Investors snap up Kraken stock in $10.2 million tokenized equity offering

Investors snap up Kraken stock in $10.2 million tokenized equity offering Investors snap up Kraken stock in $10.2 million tokenized equity offering

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Kraken, one of the oldest cryptocurrency exchanges, reached out to its customers via email offering them tokenized stock in the company. The stock, which can be bought in chunks as small as $1,000, will be sold through a regulated investment company called “Bnk to the Future.”

Kraken reaches out to customers offering stock

Companies in the crypto industry have been coming up with ways to raise funds for almost a decade now, and have gone full circle from ICOs all the way to IEOs. However, one of the oldest cryptocurrency exchanges in the world is looking past these crypto-specific funding methods and is instead going head first into selling tokenized equity as a security token offering (STO).

Kraken, a San-Francisco based crypto exchange founded in 2011, reached out to its customers offering preferred shares of its stock. According to the email with the offer, the opportunity will be open until June 20 with a minimum investment of $1,000.

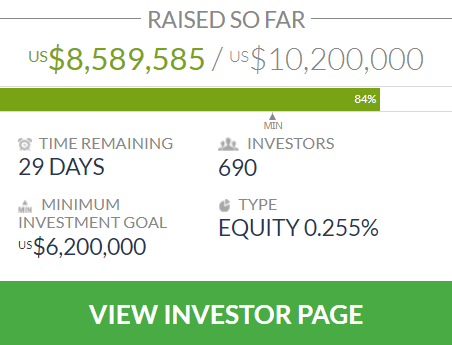

If Kraken raises the maximum $10.2 million for a 0.255 percent equity stake, then the company would boast a value of $4 billion.

The exchange partnered with Bnk to the Future, a global online investment platform that allows qualifying investors to invest in alternative financial products, including crypto companies. The little-known platform has endorsements from names such as Sir Richard Branson and Stephen Corcoran, the head of the Bitcoin Capital forum.

Both companies announced the news on their Twitter profiles.

NOW LIVE: $6,593,476 Raised. 231 investors. @krakenfx open for qualifying investors on @BankToTheFuture (https://t.co/bAO7zNjs1n) pic.twitter.com/gFqMuw7FGD

— BnkToTheFuture (@BankToTheFuture) May 21, 2019

70 percent of raise completed on first day

Apart from mentioning the investment minimumKraken’s email was very vague. The company said that users will need to register with Bnk to the Future before investing and that all of their questions will be answered in Bnk’s instructions.

But, upon creating an account with Bnk, users realized that they must have a net worth exceeding $1 million and an income exceeding $200,000 to be eligible to buy stock. These thresholds are part of Regulation D private placement offerings for securities that do not need to be registered with the Securities Exchange Commission.

According to Bloomberg, Bnk facilitates the purchase of security tokens that track share prices and commit investors’ funds to the Ethereum network, where they can’t be meddled with. If Kraken raises the full amount it would make the offering one of the largest successful security token offerings.

The too-good-to-be-true offer, however, wasn’t well received in the crypto community. While some said they don’t believe they’ll see the returns they were used to with crypto, others were more critical of the entire ordeal. Several Redditors said they received the offer on emails that were never registered on Kraken. Also, having such a large exchange ask its users to sign up with a relatively unknown platform was a red flag for many.

Apart from that, many users said they’d steer clear of owning Kraken stock due to the company’s liabilities. In 2016, Kraken acquired Cavirtex, Canada’s oldest crypto exchange that became the first crypto company to sell its own stock. The company then faced a class action lawsuit from investors after offering to buy back their stock for an amount 4 times less than their market value.

Kraken still owns the company that owes money to its investors. And, Kraken is unwilling to publish financial statements for the exchange. In culmination, these concerns resulted in many passing on the offer.

Yet, it seems that there are still plenty of wealthy investors looking to purchase a stake in the lucrative cryptocurrency exchange business.