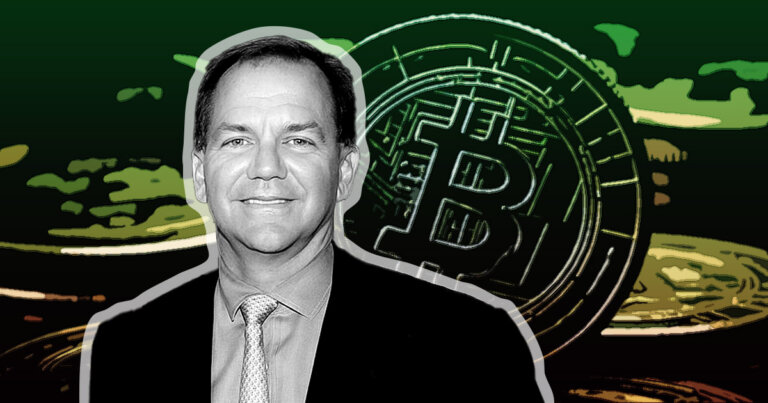

Hedge fund billionaire Paul Tudor Jones says ‘Entire US regulatory apparatus is against Bitcoin’

Hedge fund billionaire Paul Tudor Jones says ‘Entire US regulatory apparatus is against Bitcoin’ Hedge fund billionaire Paul Tudor Jones says ‘Entire US regulatory apparatus is against Bitcoin’

Jones said Bitcoin has a "real problem" in the U.S. and may not be as popular in the coming months compared to the last few years.

National Archives at College Park - Still Pictures / Wikimedia. Remixed by CryptoSlate

Billionaire hedge fund manager Paul Tudor Jones believes Bitcoin (BTC) will see strong headwinds in the coming months due to regulators and inflation.

Jones made the comments during his latest appearance on CNBC’s Squawk Box, where he discussed various economic themes and monetary policy.

Jones said he still believes in Bitcoin and continues to allocate a small percentage of his wealth to the asset. He said:

“It is the only thing that humans can’t adjust the supply in so I’m sticking with it and I’m always gonna stick with it.”

‘Bitcoin has a real problem’

Jones said he liked Bitcoin more back in December 2022 and still likes it but is cautious about its future.

He said that Bitcoin and gold have done really well recently due to great risk premiums amid the high inflation environment. However, if inflation has “done its bit,” then the gains from inflationary hedges may be over, and this could make Bitcoin “boring.”

He elaborated that Bitcoin has a “real problem” in the U.S. and may not be as popular in the coming months compared to the last few years due to the negative regulatory attitude towards crypto combined with lower inflation.

Jones said:

“In the United States, you have the entire regulatory apparatus against it [Bitcoin], so it’s just kinda yesterday’s news.”

Furthermore, if inflation comes back under control and investors are no longer hedging against it then it will likely cause a decline in gold and Bitcoin — both of which are considered good hedge assets.

Impact of AI

Jones said that the advent of AI flipped the script on an inflationary future, and it is more likely now that the Federal Reserve will get it under control.

According to Jones, this will partially be driven by the productivity boost generated by AI, as well as new innovations in the sector.

He said:

“Before AI, before the possible productivity boost we’ll get from it, I would have painted a completely different story in terms of inflationary future and inflation hedging.”