Inside OnChainFX’s Breakeven Multiple and the Winners of Last Alt Season

Photo by Matt Howard on Unsplash

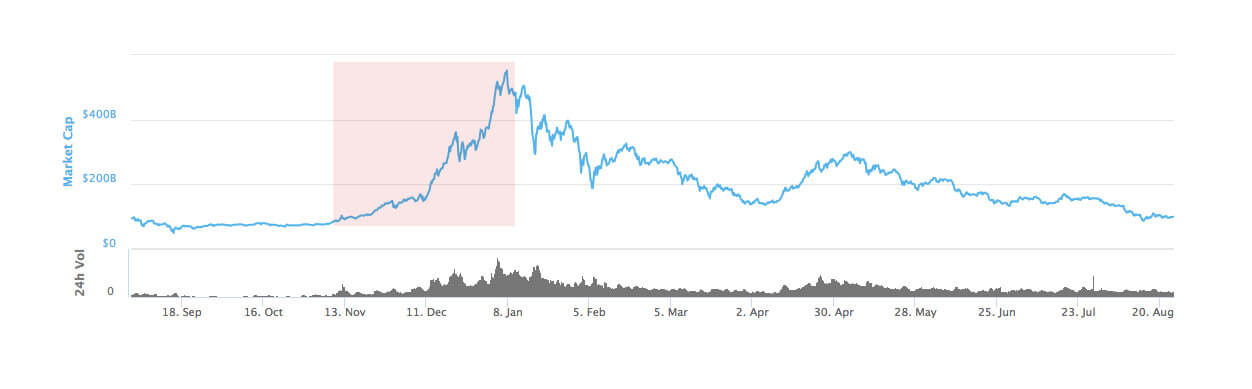

While 2017 was a year of exorbitant gains and lavish dreams, 2018 has crashed the reality of cryptocurrency enthusiasts back to Earth. Many of the incredible gains seen in 2017 have been entirely wiped out, and those who bought at or near all-time-highs (ATH) are deep in the red.

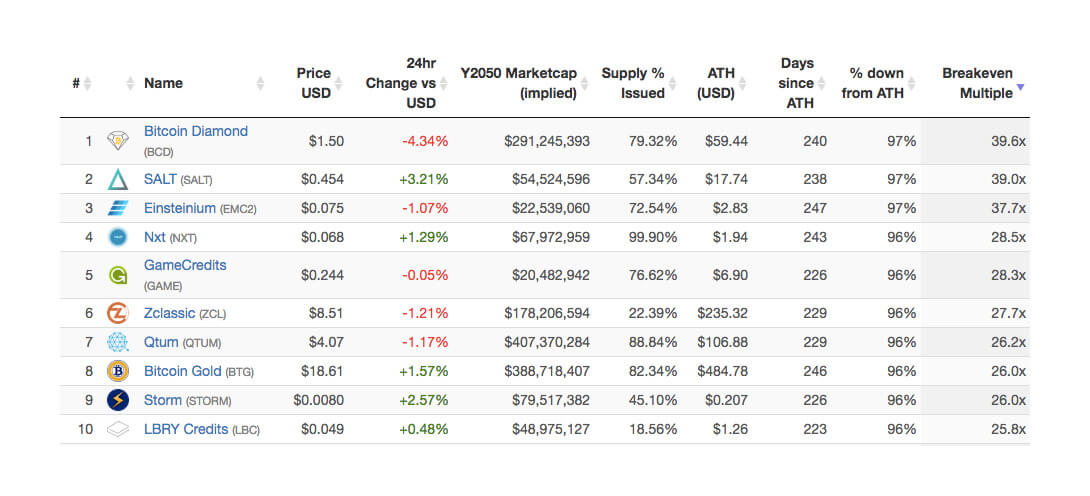

To help illustrate those losses, OnChainFX recently added a Breakeven Multiple to its cryptocurrency metrics display. Of the 107 cryptocurrencies listed, the range they had to “x” to break even varied from 1.1x to 39.6x.

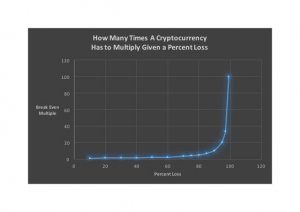

The reason for such a large spectrum can be explained by the exponential relationship between percent loss and the breakeven multiple. For example, a 40 percent or 50 percent loss requires a cryptocurrency to 1.66x or 2x to break even, respectively, and an 80 percent or 90 percent loss must multiply by a factor of 5 or 10.

To help demonstrate this further, imagine you started with an original investment of $100. If you incurred a 50 percent loss, your investment, now worth $50, would have to double to break even at $100. At the further end of the spectrum, a 90 percent loss would require your $10 investment to multiply by a factor of 10, and a 95 percent loss would require your remaining $5 to multiply by a factor of 20.

While a starting price of $100 is much easier to stomach, many people have suffered losses of far greater consequence. A recent New York Times article shared the experience of one English man, whose $23,000 investment shrank to $4,000. Another investor, a Korean teacher, lost 90 percent of the $90,000 she invested after drawing on her savings, an insurance policy and a $25,000 loan.

Although these losses are certainly devastating, the gains of 2017 still offer a sliver of hope.

In 2017, Bitcoin and Ethereum rose by more than 1,500 percent and 10,000 percent, respectively. The year also included a period of explosive growth in altcoins, dubbed “Alt Season,” which even out-performed Bitcoin’s and Ethereum’s gains.

The top five performers of 2017’s alt-season were Verge (XVG), Nano (NANO), Neo (NEO), Ripple (XRP) and NEM (XEM). For example:

- Verge started the year at $0.0019 and finished at $0.2226, a 1,171,479 percent gain or an 11,714x.

- Nano started the year at $0.0097 and finished at $21.26, a 219,072 percent gain or a 2190x.

- NEO started the year at $0.145 and finished at $75.96, a 52,372 percent gain or a 523x.

- Ripple started the year at $0.0064 and finished at $2.30, a 35,781 percent gain or a 357x.

- NEM started the year at $0.003676 and finished at $1.03, a 27,747 percent gain or a 277x.

Given these numbers, it’s certainly possible for cryptocurrencies to do the required “x” to breakeven or create new ATHs. However, there are a few reasons to be pessimistic about the probability of such an outcome occurring.

One reason to bet against some cryptocurrencies never recovering their ATHs is new regulations in the cryptocurrency space. Last year was the year of ICOs, with millions of dollars pouring into any project with any resemblance of a white paper. Unfortunately, almost none of those companies have delivered their promised project, and in response, regulatory agencies have clamped down on the ICO model.

The second reason to be wary of the recovery is due to the change in the mindset of investors. When 2017’s alt season took off, investors rushed to claim their part of the digital gold rush. Although people were advised to DYOR (“Do Your Own Research”) and only invest whatever they were prepared to lose, the exorbitant gains investors saw others making encouraged them to follow blindly.

When looking at projects that pumped, there appears to be no rhyme or reason–where pretty much any investment put into any project returned considerable gains. Now that we’re deep in a bear market, investors will be much warier of simply FOMOing (Fear of Missing Out) into cryptocurrencies and new investors will proceed with greater caution. Because of this, many of the less credible projects will likely head toward zero.

The last argument against full ATH recovery is a combination of the previous two reasons as well as the maturation of the market.

Now that companies aren’t cloaked by mind-boggling gains and a misleading market cap, investors can evaluate their true worth. Of the thousands of existing cryptocurrency projects, which ones will actually deliver their proposed product? Of those, how many are actually worth their supposed market cap?

At its peak, Ripple’s market cap was valued at $128 billion. Even if Ripple can do everything it is purported to do, is it worth that or beyond? Returning to its ATH would put Ripple in the ranks of top 100 companies like IBM, Nike and McDonald’s.

Although you can never truly know when it comes to the unpredictable and volatile cryptocurrency market, it appears likely that a good portion of cryptocurrencies will never recover their ATHs given the aforementioned reasons. Although bad for their investors, the upside is that that money will funnel into the more legitimate projects and Bitcoin, and eventually, the true value of each project will be revealed.