailblazer Andre Cronje returns with ‘weird psyops’ Medium post

Founder and architect of Yearn Finance (YFI) Andre Cronje posted an article on his medium account titled “The Crypto Winter of 2022” on Oct. 25. He discussed the downwards market sentiment, the Terra collapse, and the wave of CeFi bankruptcies. Cronje said these situations arose because of a problem of “asymmetrical information.”

Sped read the article. Man who extracted 1bn from ecosystem through information assymetry, now talks about regulation and insurance to stop the asymmetry.

— MJP.sol (@mjpldn) October 25, 2022

However, the community didn’t appreciate Cronje’s comments on asymmetry. Crypto trading platform Archax’s co-founder MJP.sol said Cronje’s platform also ran through asymmetrical information, which is why it was absurd for him to blame everything on it.

Nic Carter’ disappointed’ by lack of original research in White House report on Bitcoin mining

Coinmetrics’ co-founder Nic Carter was a guest on the latest episode of the WhatBitcoinDid podcast to talk about the recent report on Bitcoin mining released by the White House.

Carter said:

“[The White House] are not completely unaware of what Bitcoiners have to say about mining. They’re just very dismissive of those things.”

He added that the White House reached out to him to hear his comments on the report but was reluctant to listen and disregarded everything.

CryptoSlate Exclusive

Stablecoin regulation could spell the beginning of the end for DeFi

Kyle Torpey wrote an exclusive piece for CryptoSlate discussing the possible effects of stablecoin regulations on DeFi. Torpey pointed out that stablecoins make up a large portion of the DeFi economy, and the new stablecoin rules could either make or break the DeFi.

According to Torpey, strong regulations on stablecoins could remove the main attractiveness of DeFi, which is the ability to conduct financial activities freely. He wrote:

“In terms of effects on DeFi, stronger regulations on stablecoins would be massive. A key selling point of various DeFi apps is the ability to trade, borrow, lend, and conduct other financial activities without handing over personal information.”

That said, Torpey also acknowledged that the DeFi market is too big to collapse completely. Even though it would suffer from more strict KYC and AML rules, it wouldn’t disappear completely. Instead, he said:

“it would lead to a situation where the sector is a small fraction of the size it is today, as much of DeFi’s utility is removed once you regulate the stablecoins.”

Research Highlight

Research: On-chain data shows Bitcoin Long term holders are selling again

According to on-chain data, long-term holders are selling bulks from their reserves again.

Investors who have been holding their Bitcoins for over a year had sold 50,000 Bitcoins as of last week. On the other hand, holders older than two years sold almost 40,000. Investors who held on to their Bitcoins for more than three years gave up a total of 30,000 Bitcoins.

The behaviors of long-term investors are an essential metric for macroanalysis. Long-term holders’ tendency to sell is a sign of capitulation, and it usually happens at the bottom of the market since long-term investors are the strongest ones.

News from around the Cryptoverse

Hong Kong introduces green bonds

The BIS Innovation Hub Hong Kong and the Hong Kong Monetary Authority collaborated to introduce Project Genesis 2.0 report. The project combines the green bond market and the carbon market and proposes a new green bond asset. The new investment is designed to meet the mitigation outcome interests that comply with the verified carbon credits specified in the Paris agreement.

Binance is closing in on the hacker

Binance suffered from a breach on Oct.6 and lost two million BNB tokens. According to CNBC, Binance CEO Chanpeng Zhao said they are getting closer to finding the hacker responsible for the attack.

The 24-hour trading volume of Reddit Collectibles reach $1.2 million

Reddit collectible avatars NFTs soared in sales and trading, according to a post on Reddit. The total sales volume of all NFTs increased by 30% in the past 24 hours to reach $1 million. A total of 3,202 sales were made, which compensated for 17% of the sales made since the launch of the NFTs.

Mailchain starts supporting ENS domains

According to a post on the company blog, the multi-wallet communication layer company Mailchain announced that it started supporting Ethereum Name Service (ENS) domains in its secure email platform. The update will allow Mailchain users to send and receive messages directly to their blockchain wallets using their ENS names.

Near spends $40 million to replace USN stablecoin’s collateral gap

Near Foundation announced sparing a $40 million grant towards replenishing a deficit found in collateral reserves for USN, as reported by The Block.

Crypto Market

In the last 24 hours, Bitcoin (BTC) soared by -3.77% to trade at $20,077, while Ethereum (ETH) also spiked by +18.94% to trade at $1,468.

Biggest Gainers (24h)

- Toncoin (TON): +15.85%

- Cardano (ADA): +13.37%

- Ethereum Classic (ETC): +10.32

Biggest Losers (24h)

- Aptos (APT): -8.97%

- Aave (AAVE): -5.13%

- Klaytn (KLAY): -3.25%

Mentioned in this article

Bitcoin

Bitcoin  Ethereum

Ethereum  BNB

BNB  yearn.finance

yearn.finance  Solend

Solend  Maker

Maker  Aptos

Aptos  Aave

Aave  Klaytn

Klaytn  TON

TON  Cardano

Cardano  Ethereum Classic

Ethereum Classic  Binance

Binance  Tesla

Tesla  FTX

FTX  MakerDAO

MakerDAO  Changpeng Zhao

Changpeng Zhao  Andre Cronje

Andre Cronje  Sam Bankman-Fried

Sam Bankman-Fried

Deribit

Deribit