CryptoSlam data shows average NFT sell price down 94% from YTD daily high

CryptoSlam data shows average NFT sell price down 94% from YTD daily high CryptoSlam data shows average NFT sell price down 94% from YTD daily high

The NFT sector continues to crater as crypto winter bites hard, but proponents say non-fungibles are far from dead.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

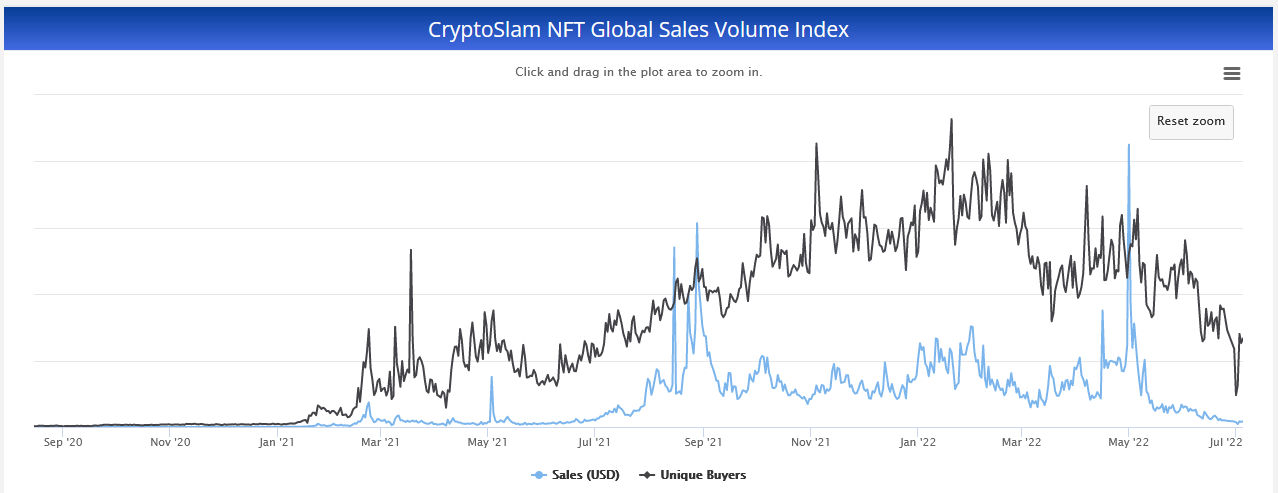

CryptoSlam metrics, including global sales volume and average sale price, show that crypto winter has hit the NFT sector hard.

Critics of NFT art argue that the drop-off in price and trading volume is long overdue — especially for collections like Bored Ape Yacht Club and CryptoPunks, which are deemed “overpriced.”

Global NFT sales tank

According to CryptoSlam, daily global NFT sales peaked at $637.9 million on May 1, following a relatively flat period between September 2021 and April 2022.

Sales have tanked dramatically since the peak, leading to a daily low of $6.6 million on July 2, representing a 99% collapse from peak to trough.

As expected, the number of unique buyers has also fallen off, dropping from a peak of 115,932 on January 20 to just 11,983 on July 1 – a 90% decline.

Data shows that August 2021 was the best month for sales, coming in at $4.854 billion and an average sell price of $1,070. The YTD peak for monthly sales is comparable, with January bringing $4.820 billion in sales at an average price of $519.

But a noticeable contraction in sales has occurred as the year has gone on. Total sales came in at $48.9 million during the first week of July — average daily sales of $9.78 million. For comparison, the average daily sale in January was $155.5 million.

Average sale price is also down significantly

As mentioned, August 2021 was the peak in terms of both total monthly sales — $4.854 billion — and an average sales price of $1,070. However, July’s average sale price comes in at just $100, marking a 91% decline since January 1.

Data from OpenSea reaffirms the above, with June trading volume dropping to a 12-month low. Similar to CryptoSlam data, analysis of OpenSea metrics shows both the number of users and average NFT sell price is also falling.

Gauthier Zuppinger, the CEO of NFT data aggregator Nonfungible, told CNBC that, despite tanking metrics, he still believes there is a future for NFTs, citing corporate interest as the reason.

“We are reached out every day by promising projects, large companies, banking groups all around the world that are gradually entering the NFT space, so we’re pretty confident that the NFT space is not ‘dead.”