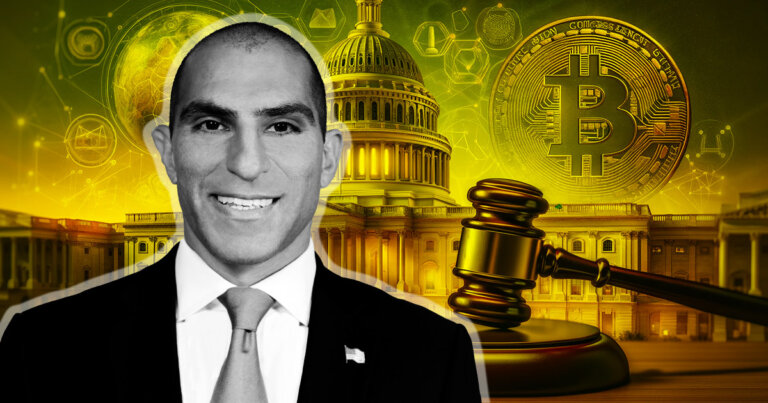

CFTC chair urges Congress to issue legislation for crypto regulations

CFTC chair urges Congress to issue legislation for crypto regulations CFTC chair urges Congress to issue legislation for crypto regulations

Rostin Behnam also told Congress that Bitcoin and Ethereum can only be considered commodities under the current regulatory frameworks.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

CFTC chair Rostin Behnam told Congress there is an urgent need for legislation that can provide regulatory clarity for the crypto industry to ensure investors are appropriately protected.

Behnam made the statement during his testimony before the House Agriculture Committee on March 6 that primarily focused on the C FTC’s fiscal year 2025 budget request.

Behnam said:

“The notion that crypto is going away is a false narrative.”

He added that more than 49% of the CFTC actions filed during the 12 months ending October 2023 involved conduct related to digital assets despite the fact that “no federal agency retains direct regulatory authority” over the crypto industry.

Framework in 12 months

During the hearing, Behnam spoke about the challenges and opportunities presented by digital assets, like Bitcoin (BTC) and Ethereum (ETH), which represent a significant portion of the crypto market’s total capitalization.

He said there is a false perception among regulators and lawmakers that the digital assets market might diminish in relevance. However, the previous decade has shown that to be far from the case, as demand for these assets has grown exponentially during that time.

Behnam stressed the need for proactive legislative measures to ensure a stable and transparent regulatory environment. He added that protecting investors should be the government’s main priority, considering the surging interest in digital assets since the start of the year.

Behnam said it would take the CFTC roughly 12 months to develop a comprehensive regulatory framework for digital assets if Congress passes the Financial Innovation and Technology Act for the 21st Century (FIT Act).

The FIT Act, which has advanced through the House Agriculture and Financial Services Committees without reaching a floor vote, aims to clarify the regulatory responsibilities regarding digital assets.

BTC, ETH are commodities

Behnam’s testimony also addressed inquiries from committee members regarding the classification of digital currencies as commodities or securities, a distinction that impacts regulatory jurisdiction.

In response to a question from Rep. John Duarte, Behnam explained that digital assets are generally considered commodities if they do not meet the criteria for being classified as securities, indicating the nuanced approach required to regulate these assets effectively.

Behnam added that Bitcoin and Ethereum did not meet the criteria needed to be classified as securities, which automatically means they fall under the commodities umbrella despite being incredibly different from physical commodities like gold or corn.

The CFTC chair told Duarte that there is an immense appetite for Bitcoin among retail and institutional investors, regardless of whether the government wants to legitimize it or not.

Behnam admitted that regulators have been trying to “shoehorn” crypto into other frameworks, and the industry needs to be considered separately.