Analysts explain why Bitcoin is primed for a rally back to $40k and higher

Analysts explain why Bitcoin is primed for a rally back to $40k and higher Analysts explain why Bitcoin is primed for a rally back to $40k and higher

Photo by Charlie Hammond on Unsplash

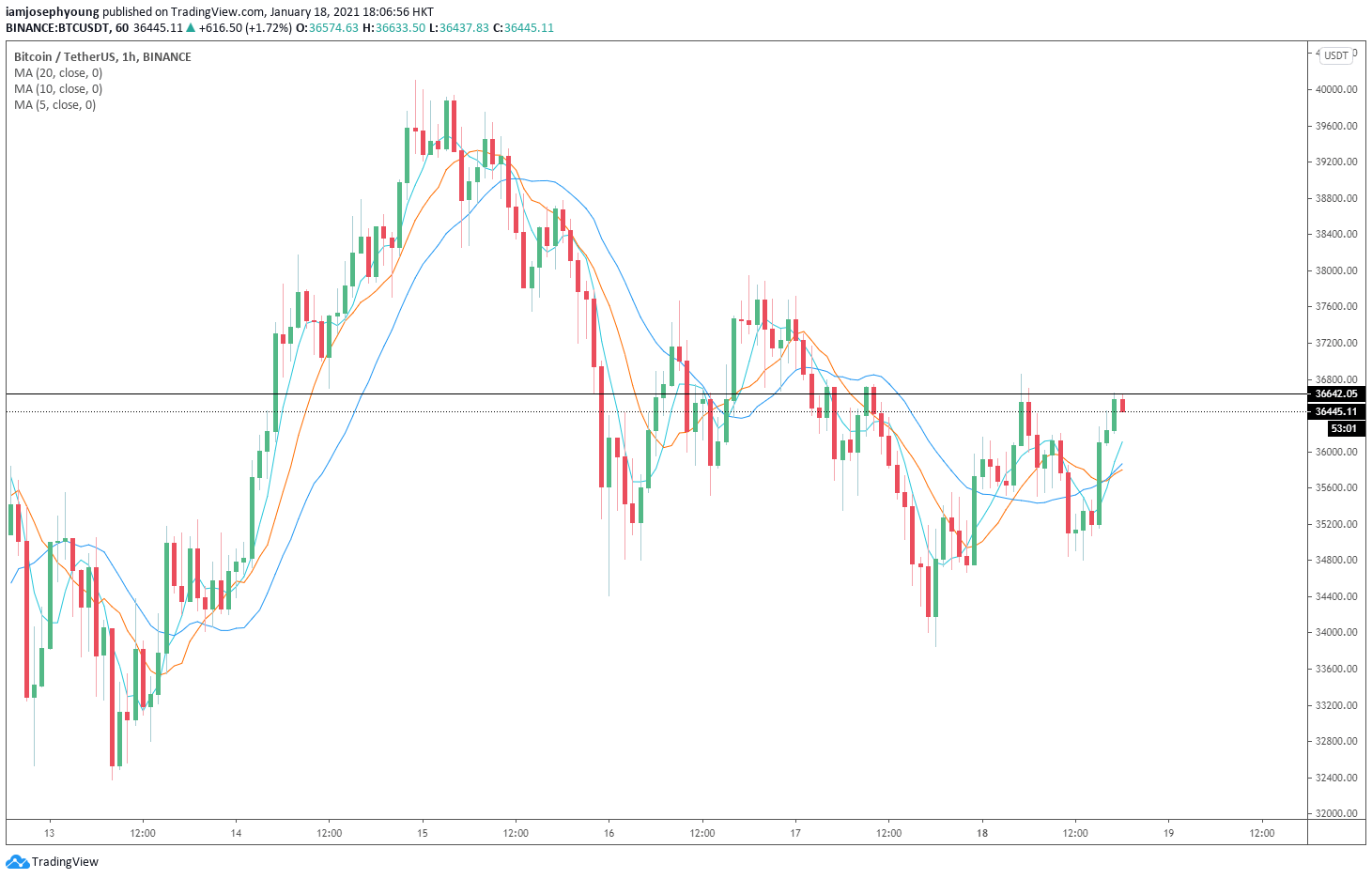

The price of Bitcoin is hovering under $37,000 after the correction from $40,000 in the past 72 hours. Trader Peter Brandt believes BTC would either face a “complicated” correction or see a broader rally.

Brandt, a long-time trader, pinpointed the daily price chart of Bitcoin to explain that the range is tightening.

When the range of an asset tightens and volatility drops, a major price movement typically occurs.

Will the Bitcoin major price movement be a rally?

Whether Bitcoin would see an explosive rally upwards or see a correction remains uncertain.

When it comes to a tight range like this, if the first impulse move is a rally, then a bigger upside movement would likely follow. Brandt said:

“Interest juncture in $BTC. Could be wrong, but I think market needs to blast off from here or a more complicated correction will occur. We’ll see.”

Raoul Pal, the CEO at Real Vision Group, echoed a similar sentiment. Referring to Brandt’s tweet, Pal wrote:

“Yes, totally agree. A triangle likes this will provide a big move one way or the other.”

There are compelling arguments to justify both a bearish pullback and a bullish retest of the $42,000 all-time high for Bitcoin.

Currently, the Coinbase premium that led the Bitcoin rally is non-existent. Throughout the uptrend, Bitcoin was trading higher on Coinbase, which signaled strong buyer demand from the U.S.

If the Coinbase premium returns, this would provide more conviction that the Bitcoin rally would resume.

One positive trend is that the deposits from whales into exchanges are dropping. This means that the overall selling pressure on the market is much lower than where it was in the past few weeks.

Lower selling pressure but lower buyer demand

In a nutshell, the market is stagnant because it is seeing generally lower selling pressure from whales but the buyer demand is not as high as before.

Ideally, Bitcoin would need to see more stablecoin deposits into exchanges and the Coinbase premium to return to see a stronger argument for more upside.

Cantering Clark, a cryptocurrency trader, also noted that the performance of the U.S. dollar is another variable that could potentially affect Bitcoin. He said:

“Too much certainty in the market right now. I am taking a bit of risk off the table. Also, CB leading the selling and not picking up at the lows. Long-term expectations are higher, but in the short term, I think the coming week will be a volatile one. Interested in seeing how Yellen’s comments affect the dollar.”

Bitcoin Market Data

At the time of press 4:07 pm UTC on Jan. 19, 2021, Bitcoin is ranked #1 by market cap and the price is up 2.63% over the past 24 hours. Bitcoin has a market capitalization of $694.56 billion with a 24-hour trading volume of $52.46 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:07 pm UTC on Jan. 19, 2021, the total crypto market is valued at at $1.06 trillion with a 24-hour volume of $132.71 billion. Bitcoin dominance is currently at 65.26%. Learn more about the crypto market ›