Bitcoin fees up more than 2000% since August due to renewed interest in Ordinals

Bitcoin fees up more than 2000% since August due to renewed interest in Ordinals Bitcoin fees up more than 2000% since August due to renewed interest in Ordinals

Bitcoin Ordinals are seeing renewed interest thanks to their recent listing on Binance.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

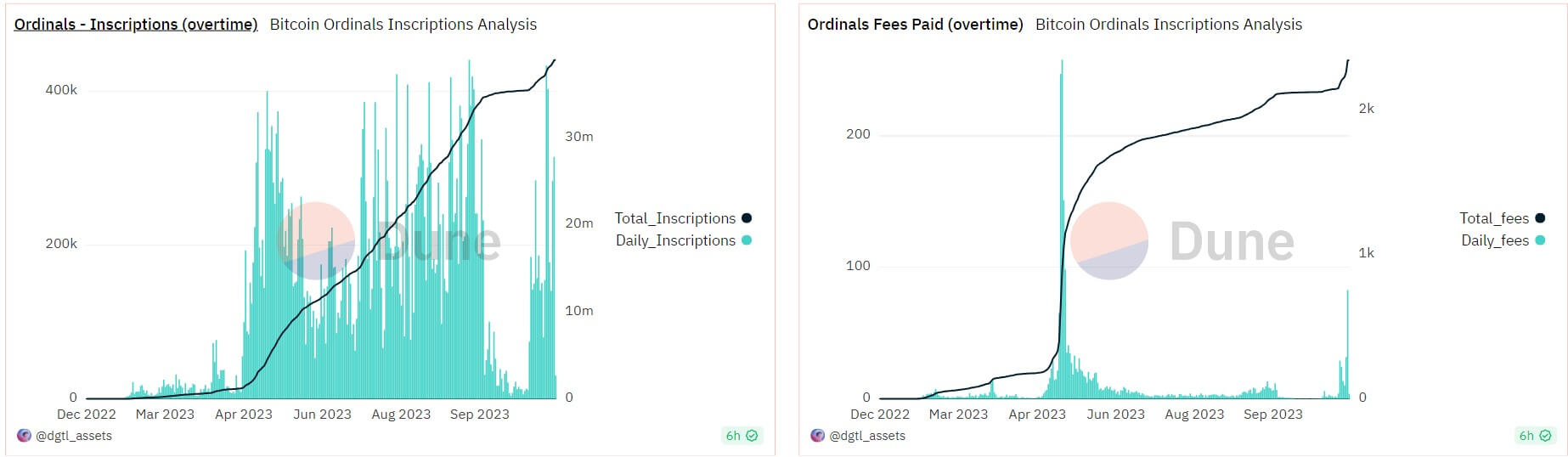

Bitcoin transaction fees have risen to a six-month high amidst a resurgence in the popularity of Ordinals Inscriptions.

Data from BitInfoCharts reveals that Bitcoin’s average transaction fee has reached its highest point since May, surging over 2,000% since its August low of $0.64.

Per the data aggregator, an average BTC transaction would cost around $15.86 as of press time.

Market observers have attributed this spike to the renewed enthusiasm surrounding Ordinals.

Ordinal Inscriptions are digital assets similar to NFTs inscribed on a satoshi, BTC’s lowest denomination. These assets had gained popularity earlier in the year and heralded Bitcoin’s foray into the NFT space. But interest in them soon faded as the market landscape evolved.