Options implied volatility drops but market still expects turbulence

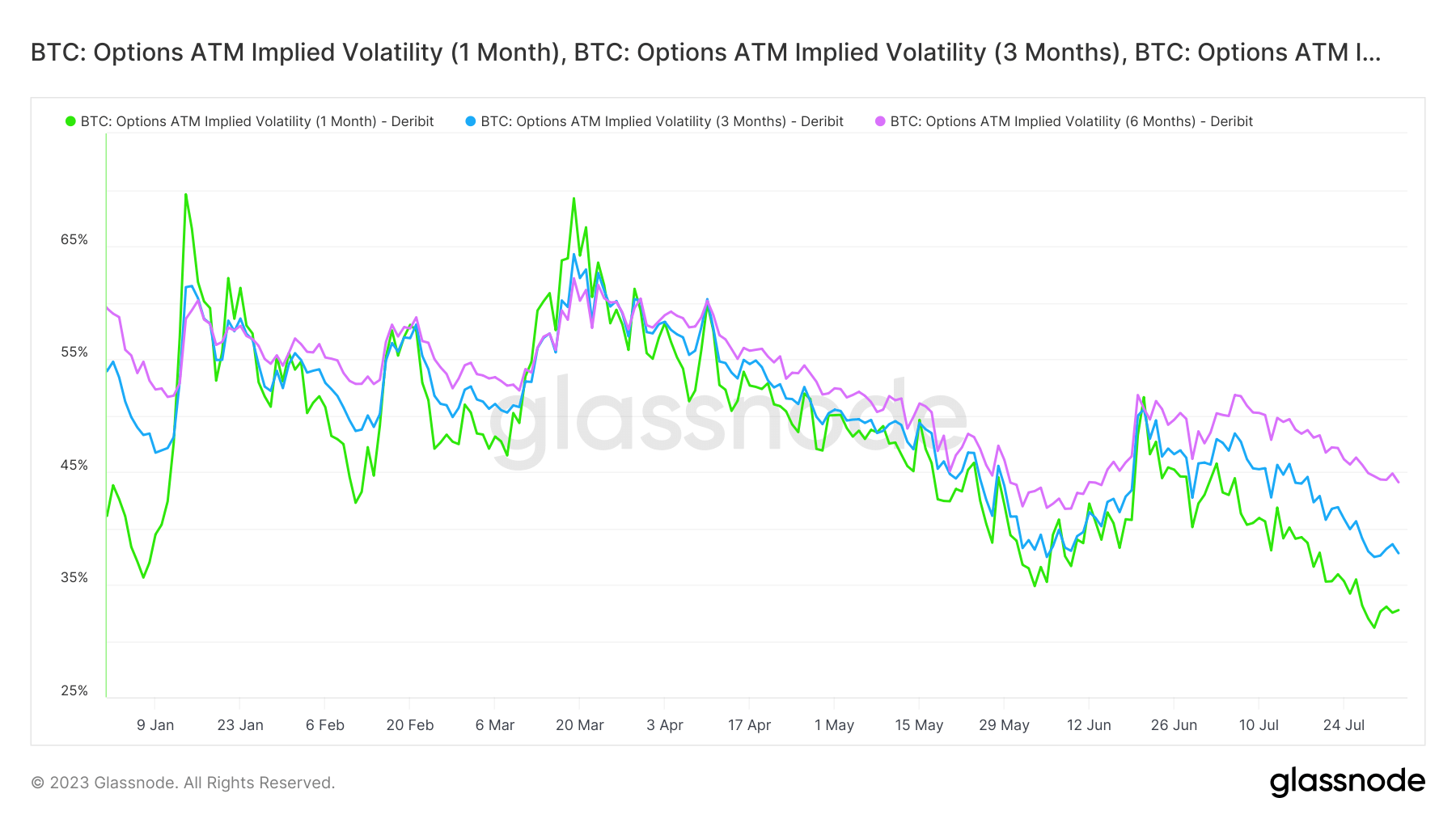

Options implied volatility drops but market still expects turbulence The implied volatility (IV) for Bitcoin options decreased significantly in July.

The IV for Bitcoin options on Aug. 3 is as follows:

| Expiry Period | Percentage |

|---|---|

| 1-Month Expiry | 32.73% |

| 3-Month Expiry | 37.78% |

| 6-Month Expiry | 44.07% |

Implied volatility is a metric that represents the expected percentage change in the price of Bitcoin over a year, with a 68% probability. Essentially, it represents the market’s expectation of Bitcoin’s volatility over the duration of the option.

The increasing IV for longer-dated Bitcoin options suggests that the market is expecting greater price uncertainty or volatility in the longer term. This pattern is known as “volatility skew.”

However, the decrease in IV in July indicates that the market’s expectation of Bitcoin’s price volatility has reduced for the near term.

Farside Investors

Farside Investors