YFI, Aave, Maker surge up to 30% overnight, what’s fueling the DeFi recovery?

YFI, Aave, Maker surge up to 30% overnight, what’s fueling the DeFi recovery? YFI, Aave, Maker surge up to 30% overnight, what’s fueling the DeFi recovery?

Photo by Josh Spires on Unsplash

Yearn.finance (YFI), Aave (LEND), and Maker have surged 12% to 30% overnight. The decentralized finance (DeFi) market strongly rebounded in a short period, lifting the overall market sentiment.

Two factors primarily triggered the resurgence of DeFi in the last 24 hours. First, Bitcoin and Ethereum rallied overnight ahead of the quarterly close. Second, the DeFi market comes off a steep correction of nearly 60%.

YFI, Aave, Maker benefit from Bitcoin and Ethereum resilience

In the past 12 hours, both Bitcoin and Ethereum have recovered by around 2% to 3%. BTC rose higher after the quarterly close on October 1, causing the market sentiment to turn increasingly positive.

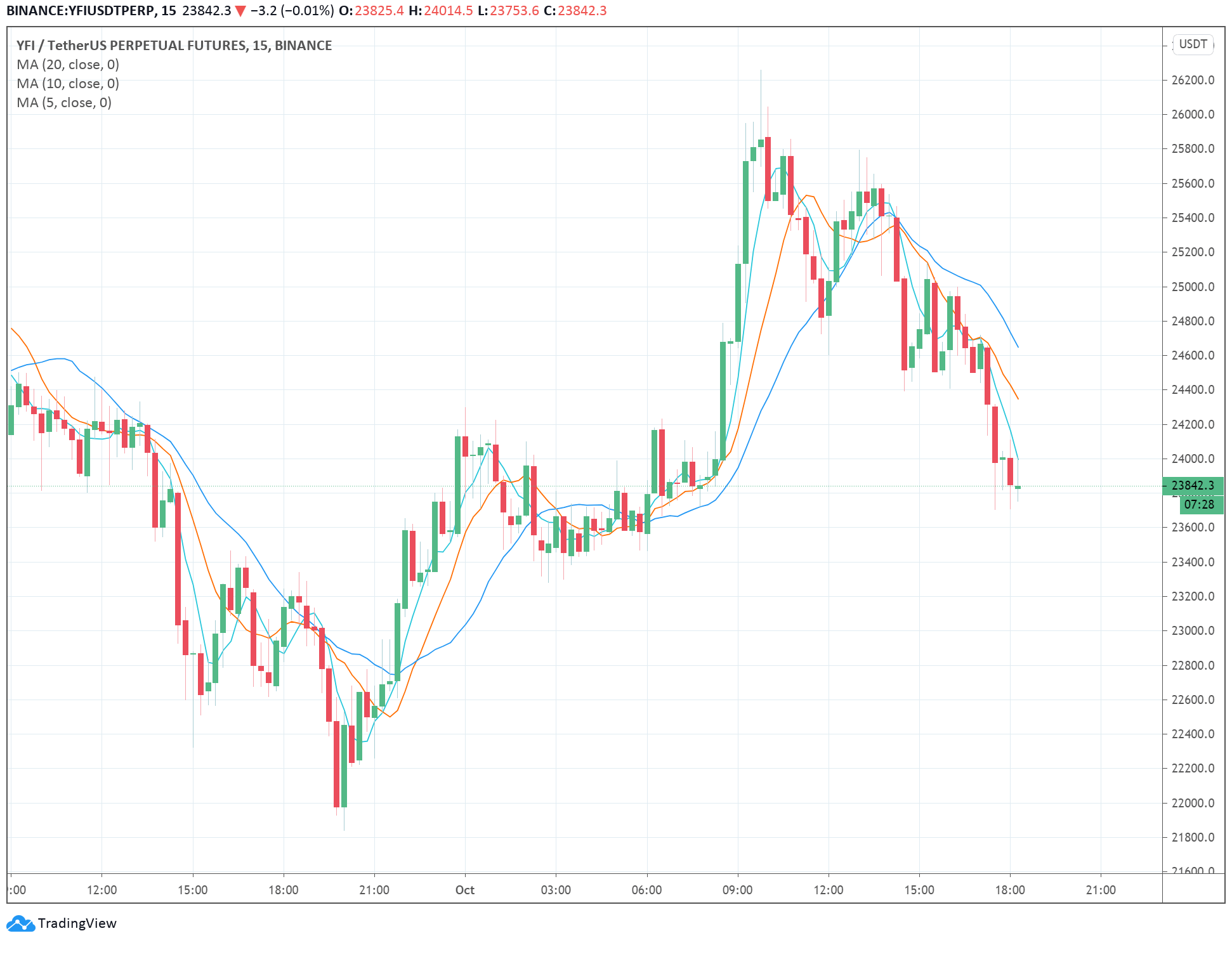

When the price of Bitcoin initially fell to as low as $10,665 on September 30, YFI plunged to $21,800. In recent weeks, after YFI reached a billion-dollar market cap, it has led the performance of many small-cap DeFi tokens.

Since then, in the last 12 hours, YFI has recovered to $24,000, rising by 10%. At the daily peak, YFI hit $26,250 across major exchanges, recording a 20% rally.

In the same period, Aave’s LEND token rebounded by nearly 12% and Maker posted an 18% rally. In the past 24 hours, Maker gained 30% after a surge in total value locked.

Product launches and rising DeFi demand are buoying investor confidence

The recovery of Bitcoin and Ethereum aided the rebound of DeFi tokens, but major DeFi projects also released major updates.

Yearn.finance, for instance, announced the release of Yearn v2 Vaults. One of the major factors behind the meteoric rise of YFI was the demand for its vaults. They allow Ethereum and other token holders to earn passive yield with minimal risk.

The Yearn.finance team wrote:

“Yearn v2 Vaults are under active development. Will include new vaults and strategies. We are very excited for this. Additional details will be shared when available.”

Yearn.finance developers also shared the official Github contribution of the new vaults, formalizing the update.

Maker’s uptrend also coincides with a key upgrade that brings the peg of the DAI stablecoin closer to $1. Upon the change, the total value locked in Maker rose by $400 million, primarily in USDC.

Jack Purdy, a cryptocurrency researcher, explained:

“While new governance tokens and sky-high APYs stealing all the attention during the latest DeFi Summer Maker has quietly grown to almost $2 billion in value locked.”

The confluence of the overall market recovery, key product launches, and crucial network upgrades aided the recovery of DeFi.

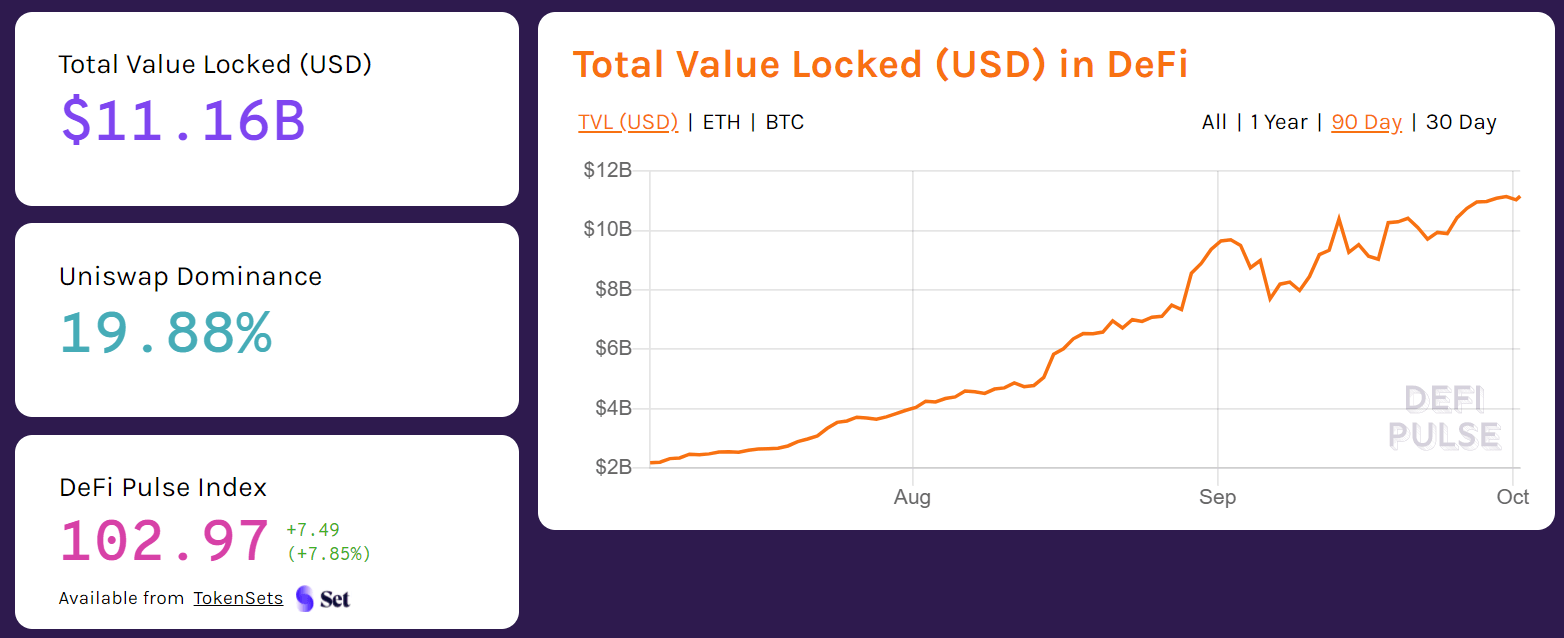

Data from Defipulse.com shows that the total value locked across all DeFi protocols is steadily recovering. The TVL is now at an all-time high above $11 billion, depicting strengthening investor confidence amid a market draught.

Maker Market Data

At the time of press 8:05 pm UTC on Feb. 4, 2021, Maker is ranked #34 by market cap and the price is up 4.18% over the past 24 hours. Maker has a market capitalization of $574.7 million with a 24-hour trading volume of $43.94 million. Learn more about Maker ›

Crypto Market Summary

At the time of press 8:05 pm UTC on Feb. 4, 2021, the total crypto market is valued at at $337.02 billion with a 24-hour volume of $87.62 billion. Bitcoin dominance is currently at 58.07%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass