Pre-market trading sees 4% increase, MSTR closing in on the $2,000 threshold

Pre-market trading sees 4% increase, MSTR closing in on the $2,000 threshold Pre-market trading sees 4% increase, MSTR closing in on the $2,000 threshold

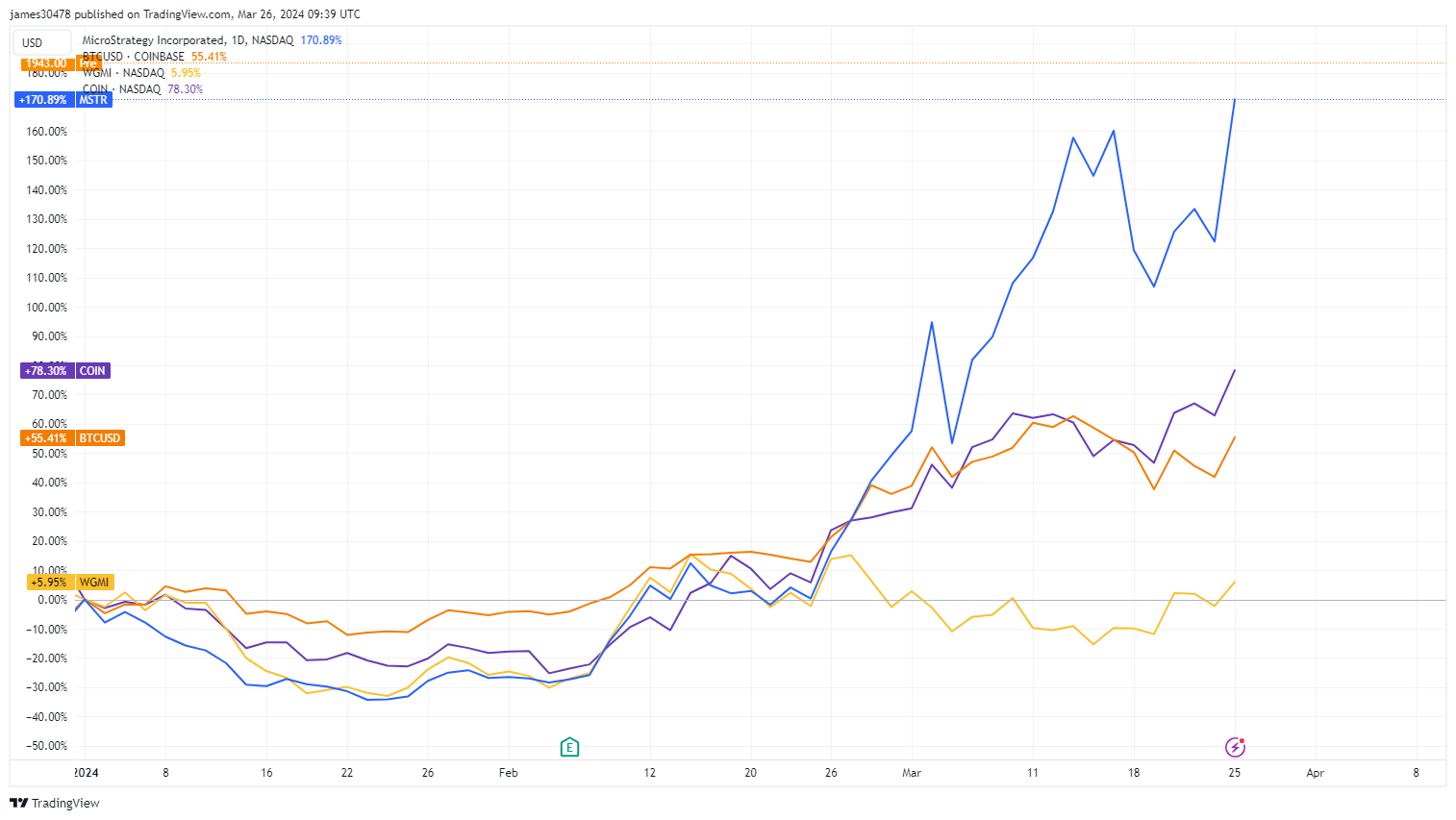

MicroStrategy's market performance outshines Bitcoin equities with a significant 171% year-to-date increase.

Quick Take

Recent market data shows that MicroStrategy continues to outperform both Bitcoin equities and Bitcoin itself. The company’s share price saw a significant surge of 22% on March 25, catapulting it up 40 places to the 280th position among US companies by market cap. This increase brings its market cap to a hefty $31.50 billion, according to Companies Market Cap.

MicroStrategy has exhibited a remarkable performance in the year-to-date analysis, with its value surging by 171%, outpacing Bitcoin’s 55% increase in the same period. Coinbase also demonstrated robust growth, with a commendable 78% rise. In contrast, the WGMI ETF, which serves as a proxy for the Bitcoin mining industry, has shown a modest gain of 6%.

While MicroStrategy’s all-time high share price peaked at $3,300 in 2000, it currently trades at roughly half that figure, around $1,856. However, according to Market Watch, early market indicators show a 4% increase in pre-market trade, making the $2,000 mark well within reach.

Despite the launching of the Bitcoin spot ETFs on Jan. 11, MicroStrategy’s premium value status remains unchallenged. Contrary to market chatter predicting a decline, the company saw a staggering 246% increase, far outpacing the 52% increase of the BlackRock ETF IBIT.

As of March 19, MicroStrategy has accumulated a total of 214,246 BTC, which represents a substantial holding exceeding 1% of the total global supply of Bitcoin.