Crypto funds see $2.2 billion inflow, pushing 2024 total to $33.5 billion

Crypto funds see $2.2 billion inflow, pushing 2024 total to $33.5 billion Crypto funds see $2.2 billion inflow, pushing 2024 total to $33.5 billion

Surging year-to-date inflows highlight growing investor confidence in digital assets post-US elections.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Last week, digital asset investment products saw $2.2 billion in inflows, reflecting a broader market uptrend driven by Donald Trump’s recent victory at the just-concluded US presidential election.

In the first half of the week, inflows peaked at $3 billion, lifting total assets under management (AUM) to an all-time high of $138 billion. However, Bitcoin’s record price performance during the period prompted an outflow of around $866 million, resulting in a net inflow of $2.2 billion.

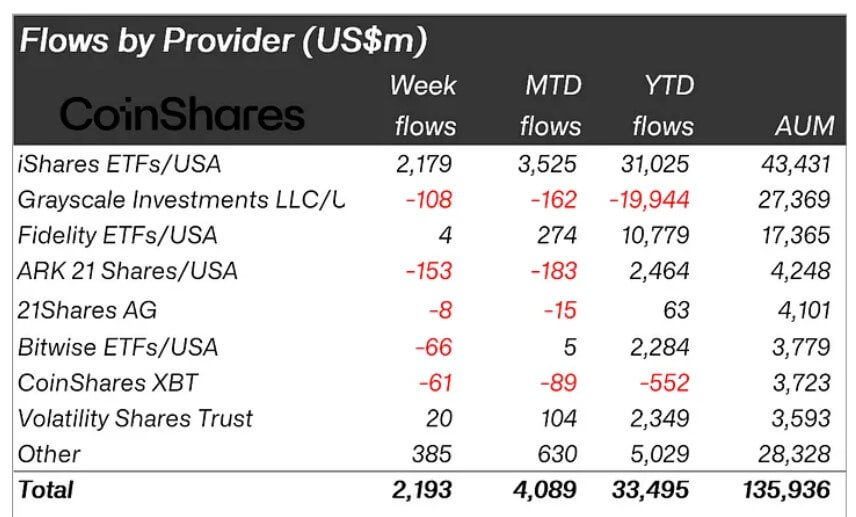

According to CoinShares, this inflow pushed the totals since the September interest rate cut to $11.7 billion, bringing the year-to-date total to $33.5 billion.

James Butterfill, Head of Research at CoinShares, explained that:

“This recent surge in activity appears to be driven by a combination of looser monetary policy and the Republican party’s clean sweep in the recent US elections.”

US-Bitcoin ETFs continue to dominate

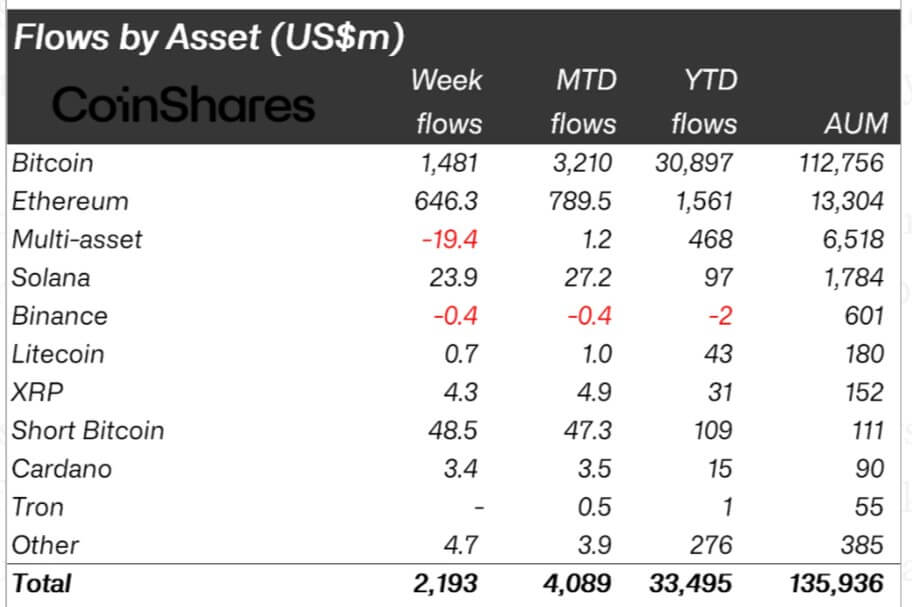

Bitcoin’s dominance remained strong, with $1.48 billion in inflows. The substantial flows can be linked to the impressive performance of the US-based spot exchange-traded fund (ETF) products, which continue to attract significant attention from retail and institutional traders.

According to CoinShares data, BlackRock’s IBIT and Fidelity’s FBTC saw inflows of $2.1 billion and $4 million, respectively. On the other hand, outflows of $153 million from the Ark 21 Shares fund outstripped those of Grayscale, which stood at $108 million for the week.

Meanwhile, Bitcoin’s record-breaking price performance above the $90,000 mark has attracted bearish traders, who invested $49 million in short Bitcoin products.

Moreover, the bullish market sentiment appeared to influence interest in Ethereum, which also attracted significant inflows of $646 million (equivalent to 5% of its AUM). Butterfill linked this inflow to election results and a proposed Beam Chain network upgrade.

Other assets, including Solana, XRP, and Cardano, saw more modest inflows of $24 million, $4.3 million, and $3.4 million, respectively.

Mentioned in this article

Bitcoin

Bitcoin  Ethereum

Ethereum  Solana

Solana  XRP

XRP  BlackRock

BlackRock  Fidelity Investments

Fidelity Investments  CoinShares

CoinShares  Ark Invest

Ark Invest  iShares Bitcoin Trust

iShares Bitcoin Trust  ARK 21Shares Bitcoin ETF

ARK 21Shares Bitcoin ETF  Grayscale Bitcoin Trust

Grayscale Bitcoin Trust  Fidelity Wise Origin Bitcoin Trust

Fidelity Wise Origin Bitcoin Trust

Farside Investors

Farside Investors