Whales sell liquid staking tokens as Ethereum Shappella upgrade nears

Whales sell liquid staking tokens as Ethereum Shappella upgrade nears Whales sell liquid staking tokens as Ethereum Shappella upgrade nears

Blockchain investigator Lookonchain reported that a whale — Blockchain Capital — profited over $2 million from selling liquid staking tokens.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

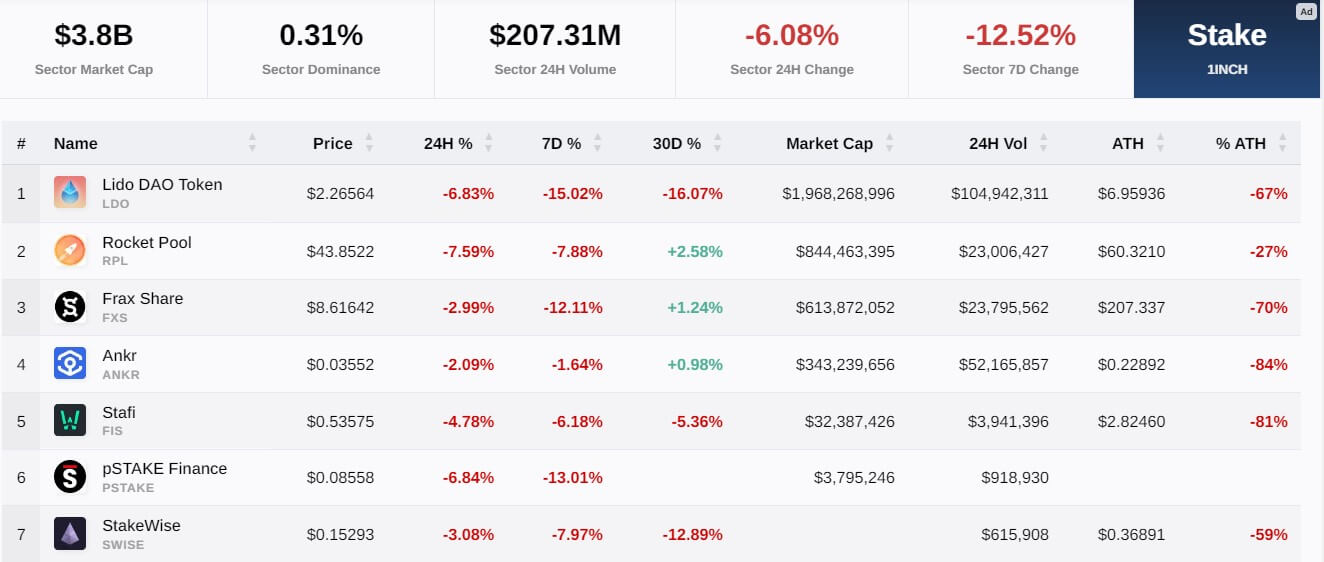

Liquid staking is one of the worst-performing crypto sectors in the last 24 hours after declining by more than 6%, according to CryptoSlate data.

According to CryptoSlate’s data, all seven projects in the space fell by more than 2%, with three of them — Lido (LDO), Rocket Pool (RPL), and pSTAKE Finance (PSTAKE)— falling by more than 6%, respectively.

On the seven days metrics, these protocols have lost 13% of their values, indicating that the current sell-off has been on for the past week.

Liquid staking derivatives (LSD) platforms enjoyed high interest earlier in the year as the market prepared for Ethereum’s Shapella network upgrade that would enable staked token withdrawals.

Lido, Rocket Pool shed over 6% as whales sell holdings

Blockchain investigator Lookonchain reported that a whale — Blockchain Capital — profited over $2 million from selling liquid staking tokens. Lookonchain said the whale sold 1.5 million LDO tokens for $2.52 million and 65,352 RPL tokens for $2.9 million.

Other LDO whales like MakerDAO founder Rune Christensen and Dragon Fly also sold over 500,000 units of the token on April 10, Lookonchain reported.

Blockchain analytical firm Arkham Intelligence noted that activity in LSD tokens was heating up. The firm added that a wallet belonging to crypto trader Sisyphus recently sold $400,000 worth of LDO tokens.

Lido and Rocket Pool are among the industry’s top three dominant liquid staking platforms. Over 6.5 million ETH — worth $12.64 billion — have been locked on the two protocols, according to DeFillama data.

Other LSD tokens

Meanwhile, Frax Share’s FXS fell by roughly 3% to $8.61642 at the time of writing. Other protocols like StakeWise (SWISE), ANKR, and Stafi (FIS) posted losses in the last 24 hours. Overall, the market cap of the crypto tokens in this sector sits at $3.8 billion as of press time.

In the last 24 hours, DeFillama data shows that the top 10 liquid staking protocols — except Marinade Finance — saw their TVL fall by an average of 2%.

Deribit

Deribit