After halving, Bitcoin could rally 3,500% to $288k: Understanding PlanB’s “perfect fit” analysis

After halving, Bitcoin could rally 3,500% to $288k: Understanding PlanB’s “perfect fit” analysis After halving, Bitcoin could rally 3,500% to $288k: Understanding PlanB’s “perfect fit” analysis

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Early last year, a Bitcoin analyst going by the moniker of “PlanB” released an article titled “Modeling Bitcoin’s Value with Scarcity” to Medium. At the time of the article’s publishing, few knew who PlanB was, and few knew what he was working on.

But in that article, PlanB — later revealed to be a European institutional investor that moonlights as a Bitcoin quantitative analyst — revealed a big finding: BTC actually has an intrinsic value, despite the cynics.

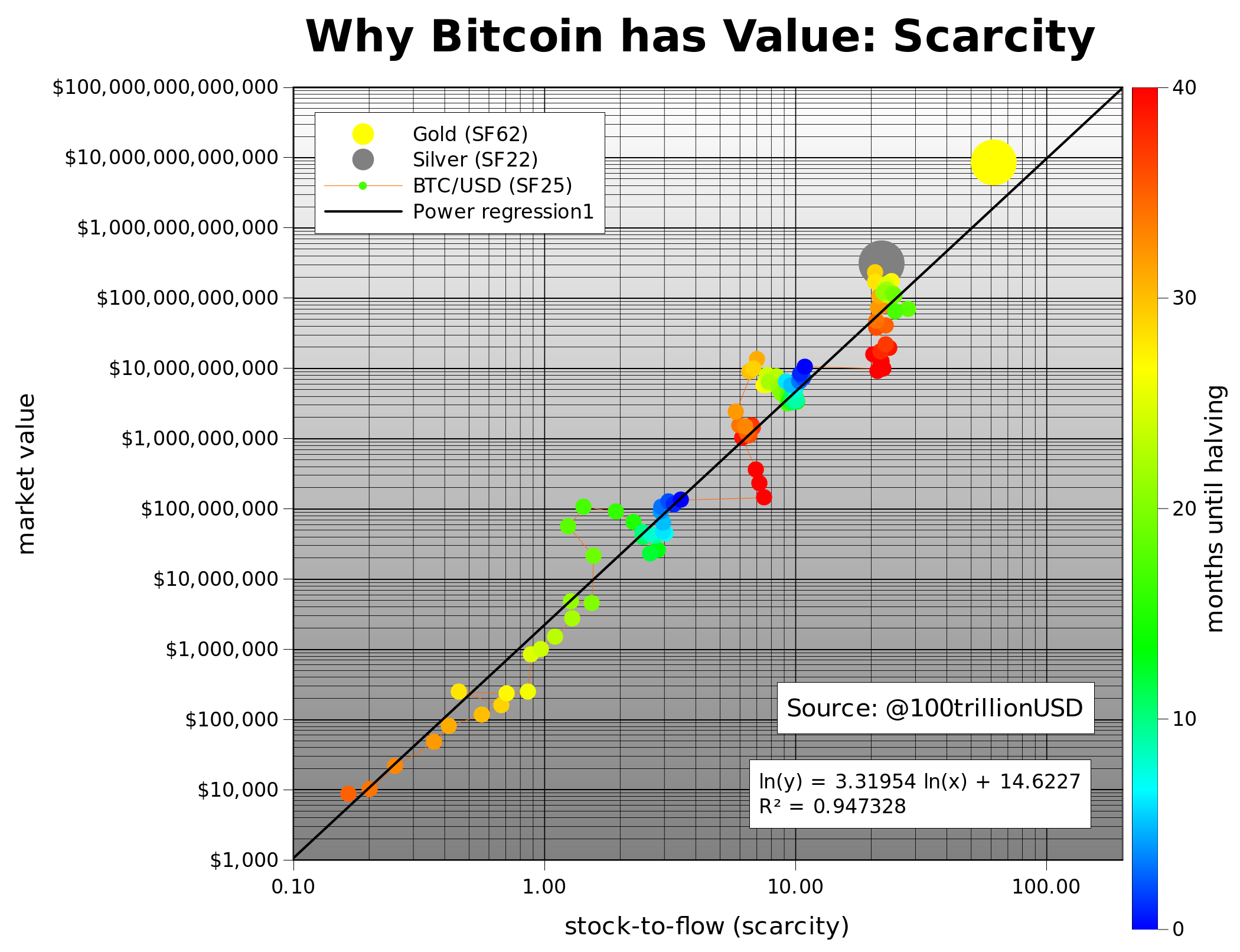

It was revealed that the market capitalization of the cryptocurrency can be predicted by creating a chart where the stock-to-flow ratio — an asset’s above-ground supply over its yearly inflation rate — is the independent variable and market cap is the dependent variable, then using a logarithmic regression to connect each historic point.

The model — then accurate to a 95 percent R squared (statistics for extremely accurate) and then confirmed by statistical studies — found that Bitcoin’s fair value will rise to $55,000 to $100,000 after the next block reward reduction or “halving” in May 2020.

While many investors have been surprised by the high prices BTC is predicted to reach, PlanB just issued an update to the model, determining that the $50,000 forecast is well too low.

As crazy as this sounds, PlanB remarked that the new model is so good, it is a “perfect fit.”

The revised stock-to-flow model for Bitcoin’s price is even more bullish than the last

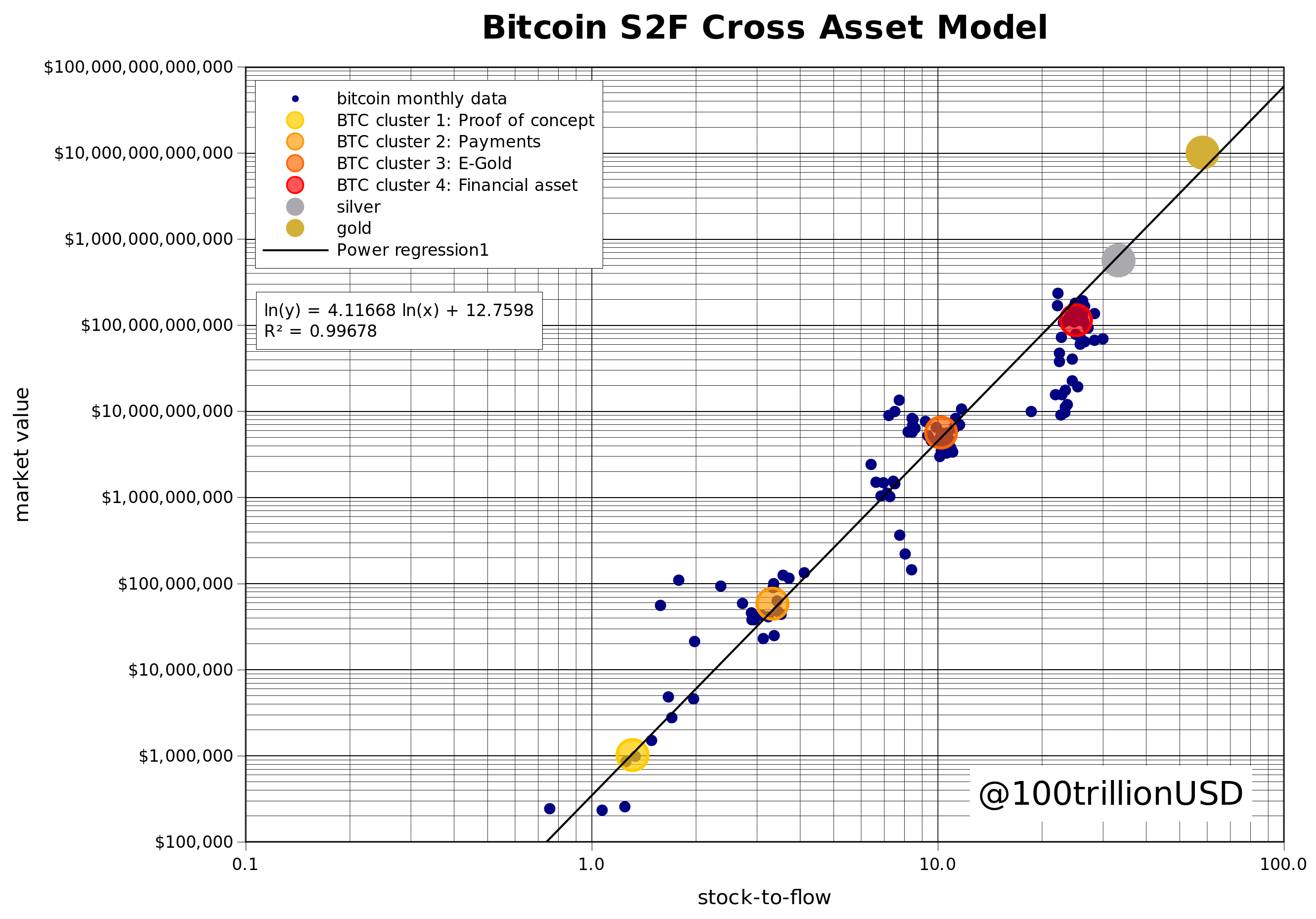

In this new analysis, titled “Bitcoin Stock-to-Flow Cross Asset Model,” it was found that a similar methodology of relating an asset’s market capitalization to its level of scarcity can be applied to not only BTC, but also gold and silver. Fittingly, gold and silver have increasingly been called BItcoin’s contemporaries.

PlanB’s kicker: these three assets can be valued with a single equation.

After explaining that once you remove time from the model, Bitcoin’s price can be plotted into four clusters or four phases: Proof of Concept, Payments, E-gold, and financial asset. The phases were determined by market cycles based on BTC’s scarcity.

Taking the average price and stock-to-flow ratios of these clusters and the data of the precious metals, the analyst found that like his original model, they can all be connected by a logarithmic regression that has a “perfect fit,” an R squared of 99.7 percent.

With the halving on the minds of all investors, this led PlanB to the following conclusion:

[The new] model estimates a market value of the next BTC phase/cluster of $5.5T. This translates into a BTC price of $288K [between 2020-2024].

$288,000, for some context, is more than 3,500 percent higher than the current market price of BTC.

Stock-to-flow model comes under fire

The release of PlanB’s latest work comes shortly after the analyst’s original work on the stock-to-flow model for Bitcoin price was bashed extensively on Twitter, with many drawing the efficacy of the math into question.

For instance, per previous reports from CryptoSlate, Hugo Nguyen, a resident at Bitcoin development firm Chaincode Labs, said that he thinks “anyone using the ridiculous S2F price model and consider flow to be effectively non-zero is just silly.”

He doubled down in a Twitter thread published Apr. 13, opening that he thinks PlanB’s original model is predicated on “2 pathetic data points,” referencing the fact that there have only been two prior halvings, and a “generous margin of error.”

Nic Carter, a partner at Castle Island Ventures, echoed this skepticism in an interview with Braiins, remarking that he thinks BTC’s actual inflation rate is actually zero percent as the issuance curve is known in advance, thus rendering PlanB’s models moot.

It isn’t clear how this new take on the stock-to-flow model has been received by the naysayers.

Other reasons to be bullish on Bitcoin

Despite the uncertainty around the stock-to-flow analysis and the effects of halvings on the market, there are many other reasons to be bullish on the cryptocurrency.

Case in point: Nguyen, in the wake of bashing the price model, pointed to four reasons to have faith that BTC will appreciate in the long run:

- Bitcoin’s sound properties as a form of money

- Its “unforgettable costliness,” referencing miners

- A 99.98 percent server uptime

- And the potential of the Schnorr Signature and Taproot technologies, slated to increase the usability of Bitcoin in many ways, potentially acting as a boon for adoption.

Farside Investors

Farside Investors