Spot Bitcoin ETFs set sail with fervor as pre-market trading begins

Spot Bitcoin ETFs set sail with fervor as pre-market trading begins Quick Take

The recent approval of the spot Bitcoin ETFs marked a significant leap in the world of digital assets, triggering intriguing market dynamics. As of Jan. 10, the green light for the ETFs to commence trading was given, and they are set to start trading at 2:30 pm GMT on Jan. 11.

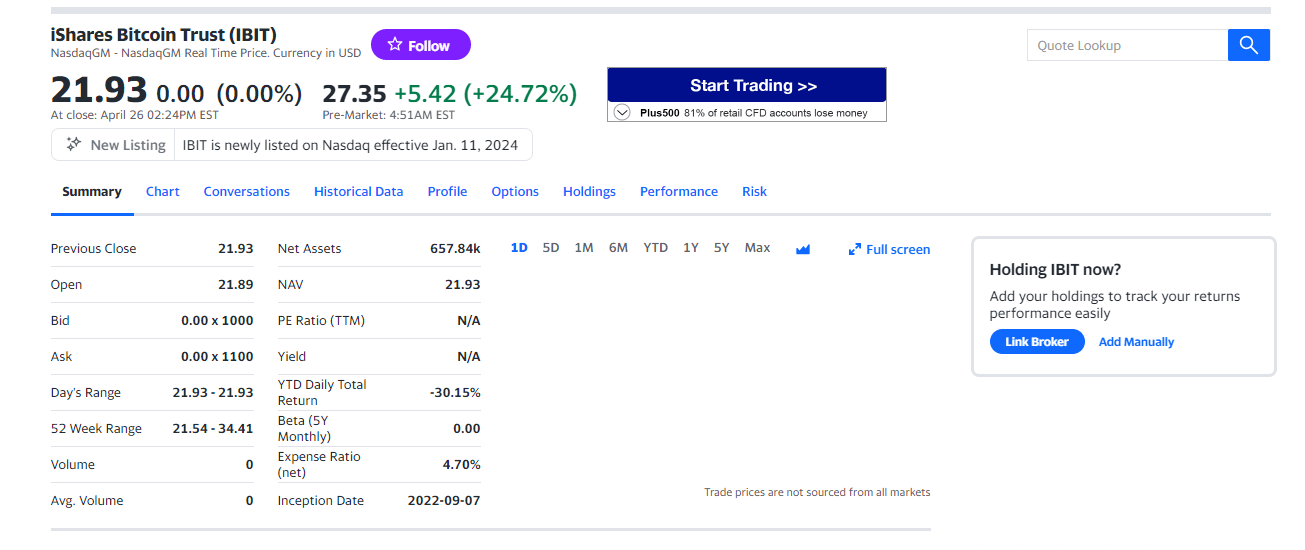

Of particular note was the iShares Bitcoin Trust BlackRock ETF. Before the market officially opened, it was already trading pre-market at a value of $27.35. More interestingly, it experienced a sharp increase of 25% in the pre-market phase, hinting at the potential bullish response from investors towards this new investment tool.

Meanwhile, the Grayscale ETF also kick-started its journey with its first pre-market trades on the NYSE, as verified by Bitcoin Archive. Observing how these initial influencers shape the performance of Bitcoin ETFs over time will be fascinating.

As these developments unfold, CryptoSlate will remain dedicated to providing up-to-date performance analysis of all ETFs in this nascent space.