BlackRock calls AI a ‘mega force’

BlackRock calls AI a ‘mega force’ BlackRock calls AI a ‘mega force’

The company's bullish AI statement comes weeks after its Bitcoin ETF filing.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

BlackRock acknowledged artificial intelligence (AI) as one major economic shift in a mid-year outlook report published on June 28.

BlackRock calls AI a “digital disruption”

The asset management giant called artificial intelligence a “digital disruption” and a force that can be leveraged through new investment opportunities.

The company said that it has an outsized or “overweight” investment in AI-related opportunities and claimed that its investment tilt “already captures AI beneficiaries.”

The company also observed various trends related to tech and AI.

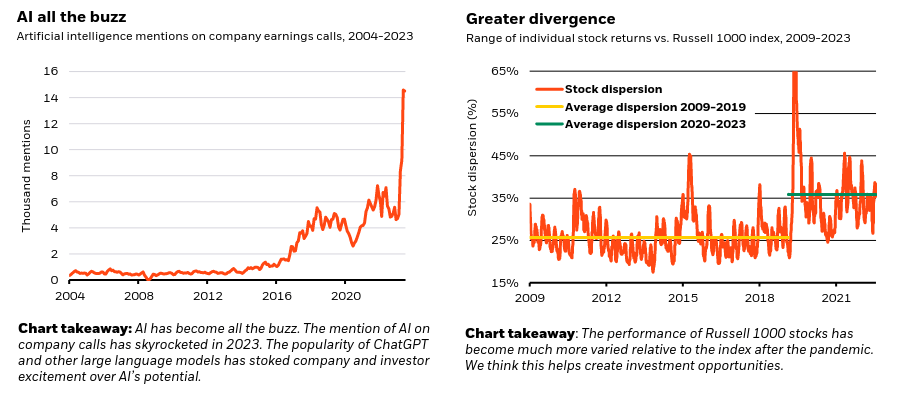

Specifically, BlackRock noted that corporate awareness and incorporation of AI had witnessed a significant rise in 2023. The firm’s charts show that the latest round of earning calls mentioned AI 14,000 times.

BlackRock also observed that S&P 500 gains now focus on a few tech stocks. This trend indicates that AI and other “mega forces” can produce returns even when the macro environment provides few other opportunities.

The firm suggested that the latest growth in AI is driven by advances in computational power, data, and machine learning, and companies are increasingly integrating AI to automate tasks, boost productivity, and fuel innovation. It said that companies are employing AI experts and using AI to automate tasks and increase productivity.

BlackRock also suggested that AI trends could also lead to further growth. For example, the trend could result in more significant investment in semiconductor production, which is needed for AI development. The trend could result in the monetization of data stores as well.

BlackRock is pursuing a Bitcoin ETF

BlackRock has recently attracted attention in the crypto community due to its recent application for a spot Bitcoin exchange-traded fund (ETF).

That filing was submitted on June 15. If regulators approve the application, BlackRock’s fund will become the first ETF of its type in the United States.

Despite the excitement in the crypto community, Bitcoin ETFs were not discussed in BlackRock’s recent AI-focused report.