BlackRock warned SEC lack of in-kind orders for Bitcoin ETF shares could hurt investors

BlackRock warned SEC lack of in-kind orders for Bitcoin ETF shares could hurt investors BlackRock warned SEC lack of in-kind orders for Bitcoin ETF shares could hurt investors

In-kind orders was always BlackRock's preference over cash-creates.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

A novel aspect of the new spot Bitcoin ETFs, as approved by the SEC, is the cash-creation mechanism for issuing and redeeming shares. The ETFs are considered commodity-shares ETFs, yet, as BlackRock points out in its iShares Bitcoin ETF (IBIT) prospectus, “all spot-market commodities other than bitcoin, such as gold and silver, employ in-kind creations and redemptions with the underlying asset.”

In its filings, BlackRock strongly advocated for in-kind orders for shares, but the SEC guided applicants toward a cash-creation model due to the nature of specific regulatory processes. People allowed to buy and sell shares of the trust (Authorized Participants) have to be registered broker-dealers, which means they are officially recognized and must follow certain financial rules. Right now, it’s not clear how these broker-dealers can follow these rules if they’re dealing with Bitcoin directly.

Due to this uncertainty, it’s risky for these broker-dealers to use Bitcoin to buy or sell shares of the trust. The SEC probably would not have allowed a product like this on the stock exchange if it’s unclear how the rules apply. Therefore, all the ETF applications were updated from in-kind to cash-creates in December before approval.

If the “NASDAQ receives the in-kind regulatory approval” to allow buying and selling shares with Bitcoin directly in the future, the ETFs will likely request a change to enable in-kind orders. However, we don’t know when this will happen or if it will happen at all.

BlackRock’s view on the cash creation model for Bitcoin ETFs

This information has been available to investors since the Dec. 19 update to BlackRock’s S1 filing. However, following the successful launch of the Newborn Nine ETFs and billions of dollars in volume, revisiting the world’s largest asset manager’s warning to the SEC concerning cash-creates seems worthwhile. It’s important to note that BlackRock is required to state any material risks in its prospectus, so the inclusion of a potential scenario means it is possible, not probable.

That said, BlackRock does not believe the cash-creation method is efficient, stating that the trust’s current practice of buying and selling shares with cash instead of using Bitcoin directly could cause problems in keeping share prices aligned with Bitcoin’s actual value.

It cautions that this mismatch might happen because cash transactions are more complex and take longer than direct Bitcoin transactions. It continues to identify that delays in these transactions could mean that the prices used to calculate the value of the trust’s shares (NAV) may not accurately reflect the real-time price of Bitcoin.

Further, under a section entitled ‘Risk Factors Related to the Trust and the Shares,’ BlackRock also warns of reduced arbitrage opportunities for Authorized Participants,

“The use of cash creations and redemptions, as opposed to in-kind creations and redemptions, may adversely affect the arbitrage transactions by Authorized Participants intended to keep the price of the Shares closely linked to the price of bitcoin and, as a result, the price of the Shares may fall or otherwise diverge from NAV.”

Finally, BlackRock warned that there is a possibility that Authorized Participants might not want to continue facilitating the trust if they think these delays and extra steps have become too risky or costly. This reluctance may also make it harder to keep the trust’s share prices close to the actual value of Bitcoin. If this system doesn’t work well, investors might buy shares for more than they’re worth or sell them for less. This could cause losses for the shareholders.

BlackRock is a more prominent advocate for in-kind orders than the model approved by the SEC. The prospectus says in-kind share creation and redemption is “generally more efficient, and therefore less costly, for spot commodity exchange-traded products.”

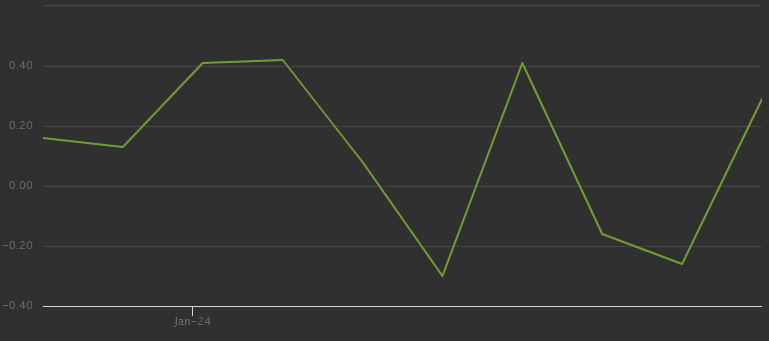

Bitcoin ETF NAV correlation with cash creation model.

Most interestingly, BlackRock identifies cash-creation commodity-shares ETFs as “a novel product that has not been tested and could be impacted by any resulting operational inefficiencies.” Specifically, BlackRock highlights times of “market volatility or turmoil” where cash-creates could materially affect the ETF’s ability to trade.

“In addition, the Trust’s inability to facilitate in-kind creations and redemptions, and resulting reliance on cash creations and redemptions, could cause the Sponsor to halt or suspend the creation or redemption of Shares during times of market volatility or turmoil, among other consequences.”

Since launch, the NAV premium to discount spread has been less than 100bps, ranging from +40bps to -30bps over ten trading days. By comparison, BlackRock’s iShares Core S&P 500 ETF (IVV) has not deviated more beyond +5bps and -11bps over the past twelve months.

In a more direct comparison, however, the iShares Gold Trust (IAUM) has seen a spread of around +300bps over the past twelve months. Its highest premium to gold was over +200bps, and the lowest discount was around -140bps.

Given that IAUM can use in-kind orders for gold and BlackRock believes cash-creates could create a more volatile discount or premium for IBIT, investors may wonder if we should expect it to see deviations from the NAV beyond 3% in the future. Alternatively, perhaps BlackRock’s resolve for in-kind orders was a foretelling of the exodus from Grayscale, which, if handled in-kind, may have simply seen Bitcoin leaving one ETF and flowing directly into another instead of being resold several times.

The next filing to look out for regarding potential in-kind Bitcoin ETF orders is whether the Nasdaq requests that Bitcoin be considered a viable asset for buying and selling shares. Until then, the cash creation of shares will continue.