Why did Ripple (XRP) surge 35,334% in 2017?

Why did Ripple (XRP) surge 35,334% in 2017?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Cryptocurrencies and their accompanying blockchain technology are full of promise. Even as they soared in value this year, there is an underlying exuberance for their promised use cases that transcend speculative investment, purchasing cheap goods on Overstock or luxury apartments in Dubai. So far, the fulfillment of that promise is mostly relegated to the crypto-space itself.

For example, Ethereum is a blockchain juggernaut that provides the technical prowess for so many successful ICO launches this year.

It’s native currency, Ether, soared in value as its platform rose to prominence. However, while consortiums like the Enterprise Ethereum Alliance and others are heavily investing in industry-wide applications, Ethereum largely remains a product for crypto enthusiasts (see CryptoKitties, for example).

Perhaps that’s why Ripple’s recent rise is so noteworthy. Unlike cryptocurrencies like Bitcoin or Ethereum, Ripple is an enterprise-initiated blockchain and cryptocurrency that’s designed with businesses and banks in mind.

Ripple is a blockchain-based platform, aptly named RippleNet, that facilitates transactions between “banks, payment providers, digital asset exchanges and corporations…to provide one frictionless experience to send money globally.” The platform embraces a wide variety of cryptocurrencies, but it runs on its native currency, XRP. Also known as Ripples, XRP is growing in notoriety.

More importantly, Ripple’s promise is more than just lip service. In October, CNBC reported that:

“Ripple has signed up more several new financial institutions to its blockchain network, bringing its clientele to more than 100.”

In other words, Ripple looks like more than just another alt-coin making that boasts of disruption while actually achieving very little. Ripple just might be the real deal.

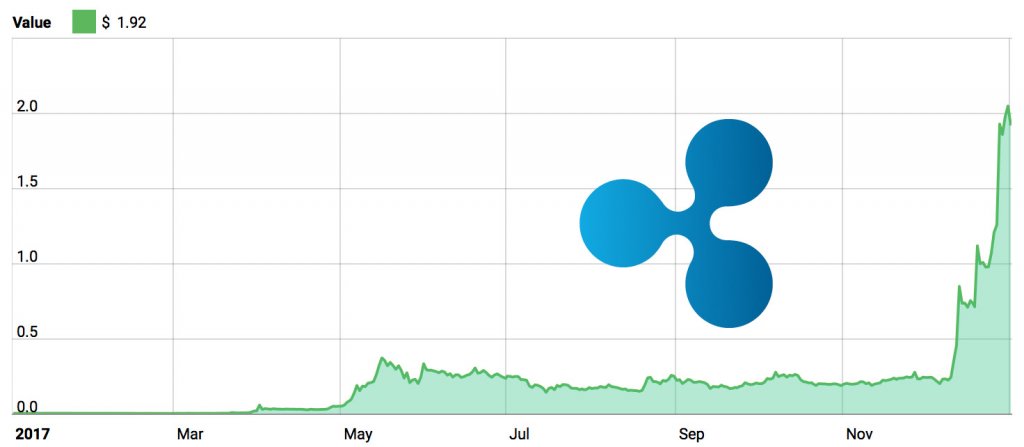

It appears that investors feel the same way. Here’s some perspective: On January 1st, 2017, the price of XRP was $0.0064.

Fast forward 11 months later and at the beginning of December 2017, Ripple was valued at less than $0.25. By mid-December, Ripple broke the $1 barrier, and it briefly surpassed $2 before barely slipping back under that threshold.

Ripple boasts a market cap of more than $85 billion. By that measurement, Ripple is now the second-largest cryptocurrency, edging out third-place Ethereum.

Not only that, but Ripple’s ascension also places it above some of the most notable tech giants in the world. Uber, once lauded as the most valuable private company in the world, has seen its value decrease because of a series of embarrassing scandals. At the end of November, The Wall Street Journal reported that SoftBank was purchasing Uber shares at a discount based on Uber’s estimated value of $48 billion.

With such prolific comparisons, it’s worth wondering: what makes Ripple different than other cryptocurrencies?

What Makes Ripple Different?

For starters, Ripple is old. Relatively speaking.

Ripple’s first iteration appeared in 2004 as the brainchild of Ryan Fugger. The vision was to “create a monetary system that was decentralized and that could effectively empower individuals and communities to create their own money.” This is astonishing foresight into an industry that would truly develop for another decade.

Under professional management by a team that included Chris Larsen and Jed McCaleb, respective founders of E-Loan and Mt. Gox, Ripple’s current expression launched in 2012. Even under its later launch date, Ripple is a veteran in the crypto space.

In the past twelve months, there were hundreds of ICOs and each made unique promises about their product’s ability to transform the world.

While most cryptocurrencies have at least some merit to their claims, Ripple is one of the few to have actual industry support. In December, American Express became the latest to join Ripple’s ranks. They joined other large companies including Accenture, Visa, Citi, and Nasdaq.

In total, Yahoo Finance estimates more than 75 banks have partnered with Ripple.

Of course, the market performance of real-world value does not always correlate. Ripple established a bona fide client-base long before its XRP token price began accelerating.

Ultimately, it’s rising because it’s a cryptocurrency and there is massive speculation its price will continue to increase. On December 15th, there was a transaction of a single purchase of over 900,000 XRP. When there is that much demand for anything, that price is guaranteed to go up.

Bitcoin and Ethereum have done the heavy lifting to bring cryptocurrencies into the mainstream. As a result, dozens of different digital currencies have seen tremendous growth this year, and, at least to some extent, Ripple is benefiting from that exposure.

Ripple has also benefited from positive news for most of 2017, from the partnership with Japanese banks to use XRP for settlements, to the escrow of 55 billion Ripple for supply predictability, to the incredible demand coming from Asian markets. There has also been a long-standing rumor that Coinbase may Ripple to the platform in 2018.

However, Bitcoin began surging at the beginning of 2017, and Ripple’s late ascension feels more like a buzzer-beater than a complete game dominance, so this can’t be the only factor.

One of Ripple’s most compelling aspects is its established client base and the market demand for its products. Investors may be beginning to pay heed to concerns about an inflated crypto-market predicated on nonviable use cases that are more hype than substance.

As a result, it’s possible that 2018 will see a market correction in which the most money flows to the most realistically viable, business-impacting crypto platforms.