Bitcoin and gold show similar trends as miner shares fall behind spot prices

Bitcoin and gold show similar trends as miner shares fall behind spot prices Quick Take

CryptoSlate’s recent analysis has highlighted a growing divergence between Bitcoin miners and the spot price of Bitcoin, hypothesizing a link to the upcoming halving event next year.

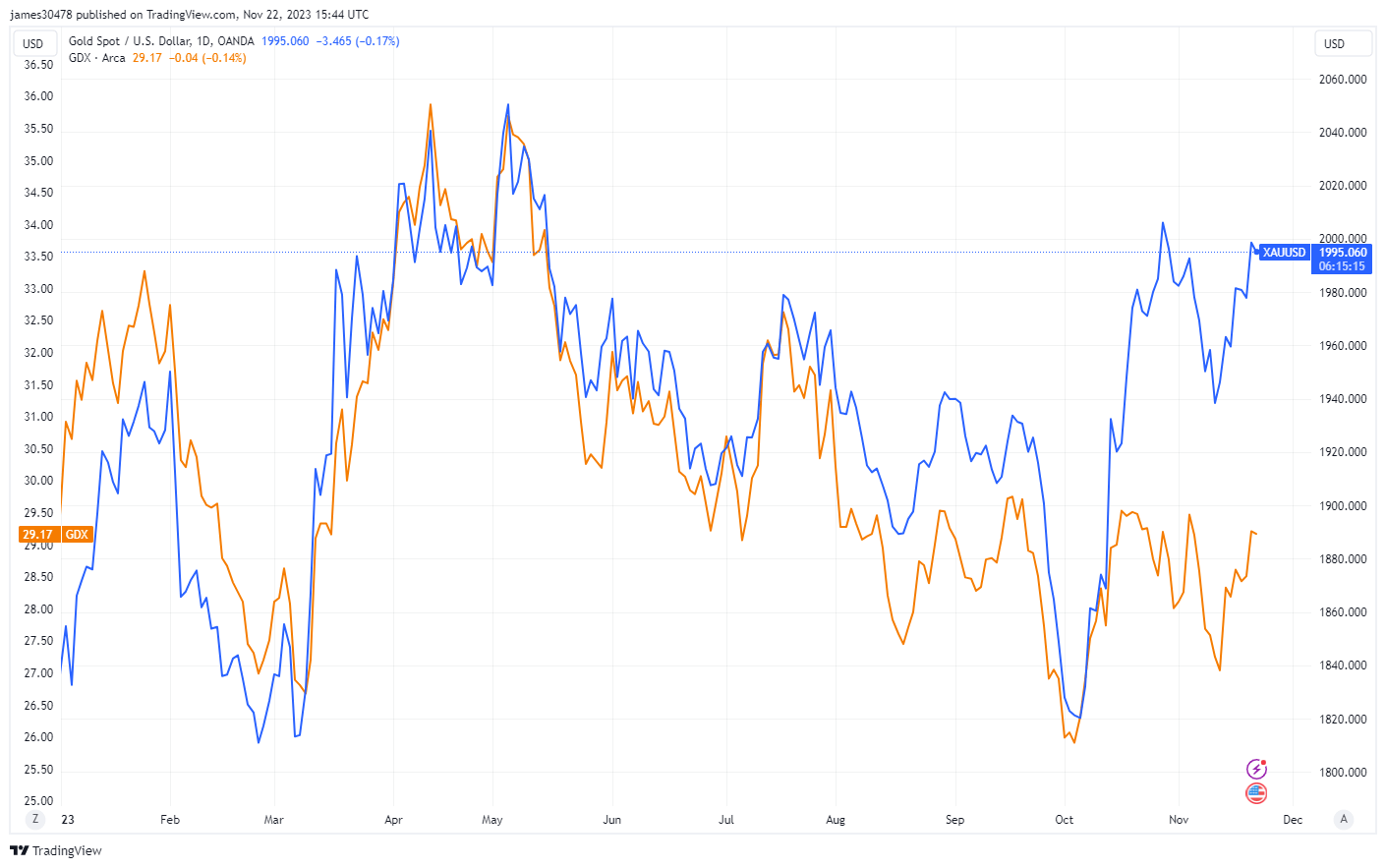

Intriguingly, this trend seems to echo in the world of precious metals, gold, to be precise. The spot price of gold reached $2,000 this week; this year’s overall price is up 8.4%.

In the same timeframe, the GDX VanEck Gold Miners ETF has seen a 2% decrease, underpinning the notion of underperformance within the mining sector. Remarkably, this trend mirrors the Bitcoin mining scene, where miners appear to be unsupported by the current spot price.

This parallelism suggests that market forces affecting miners – whether digital or traditional- may be more intertwined than previously anticipated.