Australia aims to finalize crypto regulation by 2025

Australia aims to finalize crypto regulation by 2025 Australia aims to finalize crypto regulation by 2025

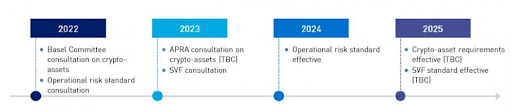

Australian Prudential Regulation Authority’s (APRA) roadmap includes annual action steps to regulate all crypto-related activities and aims at releasing the regulations by 2025.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Australia’s Prudential Regulation Authority (APRA) released a roadmap of its plan to fully regulate the crypto industry in the country by 2025.

Under the plan, the APRA will gradually increase its sector supervision over the coming three years. The watchdog will carry out consultations during 2022 and 2023, following which it will gradually introduce regulatory standards in 2024 and 2025.

APRA Chair Wayne Byres said:

“APRA is developing the longer-term prudential framework for crypto-assets and related activities in Australia in consultation with other regulators internationally, to ensure consistency in approach.”

2022

The Basel Committee consultation on crypto assets will provide insights on how to cautiously expose banks and other authorized deposit-taking institutions (ADIs) to crypto. These insights will minimize the operational risks associated with handling crypto and provide a starting point for other APRA-regulated industries.

2023

After setting the requirements in 2022, APRA will start shaping the articles. It will receive additional consultancy services in the process if it needs. In addition, all related payment, technology, and financial services regulations will be updated to align them with the crypto asset requirements.

APRA will also start working on prudential regulation of payment stablecoins. It likens these stablecoins to Stored-value Facilities (SVFs). Therefore, it will look for ways to incorporate stablecoins into the regulatory framework for SVFs. The Council of Financial Regulators (CFR) will also step in for this action point.

2024 and 2025

The roadmap also includes APRA’s expectations from crypto businesses regarding risk management and annual action steps.

Entities that offer services associated with crypto assets are expected to conduct appropriate due diligence and comprehensive risk assessments while complying with all conduct and disclosure requirements by Australian Securities and Investments (ASIC).

APRA plans to elaborate and enact these operational risk standards in 2024 to include instructions regarding investment and lending activities, crypto-asset issuances, and partnering with third parties.

After that, APRA aims to finalize the crypto asset requirements and stablecoin standards by 2025 and finalize its regulatory framework.

Australia and crypto

Australia has been publicly supporting all aspects of crypto and blockchain, including payments, NTFs and metaverse, and DeFi. The country also showed a pro-regulation stance in March 2022 when a senator proposed a new regulatory framework.

Australia has a crypto high adoption rate. The country has the third-highest crypto ownership rate, with 17.7%, according to a report from October 2021.

Farside Investors

Farside Investors