Investment in European crypto startups defied the 2022 bear market

Investment in European crypto startups defied the 2022 bear market Investment in European crypto startups defied the 2022 bear market

European crypto startups raised a record level of funding last year and saw increased interest from U.S. investors.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

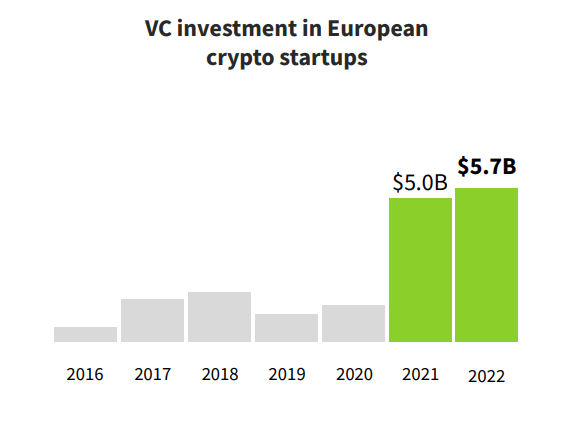

The crypto industry in Europe defied the bearish trends of 2022 and saw a record level of funding. Startups in the crypto space raised over $5.7 billion in 2022 while global and U.S. venture funding in the industry contracted. This is a notable increase from the $5 billion E.U. companies raised in 2021.

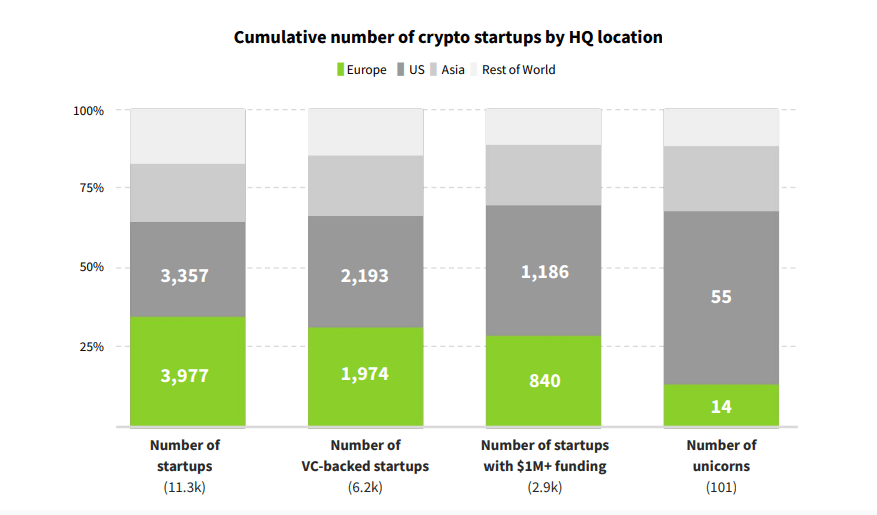

According to data from RockawayX and Dealroom, Europe has the largest number of startups working on blockchain and crypto solutions — surpassing both the U.S. and Asia. The majority of them are early-stage, small-to-mid-sized companies with modest funding. Further along the startup funding journey, the U.S. leads the way as it has the largest number of unicorns.

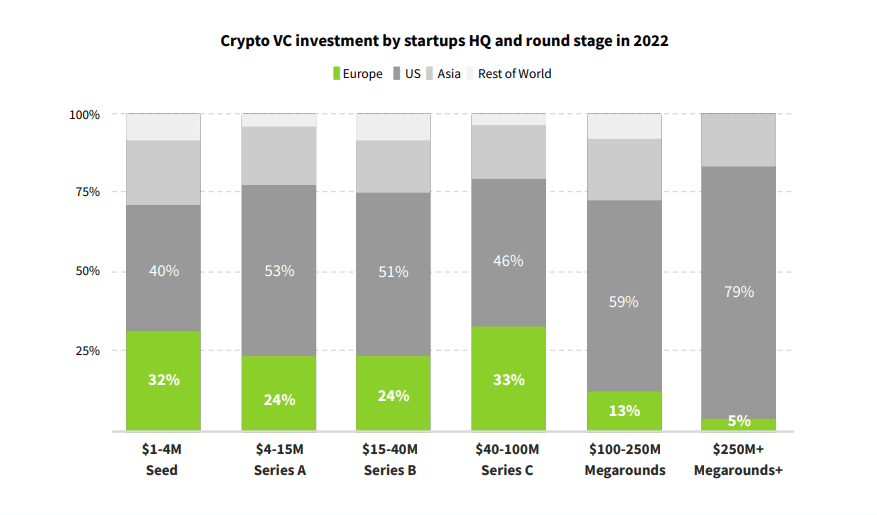

While European companies accounted for 20% of the total global early-stage crypto startup funding, U.S. companies dominated funding rounds exceeding $100 million.

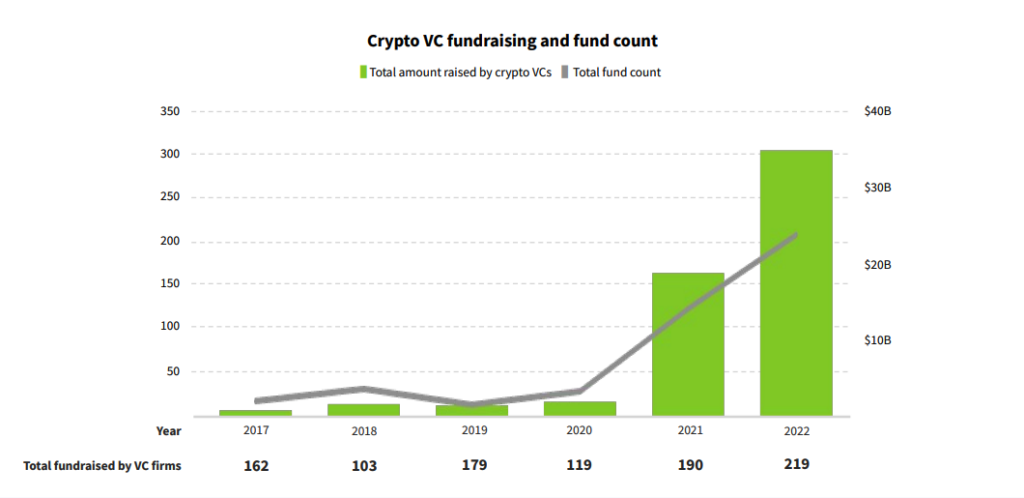

In 2022, crypto VC funds collectively raised over $35 billion, pushing crypto companies into the forefront of venture capital. Despite $35 billion accounting for only around 16% of the total VC fundraising last year, it still represents the highest amount ever raised in the industry.

The ongoing bear market is yet to scare investors. Viktor Fischer, the CEO of RockawayX, said that every market cycle — be it a bear one or a bull one — increases VC activity.

“In the past, VC funding remained relatively stable, or even moved counter-cyclically, during crypto price downturns. Investments made when digital asset prices were depressed materialized in tech and usage traction alongside “bull market” price recoveries.”

Fischer noted that some of the most notable companies in the crypto space today — including Uniswap, OpenSea, Dapper Labs, and Sorare — were funded and launched during the 2018 crypto winter.

Samantha Bohbot, RockawayX’s chief growth officer, said that the biggest difference between investing in bull markets and investing in bear markets is the speed of execution.

“As investors, we see the slowdown change the way deals play out. Where fundraises were once fast — oversubscribed and frantically closed, sometimes in days after the process kicks off — raises often stretch months now.”

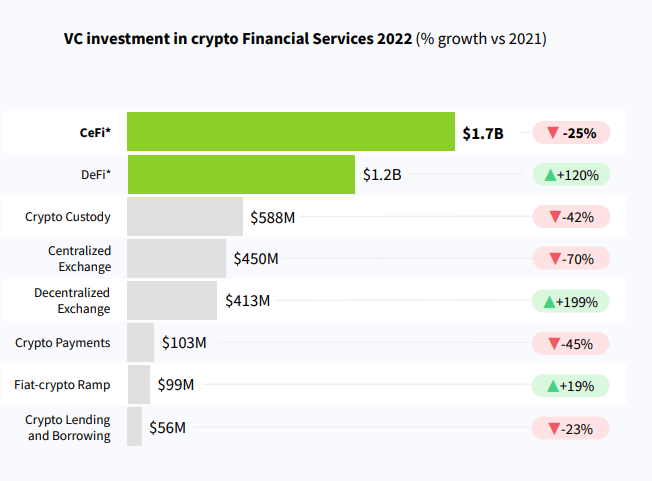

While decentralized finance (DeFi) saw a 120% increase in the amount raised, centralized finance (CeFi) still leads the way when it comes to VC investments.