Crypto Price Watch: Bitcoin, Ethereum, Bitcoin Cash Incur Sudden Drops

Crypto Price Watch: Bitcoin, Ethereum, Bitcoin Cash Incur Sudden Drops Crypto Price Watch: Bitcoin, Ethereum, Bitcoin Cash Incur Sudden Drops

Photo by Luke Stackpoole on Unsplash

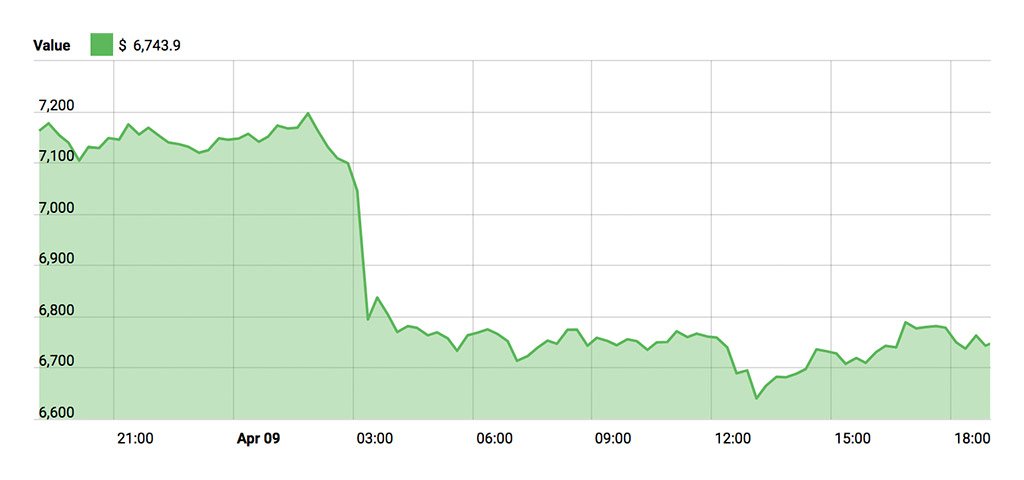

We have started a new week, and it looks many cryptocurrencies are starting it in the red. Though Bitcoin did manage to hit the $7,000 mark over the weekend, it has seemingly fallen by over $200 and is now trading for roughly $6,700.

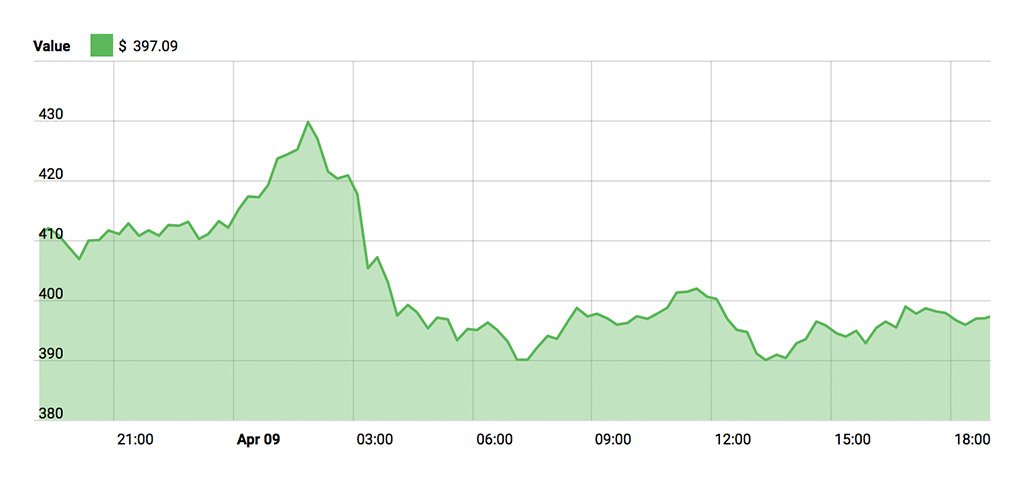

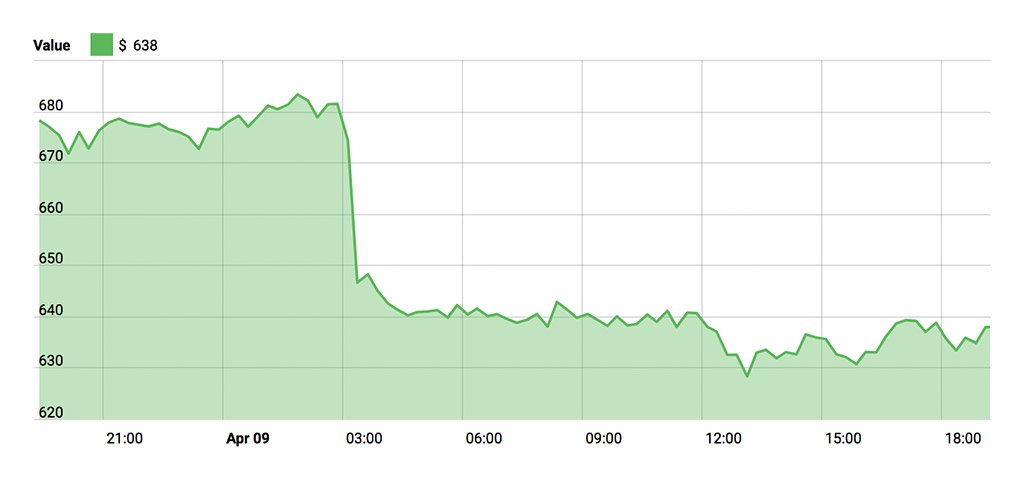

Joining Bitcoin is Ethereum, which is down nearly 2.5 percent and is hovering at around $391 at press time. Ripple has fallen by three percent, and stands at just over $0.40, while Bitcoin Cash and Litecoin are down by over three percent each, and sit at $637 and $114 respectively.

April 7th through the 8th did see cryptocurrency experiencing a few substantial rises, thus teasing users of a potential bull run. Bitcoin had jumped to $7,000 following its previous trading stance of $6,600 following news that the famous Rockefeller family would be investing in cryptocurrencies and getting in on the action.

Institutional Adoption

Specifically, Venrock – the venture capital firm of The Rockefeller Foundation – explained that it was partnering with Coinfund, a private crypto-asset investor, and blockchain research advisory firm.

The news followed an announcement by the head of Soros Fund Management that the company had recently garnered permission to begin trading cryptocurrencies within the next few months.

George Soros has often referred to bitcoin as a “bubble,” and rejected any potential notions of legitimacy.

As one of the world’s wealthiest hedge fund managers, his sudden change of heart was a welcomed move in an industry that has been suffering heavily since January.

India Not Banning Cryptocurrencies

Also, it was discovered that India was not banning cryptocurrencies as so widely reported before, but it was making it harder to use them.

India’s Reserve Bank had recently stated that it would no longer support businesses that dealt in or traded cryptocurrencies, and it was ordering all neighboring banks to do the same.

As banks in India fall under the organization’s power, they were given no choice but to adhere to the demand.

However, where reporters likely had the wrong idea is that for the country to entirely ban crypto-trading, an order would have to be issued either by a central or state governing body or by the country’s judicial branch. RBI does not fall into any of these categories.

Thus, while digital currency ventures can no longer rely on Indian banks to complete financial transactions, the process of trading crypto can continue granted the government stays open to it.

Though ether has ultimately fallen back in the last 24 hours, the currency did allegedly spike enough to graze the $430 level. Ethereum blockchain developers recently rejected the notion of implementing a hard fork over ASIC mining rigs.

Presently, the situation is not considered a massive threat, though users should not be surprised if this issue is touched upon again in the coming months. Resistance also proved to be too strong for Ethereum’s current taste, which accounts for the coin’s lower trading price.

Ironically, it appears Bitcoin Cash was trading for as high as $679 during the early morning hours of April 9, though Twitter’s closing of the promotional @Bitcoin account may have had something to do with the subsequent drop.

CryptoQuant

CryptoQuant