Here’s the first multi-CBDC settlement project and participating countries

Here’s the first multi-CBDC settlement project and participating countries Here’s the first multi-CBDC settlement project and participating countries

Australia, Malaysia, Singapore and South Africa will be participating in the multi-CBDC platform pilot led by the Bank of International Settlements.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

While the US debate over the CBDCs and their effects, the rest of the world are getting closer to releasing their own CBDCs.

The Bank of International Settlements (BIS) recently announced their multi-CBDC pilot program Project Dunbar. Led by the BIS Innovation Hub, this program will be the first-of-its-kind method to settle multi-currency international payments more securely and quickly. The announcement states:

“Project Dunbar explores how a common platform for multiple central bank digital currencies (multi-CBDCs) could enable cheaper, faster and safer cross-border payments.”

The Reserve Bank of Australia, Bank Negara Malaysia, the Monetary Authority of Singapore, and the South African Reserve Bank also announced that they will be participating in Project Dunbar to test if multi CBDCs are technically viable.

Expected benefits

Participating authorities expect to achieve:

- Reduced reliance on intermediaries. With the application of CBDCs, correspondent banks (banks that hold foreign currency accounts) will not be needed for settlements. This also eliminates the AML/CFT compliance steps of correspondent banks.

- Simplification of the settlement process. CBDCs won’t require banks to hold foreign currency accounts. Instead, CBDCs will be transferred directly from the sender to the recipient bank. All transfers will be recorded on a single ledger momentarily and have full-time visibility to all participants.

- Efficiency gains with common platform processes by eliminating the manual conciliation processes with plural AML/CFT requirements. A digital system will be pre-setting the sanctions and requirements of each country and monitor the transactions’ conformity automatically.

- Process automation with smart contracts. An efficient CBDC platform will also automatically apply business rules and conditions such as having sufficient liquidity, technical validations and meeting business requirements via smart contracts.

Main Challenges

At its initial step, Project Dunbar foresees three major challenges that have a subsequent impact on the multi-CBDC settlement platform.

Access

The access challenge is mainly about non-resident banks that don’t have a local presence and are not authorized to provide domestic financial services. Will these banks be trusted to access and issue payments with CBDCs?

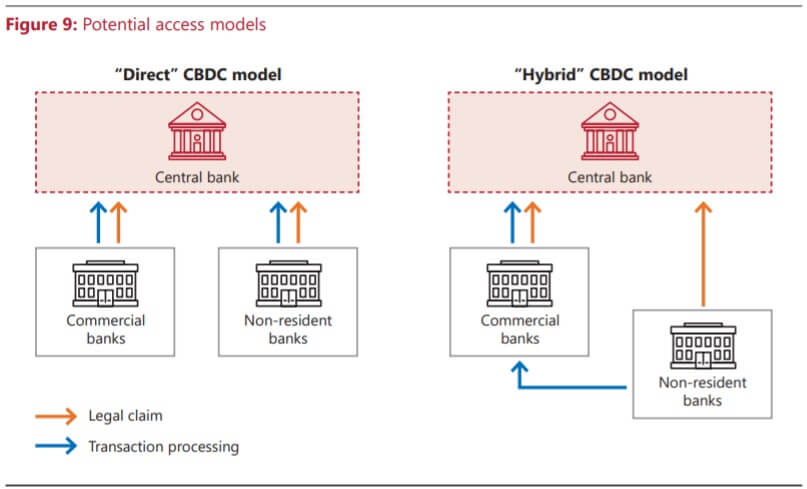

To combat this problem, Project Dunbar includes two access frameworks as “direct” and “hybrid”.

The direct model will trust non-resident banks and allow them to hold and transact directly with CBDCs. The hybrid model, on the other hand, will require non-resident banks to obtain a sponsorship from a commercial bank to monitor their KYC, AML, and CFT processes. If all are in order, the non-resident banks will be able to access the multi-CBDC platform through their sponsor banks.

Jurisdictional Boundaries

Simplifying the cross-border payments while respecting regulatory differences across jurisdictions presents another major challenge to Project Dunbar. To solve this complication, the project took a design approach that differentiate between cross-border settlements and other “non-settlement” processes.

Non-settlement processes like KYC requirements will be differentiated and handled off the platform, while regulations regarding the international transfer settlements such as sanctions will be operated through smart contracts.

Governance

Finally, while the shared platform is intended to apply universality, a certain level of security and privacy must be maintained. Therefore, the project designed a fair governance system where diverse stakeholders are properly represented and decisions are made fairly. In addition, central banks are also granted autonomy within the boundaries and parameters of a universal platform-level framework.

Despite challenges, participants are hopeful that Project Dunbar will be a valuable experience, even if it fails. Chief FinTech Officer of Monetary Authority of Singapore Sopnendu Mohanty expressed their excitement and said:

“Project Dunbar marks a key milestone in advancing the efficiency of cross-border payments globally. The strong collaboration between participating central banks, commercial banks, and technology solution providers has established the foundation for developing future-ready payment rails. We look forward to participating in subsequent phases of this bold endeavor.”

Farside Investors

Farside Investors