Bitcoin mining equipment older than 2019 reaches shutdown price

Bitcoin mining equipment older than 2019 reaches shutdown price Bitcoin mining equipment older than 2019 reaches shutdown price

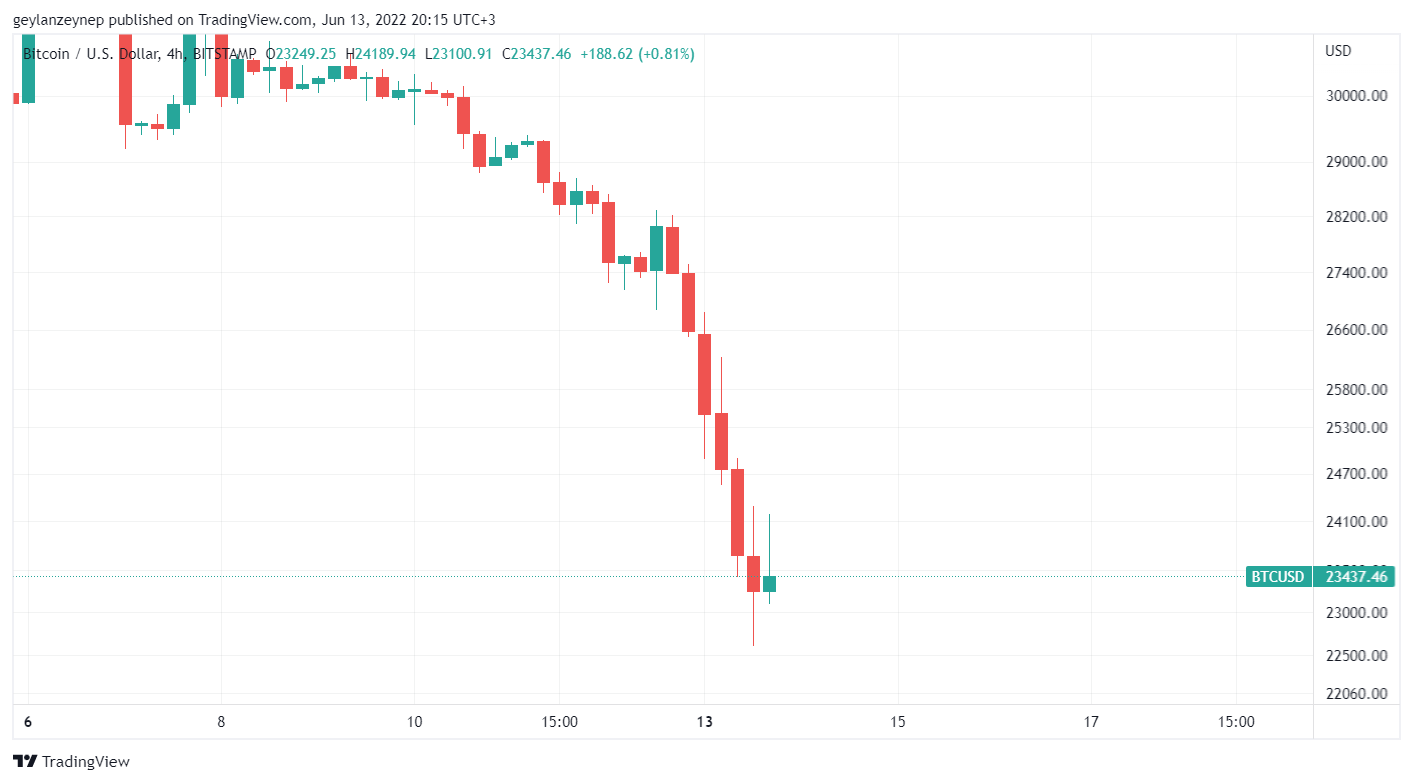

With the recent price fall in Bitcoin, some mining rigs produced in 2019 are working in the red as the amount they mine does not compensate for the energy they spend.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

As Bitcoin fell as low as $22,600, some mining equipment manufactured in 2019 is no longer profitable, while the rest is barely producing positive returns.

Bitcoin (BTC) mining company Bitdeer posted a chart on Twitter showing the price limits for each piece of equipment to remain profitable.

💡For your information, we publish the latest list of the Shutdown Price below which crypto mining machines in this chart will have to be shut down for lack of profitability. pic.twitter.com/qxGtLjJI9l

— Bitdeer (@BitdeerOfficial) June 13, 2022

Based on the chart, Antminer S17+/67, which was manufactured in 2019, is no longer profitable as of noon UTC today when Bitcoin fell below $25,000.

At press time, Bitcoin is trading at $23,437. However, it fell below $22,000 earlier today, which temporarily made Antminer S17+/73T’s unprofitable as well.

Antminer S19 and Whatsminer M30S+ were produced in 2020, while Antminer S19j was developed in 2021. These machines can handle an additional 15% loss in Bitcoin prices before they’re deemed unprofitable.

The remaining machines, which were also produced after 2020, can remain profitable for up to a 30% price loss in Bitcoin.

Did miners see it coming?

Bitcoin miners have been selling their earnings immediately since the beginning of the bear market.

Crypto YouTuber Lark Davis drew attention to the sell-off with his Tweet.

Ever since the recent crash began miners have been selling their #bitcoin.

This is the biggest sell off in 2 years. pic.twitter.com/eXg2vNT3TX

— Lark Davis (@TheCryptoLark) June 6, 2022

Since miners usually hold their earnings until the next bull market to sell for a higher price, their tendency to sell immediately indicated that they expected the Bitcoin price to fall even more.

On June 6, when CryptoSlate took a deep dive on the topic, Bitcoin was at $31,331.

Affordable mining

Countries that rely heavily on renewable energy sources become miners’ first choices because of affordable electricity prices.

Norway is one of those countries. According to the numbers from April 2022, Norway compensates 88% of its total energy need from hydroelectric power plants. As a result, the country historically had cheap electricity priced between $0.03 to $0.05. This would make mining equipment in Norway more prone to Bitcoin price falls.

Green mining has been on the surge for the last year, partly because miners aim to reduce costs and partly due to its harmful effect on the environment.

According to a report from Bitcoin Mining Council, around 58.4% of Bitcoin mining in the globe uses sustainable energy sources as of the first quarter of 2022. This indicates a 59% increase in usage of green energy in Bitcoin mining since the first quarter of 2021.

Examples of cheap and green mining emerge daily due to public figures’ encouragement and private partnerships.