Bitcoin and gold surge in Q1 2024, showcasing strong investor correlation

Bitcoin and gold surge in Q1 2024, showcasing strong investor correlation Quick Take

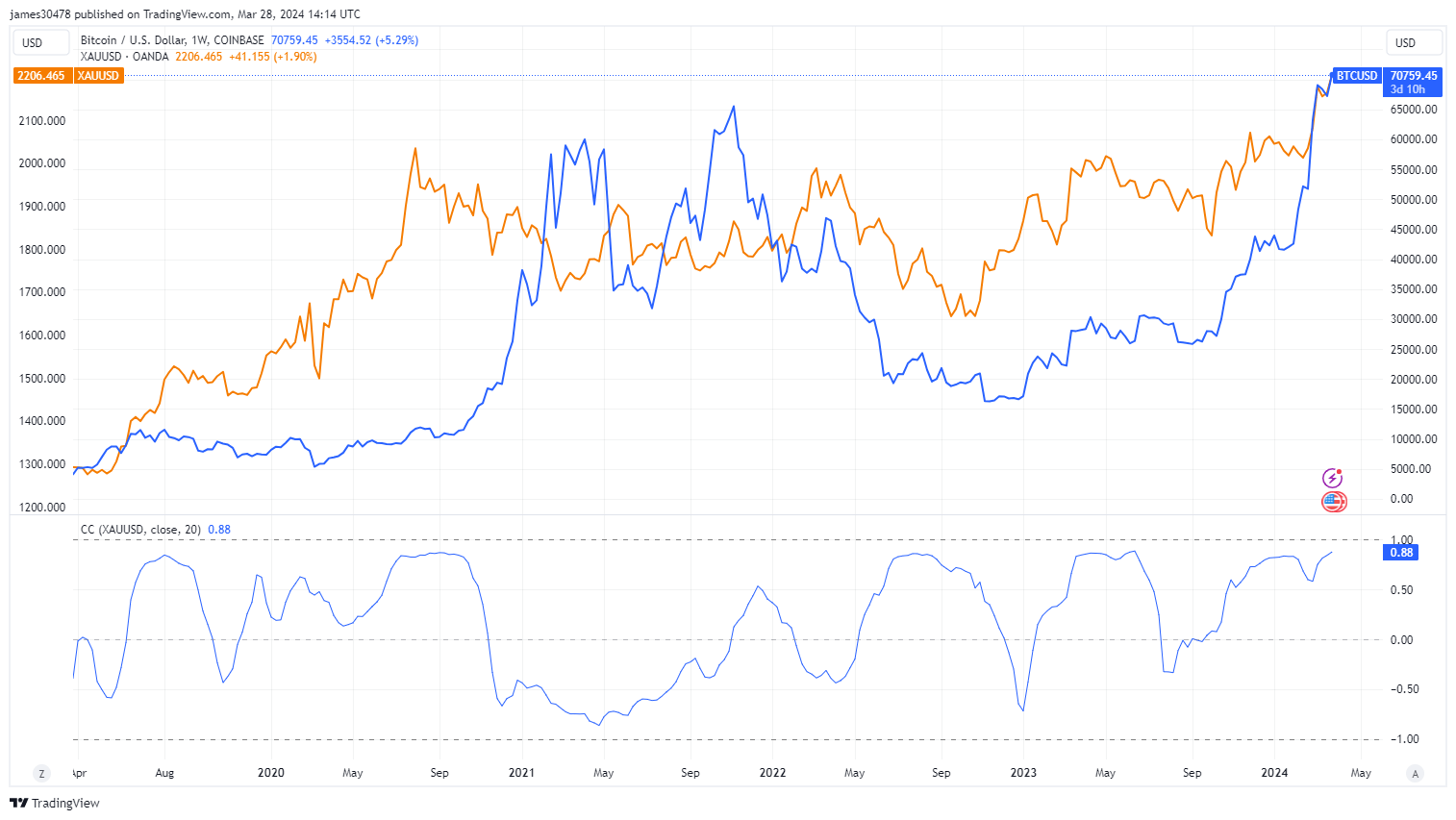

Bitcoin, frequently dubbed “digital gold” and traditional gold, showcased impressive performance throughout Q1 2024. Bitcoin has surged over 60%, trading above $70,000 and nearing its all-time high of approximately $73,500. Similarly, gold has gained over 7%, trading at over $2,200, close to its record high.

Notably, the correlation between Bitcoin and gold over five years has reached 0.88, one of the strongest correlations between the two assets. This high correlation suggests that investors treat the two as similar safe-haven assets.

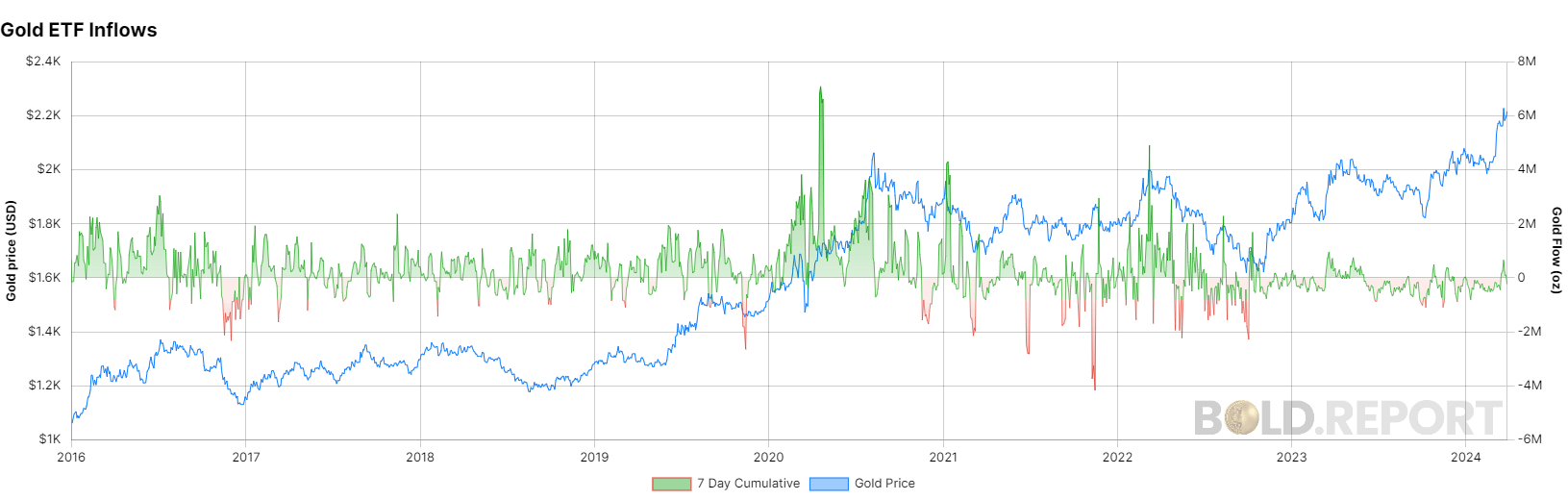

Gold ETFs have seen inflows in the past week, reversing earlier 2024 outflows, per BOLD.report. This trend shift, potentially spurred by Bitcoin ETFs’ success, now suggests investors are realigning investments attracted by gold’s peak values.

As Bitcoin and gold continue their impressive runs, their strong correlation emphasizes their parallel roles in investors’ portfolios as alternative investment options.