Bitcoin is stable above $16k with little mainstream hype, and it’s very bullish

Bitcoin is stable above $16k with little mainstream hype, and it’s very bullish Bitcoin is stable above $16k with little mainstream hype, and it’s very bullish

Photo by Kristina Flour on Unsplash

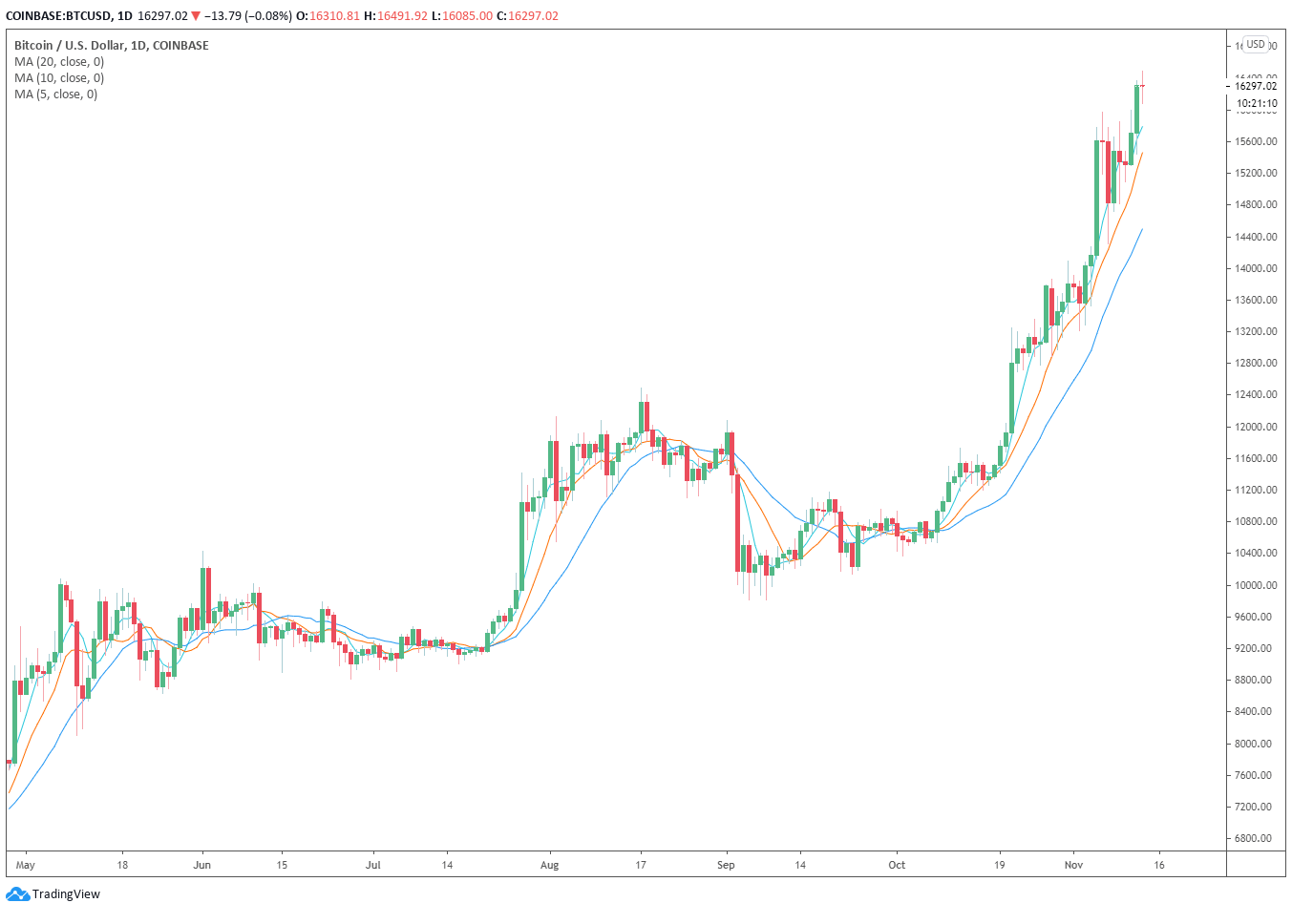

The price of Bitcoin is showing stability above $16,000 after a continuous rally since November 10. Every major dip was aggressively bought up, allowing BTC to sustain strong momentum. Yet, there is little mainstream hype behind the rally.

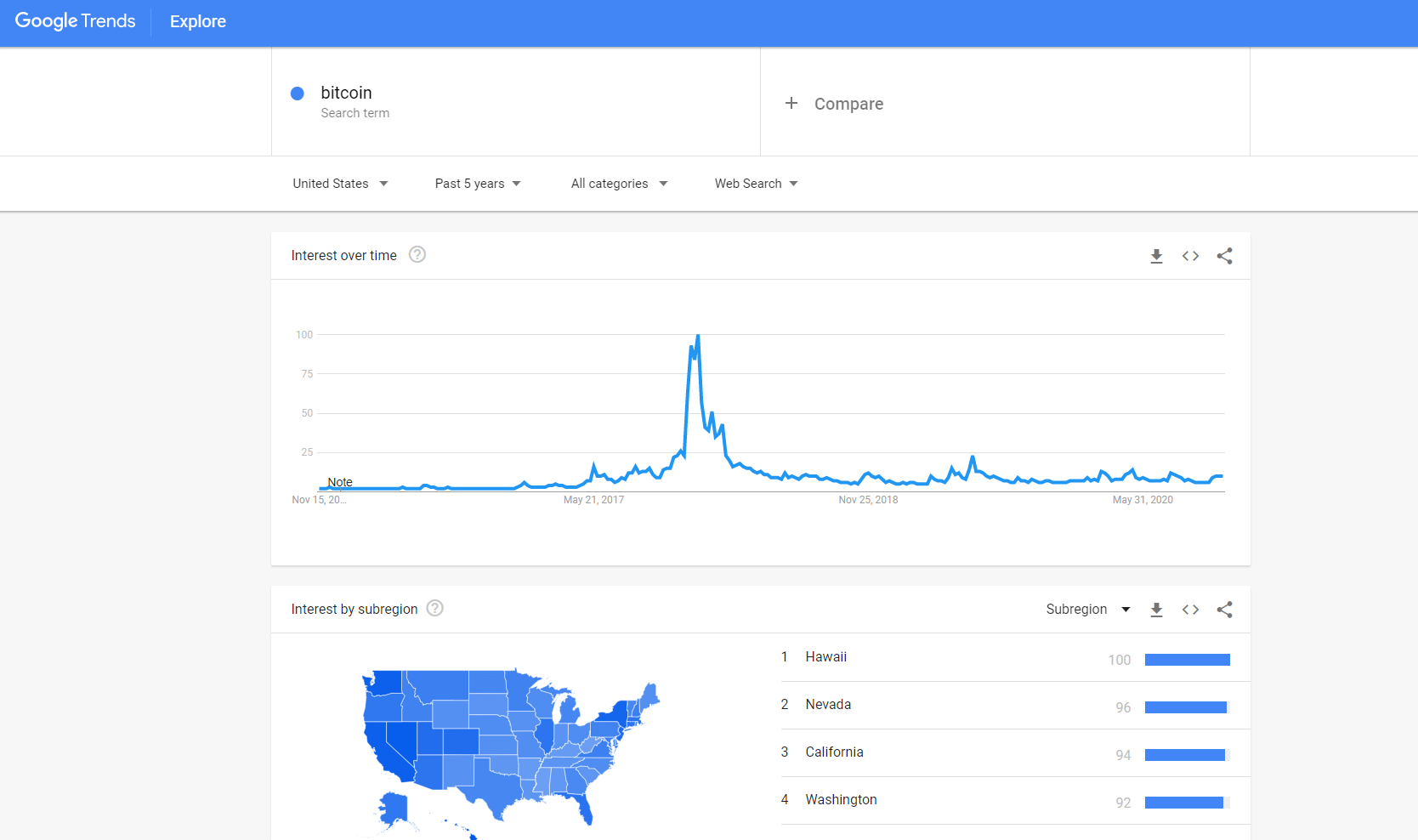

According to Google Trends, compared to the 2017 rally when Bitcoin hit $20,000, there is noticeably lower mainstream interest.

The popularity of the keyword “Bitcoin” on Google’s search engine is at 10 points out of a possible 100. In contrast, in 2017, the popularity of the same keyword hit achieved 100 points out of 100.

Why Bitcoin increasing in price without mainstream hype is optimistic

Throughout the past two months, the price of BTC has increased by around 65%. The entire rally occurred without much interest from the mainstream, at least on Google Trends.

This ongoing trend indicates three things that suggest that a broader Bitcoin rally would likely emerge in the medium term.

First, it shows that sidelined capital within the cryptocurrency market has flown back into Bitcoin. It demonstrates growing confidence from investors who likely hedged their BTC holdings with stablecoins like Tether.

Second, it signifies that BTC still has a large room for a larger rally because mainstream investors have been absent throughout the recent uptrend. In 2017, as soon as mainstream investors entered the cryptocurrency market, an explosive marketwide rally materialized.

Third, it depicts the trend which many on-chain analysts, including Woobull.com founder Willy Woo, have been emphasizing. The ongoing rally is organic because it is yet to see mainstream demand and it has been led by the spot market.

As such, when the mainstream demand for Bitcoin begins to pick up, a larger and a prolonged uptrend could emerge.

Analysts are positive about the year-end performance

Nunya Bizniz, a cryptocurrency investor, pinpointed the lackluster Google Trends interest when BTC was at $14,000.

Since then, BTC has increased by around 15% but the mainstream interest has stagnated since. Bizniz previously said:

“Google Trends: ‘Buy Bitcoin’ Interest in buying at $14K last time compared to today. The sheep are still asleep!”

A pseudonymous Bitcoin investor known as “Mr. HODL” echoed a similar sentiment. He wrote:

“We’re at $16k with zero hype. This is going to get stupid.”

On top of the low mainstream demand for Bitcoin, on-chain metrics are favoring a BTC uptrend in the near term.

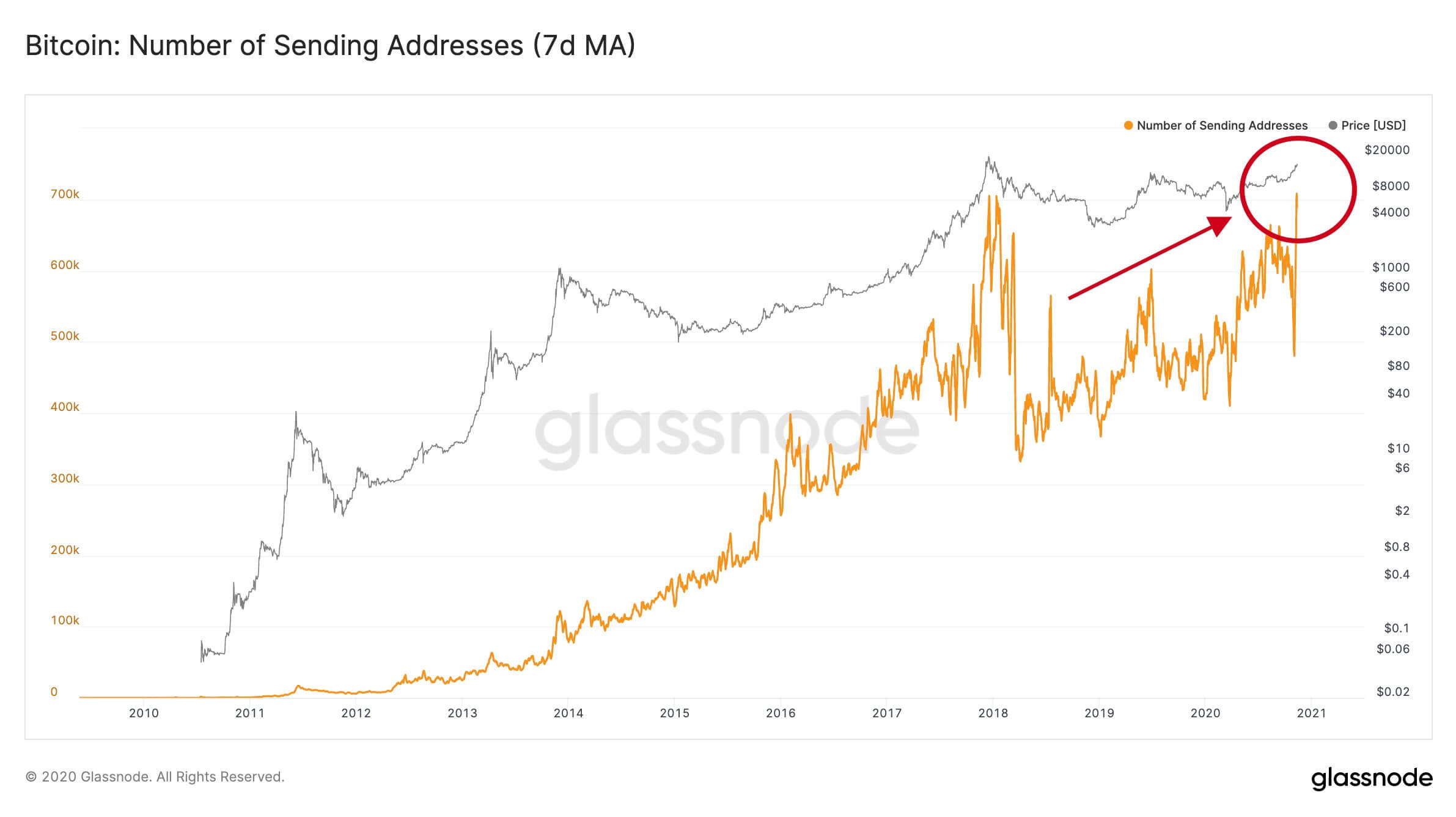

According to Glassnode, the number of Bitcoin addresses from senders reached an all-time high. This shows a high level of user activity on the blockchain, which generally indicates strong fundamentals for the dominant cryptocurrency.

The confluence of positive fundamental, technical, and macro factors are catalyzing a Bitcoin uptrend. When the momentum is met with real mainstream interest, there is a possibility that a 2017-esqe rally could occur once again.

Bitcoin Market Data

At the time of press 2:06 pm UTC on Nov. 13, 2020, Bitcoin is ranked #1 by market cap and the price is up 2.33% over the past 24 hours. Bitcoin has a market capitalization of $300.87 billion with a 24-hour trading volume of $35.75 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 2:06 pm UTC on Nov. 13, 2020, the total crypto market is valued at at $464.94 billion with a 24-hour volume of $123.91 billion. Bitcoin dominance is currently at 64.74%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant