Jim Cramer says bull market may return soon but full recovery for Bitcoin years off

Jim Cramer says bull market may return soon but full recovery for Bitcoin years off Jim Cramer says bull market may return soon but full recovery for Bitcoin years off

A bull market within the current one may emerge if a number of conditions happen, but Bitcoin is not likely to reach its old highest for years to come.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

CNBC’s Mad Money host Jim Cramer said a short bull sentiment might arise in the coming months if six things happen.

Regardless, the bull sentiment won’t be enough for Bitcoin to reach or exceed its old highs, and it could take years to get back on its feet.

Cramer analyzed the current charts and suggested investors wait for the possible bull run to exit. He said:

“The charts […] suggest that bitcoin could have a nice relief rally over the next few months, even if he doesn’t see it revisiting its old highs for years or even decades.

I can’t countenance buying crypto here, but if you still own some and you want out, I’m betting that from this, if you’re another dip down, you might get a better price to get out.”

The six signs of bull run

According to Cramer, investors can tell if a temporary bull market is coming by keeping an eye on the six signs.

Here is Cramer’s list of things that need to happen, not necessarily in this order:

- Oil prices must stabilize at a level that favors producers and the public.

- The increase in the food price has to stop.

- Unemployment rates should reach 5% for a few quarters. This way, the demand will be constricted, and the economy will have room to fight inflation.

- Speculative trading has to be minimized.

- Major companies should merge with smaller, “junkier” new firms

- And most importantly, the advance-decline line must improve. Cramer stresses the importance of this by saying:

“This is an all-important gauge that measures the overall breadth of the market — how many stocks are going up versus down. When you see it going steadily higher, that’s a solid precursor to a run,”

When all these conditions suffice, the bearish investors will emerge, and interest rates will drop, creating an upwards trend in the market.

Bitcoin will take years to heal

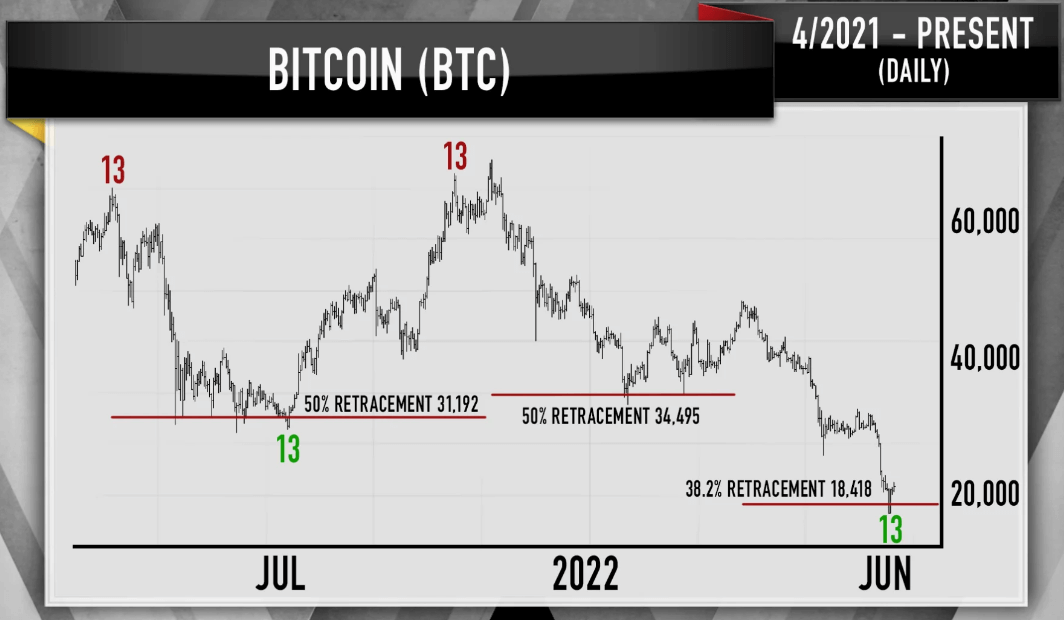

Cramer addressed DeMark’s 13-step-indicators in his Bitcoin analysis and said Bitcoin is not likely to heal back to its old highs immediately.

By falling more than 50% on a closing basis, Bitcoin had its sharpest fall since 2020. Cramer cited DeMark and said this kind of steep decline causes structural damage to the asset, which is difficult to heal.

He said:

“If you’re thinking long-term, DeMark says that it could take many years for bitcoin to come near its old highs, maybe even decades. It’s possible we’ll never see them again,”

Cramer said DeMark has a point, but that does not mean Bitcoin can’t bounce back.