What happens to Bitcoin after 9% plunge in 2 hours? Analysts explain

What happens to Bitcoin after 9% plunge in 2 hours? Analysts explain What happens to Bitcoin after 9% plunge in 2 hours? Analysts explain

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

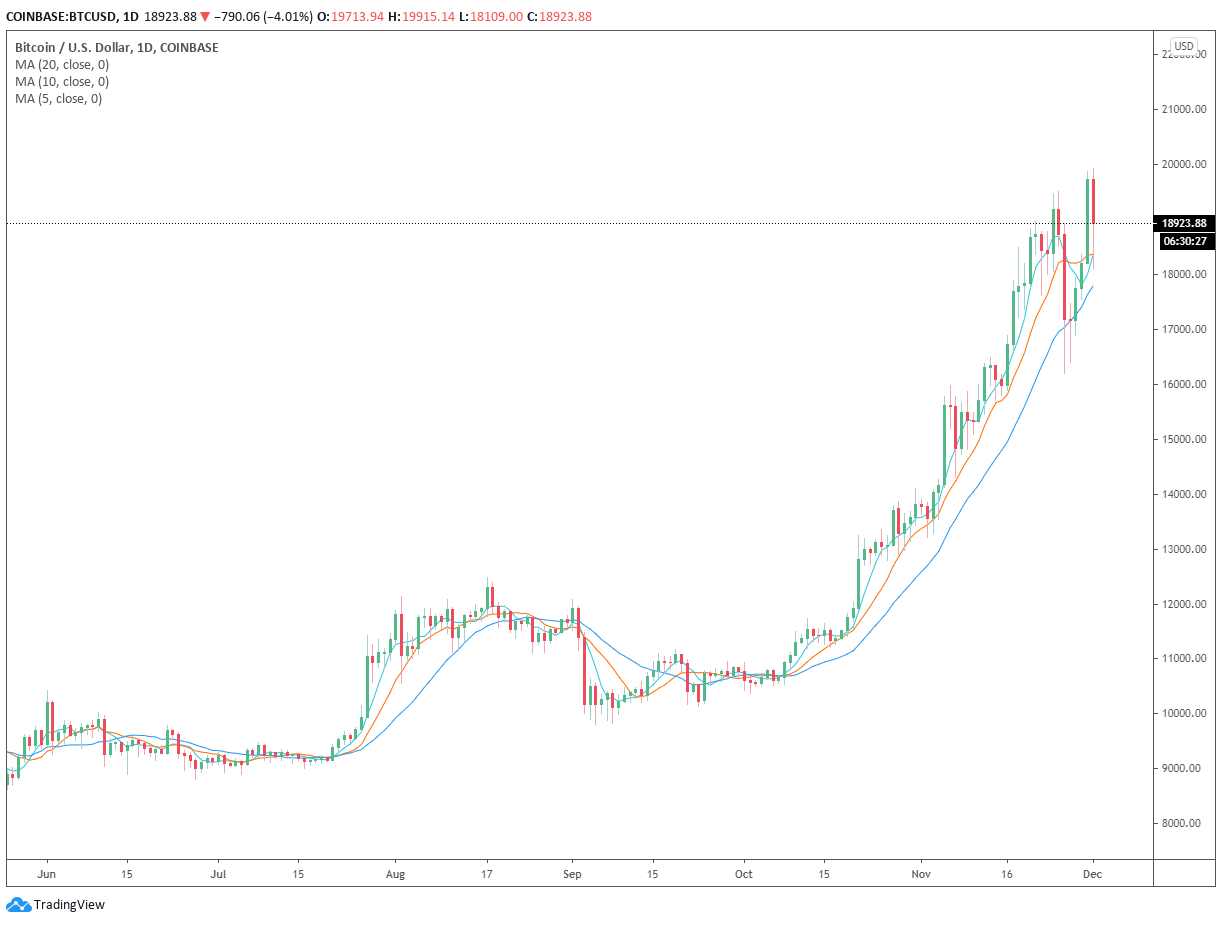

The price of Bitcoin dropped 9% in 2 hours and then quickly recovered. Analysts remain divided on the direction of BTC in the near term.

The drop occurred as top futures exchanges, like Binance Futures, saw large liquidations across the board.

Generally, traders remain optimistic in the medium term, as Bitcoin surpassed its record high. But, in the short term, technical analysts are leaning cautiously as BTC shows signs of a top.

Two factors make a larger Bitcoin drop likely

In the near term, there are two main reasons a deeper correction could occur.

First, BTC faces major resistance at $19,400 and $20,000. The latest retest of $20,000 was met with a strong sell-off.

Second, the volume in the Bitcoin market is beginning to dwindle, which decreases the probability of a strong breakout above $20,000.

A pseudonymous trader known as “Beastlorion” said that the recent rejection makes a sustainable rally above $20,000 less likely. The trader said:

“IMO it makes the most sense for $BTC to drop back to support before really breaking through $20k. It’s a little to extended to sustainably break above $20k now. If it pulls back it will act as a spring for the following rally. Ready to long $15k with everything.”

The bearish market trend coincides with unfavorable volumes across major spot exchanges. For BTC to surge past its all-time high, strong volume is needed to aid the uptrend.

But, a trader known as “Byzantine General” noted that volume analysis shows the volume was lower on the way to $20,000 than the previous rallies. The trader noted:

“Some volume analysis. You’re looking at aggregated spot volume. We took out the local high, but vol was way lower than during the previous pump. It really kicked in during the dump. Volume could have told you the rally wasn’t real.”

Bitcoin would have to see three key trends emerge in the near term to surge past $20,000. The trends are rising volume, the rebuilding of the futures market’s open interest, and consolidation above $19,000.

What the on-chain metrics show

Typically, the on-chain movement of addresses and Bitcoin demonstrate the overall Bitcoin market trend.

According to Rafael Schultze-Kraft, the CTO at Glassnode, Bitcoin tends to top when the number of profitable BTC moved on-chain hit 65%.

The indicator recently achieved 65%, and a drop followed shortly thereafter. This could increase the probability of a relief rally in the near term. He said:

“How many bitcoins moved on-chain are in profit? Great indicator to detect local tops when reversing above 65%. Looks like the recent reversal only lead to the $19k to $17k dip – and started moving back up. More upside here? Watching closely.”

Whether the relief rally was the intraday upsurge of BTC from $18,200 to $19,400 remains to be seen. For now, BTC is treading under $19,000, which indicates lacking momentum.

CryptoQuant

CryptoQuant