Bitcoin surges a day after Grayscale reopens deposits, and it’s not a coincidence

Bitcoin surges a day after Grayscale reopens deposits, and it’s not a coincidence Bitcoin surges a day after Grayscale reopens deposits, and it’s not a coincidence

Photo by André François McKenzie on Unsplash

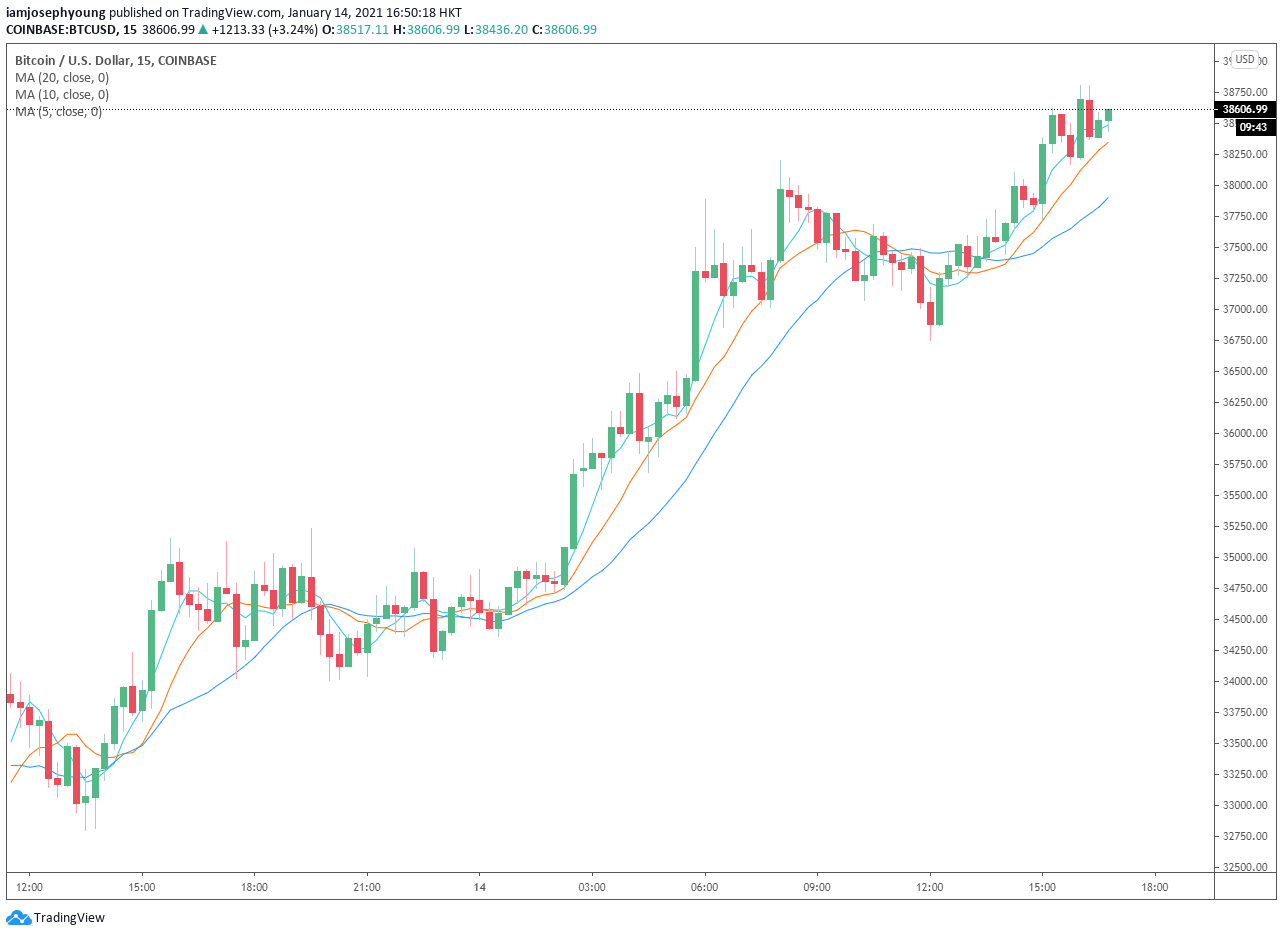

The price of Bitcoin has recovered strongly overnight, rising from around $34,000 to $38,500. The 10% rally coincides with Grayscale reopening its products.

Last month, Grayscale closed its products for new investors. Since Christmas, the Grayscale Bitcoin Trust did not report any additional inflow as a result.

The Grayscale Bitcoin Trust is the go-to investment vehicle for institutions in the U.S. to gain exposure to BTC. Hence, when it is closed to new investors, there are naturally lower capital inflows into the Bitcoin market.

Is Grayscale kickstarting the Bitcoin rally?

Although it is difficult to prove an exact correlation, the timing of Bitcoin’s relief rally is noteworthy.

Grayscale reopened its products for new investors on January 13. Within 24 hours, Bitcoin surged by 10%, seeing an explosive reaction from buyers to the $30,000 support level.

Bybt, an aggregated derivatives exchange data provider, reported that Grayscale added 2,172 BTC in the last 24 hours. At the price point of $38,500, it is equivalent to $83.6 million.

Grayscale is back!Grayscale gains another 2172 #BTC in 24 hours. Their total AUM now $26.39 billion.

?https://t.co/r1tmKT6a3r pic.twitter.com/lZlcJdNvTk— Bybt (@bybt_com) January 14, 2021

Throughout the fourth quarter of 2020, institutional investors were the primary catalyst of Bitcoin’s rally.

Grayscale saw large inflows, causing its assets under management to surpass $26 billion. Bakkt, CME, and LMAX Digital, all three that facilitate institutional trades, saw a significant increase in trading volume.

Hence, some analysts suggested that the reopening of Graycale’s products could result in a newfound rally for Bitcoin.

Since Grayscale closed its products to new investors, Bitcoin consolidated for a prolonged period. It saw a steep rejection from $42,000, dropping by 16% on a single day.

Based on the market’s reaction in the last 24 hours, it is becoming more evident that institutions are beginning to play a vital role in the cryptocurrency market.

Unlike the U.S. stock market that deals with trillions of value, the cryptocurrency market is worth just over $1 trillion.

In the stock market, retail investors could overrun institutions and there were instances of this throughout the last quarter of 2020.

Analysts, like Jim Cramer, said that Robinhood traders overwhelmed institutions at times, especially when the market started to become overheated.

In the cryptocurrency market, it is hard for retail investors to overpower institutions and professional traders. The volume of the market is increasing rapidly but it is still well dominated by whales, institutions, and high-net-worth investors.

What comes next?

Due to the volatility and large price swings, the cryptocurrency market sentiment tends to change radically at every correction and recovery.

The pseudonymous derivatives trader “Light” noted:

“Remember how you felt in the $40,000s. Now remember how you felt at $31,000. Now we come full circle to how you feel today. This never-changing cycle and its associated emotions are all you need to imprint in your self, and if you do, you will beat markets.”

Considering this trend, the market would likely see a euphoric sentiment in the foreseeable future, until the next shakeout comes.

Bitcoin Market Data

At the time of press 3:14 pm UTC on Oct. 19, 2021, Bitcoin is ranked #1 by market cap and the price is up 4.07% over the past 24 hours. Bitcoin has a market capitalization of $732.4 billion with a 24-hour trading volume of $62.95 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 3:14 pm UTC on Oct. 19, 2021, the total crypto market is valued at at $1.07 trillion with a 24-hour volume of $132.96 billion. Bitcoin dominance is currently at 68.55%. Learn more about the crypto market ›