Yield farming frenzy has led to massive Ethereum, Tether withdrawals in China

Yield farming frenzy has led to massive Ethereum, Tether withdrawals in China Yield farming frenzy has led to massive Ethereum, Tether withdrawals in China

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The ongoing rush for “yield farming” in the crypto market has reportedly led to Chinese investors withdrawing funds from exchanges in the country to lock them up on obscure protocols that promise high yields, said local outlet WuBlockchain earlier today.

Ethereum withdrawals surge in China

Colin Wu, a reporter focused on the local blockchain and cryptocurrency sector in China, said that on September 6, “many exchanges in China experienced difficulties in withdrawing coins and shutdowns.”

Breaking: On Sep 6th, many exchanges in China experienced difficulties in withdrawing coins and shutdowns. Chinese community is launching a "coin withdrawal campaign", calling to withdraw all USDT and crypto in the exchange and delete their accounts. pic.twitter.com/JwUzRFbqXx

— Colin Wu(WuBlockchain) (@WuBlockchain) September 7, 2020

He claimed it was caused by the Chinese crypto community withdrawing liquidity en masse and transferring millions of dollars worth of Tether and other altcoins to yield farming projects like Yearn Finance and SushiSwap.

Wu supported the claim using data from CryptoQuant, an on-chain analytics firm. He said the recent price drop over this weekend caused investors to buy the dip and then transfer to decentralized exchanges, like Uniswap, to exchange to other tokens.

The data shows that due to the popularity of yield farming, especially the recent sharp drop in the price of ETH, many users buy bottoms on exchanges and then transfer to DEX for farming. The stock of ETH and other farm crypto on the exchange is falling frantically. pic.twitter.com/I6982HMVTL

— Colin Wu(WuBlockchain) (@WuBlockchain) September 7, 2020

The data showed exchange “reserves” — or the number of cryptocurrencies present on any exchange at a given time for trading — saw a significant dip. Bitfinex and Kucoin, two popular crypto exchanges, were the most affected.

Wu added in a follow-up tweet:

“The “withdrawal movement” is widely spread, but the actual impact is uncertain. Exchanges are also starting to defend, such as a crazy listing of DeFi coins to make users gamble in the secondary market, and helping users with yield farming.”

DeFi’s “crazy” rush

Wu’s comment came as crypto exchange Binance launched its “Launch Pool” service on Sunday to provide yields using its BNB token. In an announcement, Binance said BNB holders opting for Launch Pool will automatically receive interest on projects that issue their tokens on the Binance chain, starting with Bella Protocol yesterday.

“We’re excited to host @BellaProtocol as Launchpool’s first #DeFi offering on the Binance platform, and are delighted to offer #Binance users the opportunity to securely farm new assets.” – @cz_binance https://t.co/A4EsXklbL7

— Binance (@binance) September 6, 2020

The rush for DeFi listings and yield farming has picked up massively in the past month, with projects locking up hundreds of millions upon launch in a reminiscent of 2017’s infamous ICO bubble.

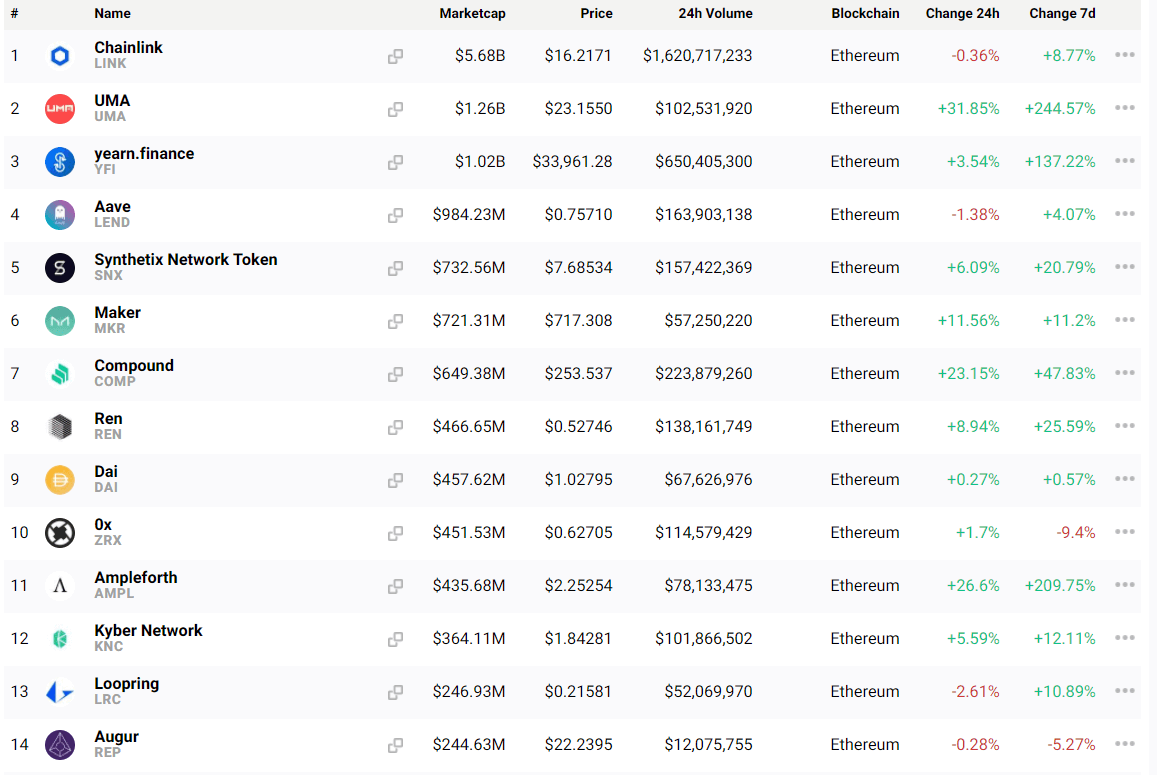

Ethereum is still the choice of blockchain among issuers. As per CryptoSlate’s data page, the top-15 DeFi tokens and projects operate on the Ethereum network and lock up billions of dollars.

As a consequence, the activity has caused immense congestion and strain on the network with fees spiking up to over $60 per transfer.

And that might just be getting started, especially if the market attracts billions of dollars from new users in China.

Farside Investors

Farside Investors

CoinGlass

CoinGlass