Grayscale hits $13B: Why Bitcoin institutional demand soaring at $19k is bullish

Grayscale hits $13B: Why Bitcoin institutional demand soaring at $19k is bullish Grayscale hits $13B: Why Bitcoin institutional demand soaring at $19k is bullish

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The assets under management (AUM) of Grayscale achieved $13 billion, which is indicative of the large influx of capital into Bitcoin (BTC).

The continuous increase in institutional demand for Bitcoin as the price hovers at $19,000 is optimistic for two reasons.

First, it means that there is consistent demand despite Bitcoin nearing a key resistance area. This shows that institutions are accumulating without the fear of a massive corrective phase at the all-time high.

Second, it shows that the trend of institutions allocating a fraction of their portfolios into Bitcoin is being sustained.

Why Grayscale AUM growing from $7.6 billion to $13 billion in 45 days is bullish

According to Barry Silbert, the CEO of Grayscale, the firm’s AUM grew from $7.6 billion to $13 billion from November 1 to December 15.

Grayscale AUM on Nov 1: $7.6 billion

Grayscale AUM today: $13.0 billionSee below https://t.co/RpvVKd4TWJ

— Barry Silbert (@BarrySilbert) December 14, 2020

The explosive growth of Grayscale’s AUM is highly important for the growth of Bitcoin in the U.S.

Unlike some regions, like Canada, there is no BTC exchange-traded fund (ETF) in the U.S. Hence, the go-to alternative to an ETF in the U.S. is the Grayscale Bitcoin Trust (GBTC)

The trust operates like an exchange-traded note (ETN). Investors can gain exposure to Bitcoin by purchasing shares of GBTC on OTCMarkets, an over-the-counter securities exchange in the U.S.

This allows institutions to essentially trade Bitcoin with brokerage accounts in the public U.S. market.

Since GBTC tailors to accredited and institutional investors, the growth of Grayscale’s AUM suggests a clear increase in institutional appetite for Bitcoin.

Vetle Lunde, an analyst at Arcane Research, said GBTC now holds just below 3% of the total circulating Bitcoin supply. Lunde said:

“The Grayscale Bitcoin Trust has attracted new investors throughout the year, leading to a doubling of Grayscale’s BTC holdings from approx. 261k BTC in January to 544k BTC by Dec 12th. The holdings of GBTC is just below 3% of the total circulating BTC supply.”

The timing of the rising inflow of capital into GBTC is noteworthy because it shows institutions are not concerned in BTC’s short-term price cycle.

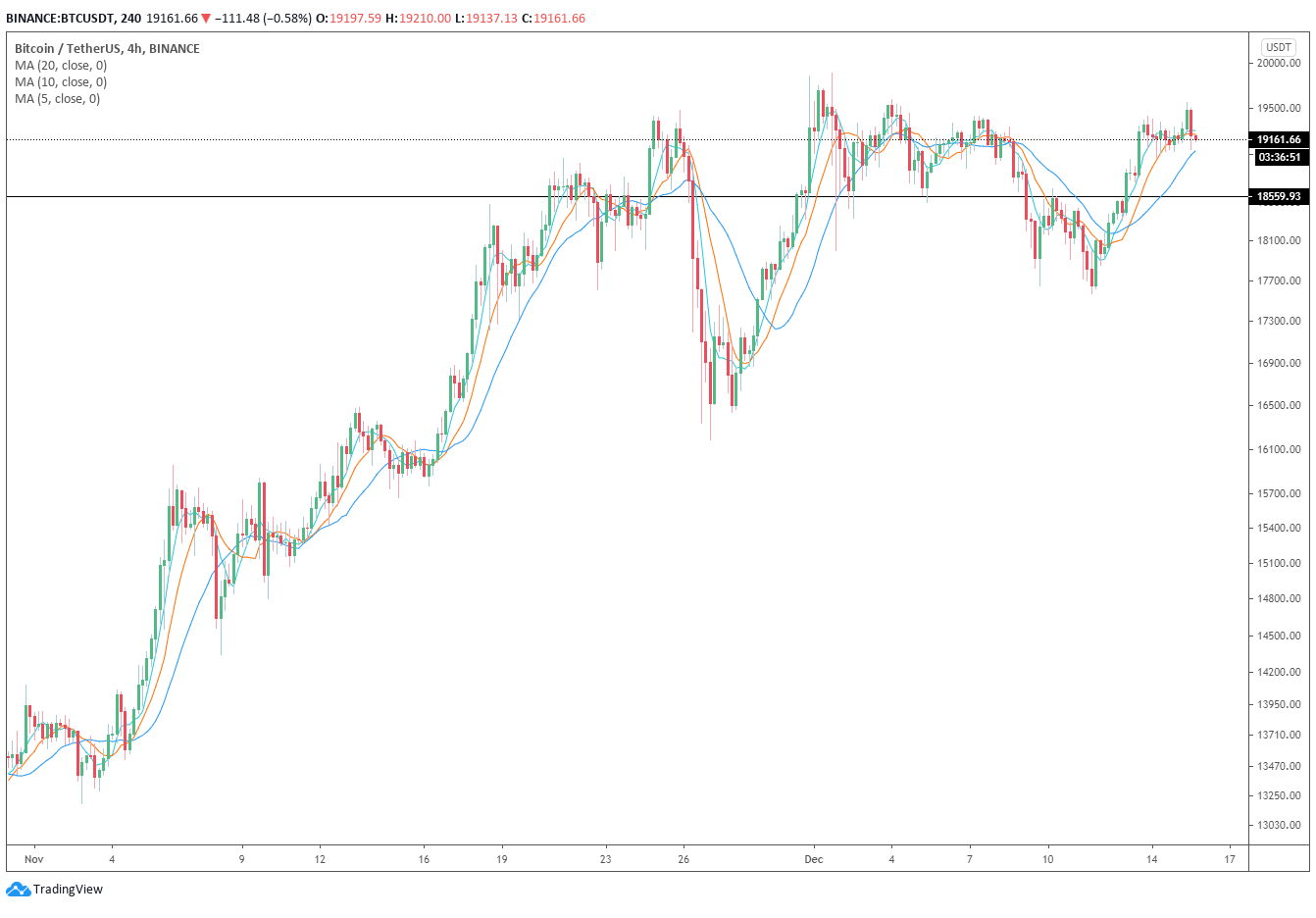

Technically, if Bitcoin continues to reject the $19,600 to $20,000 resistance range, the probability of a larger pullback increases.

Yet, the inflows into Grayscale suggest institutions remain confident in the medium-term price cycle of Bitcoin.

The overall crypto sector is seeing big demand outside of Bitcoin too

According to Lunde, atop GBTC, the Grayscale Ethereum Trust has also seen impressive inflows since January. The analyst noted:

“The growth of the @Grayscale Ethereum Trust has been even more impressive. In January, the ether holdings of the trust sat below 0.5m ETH. Now the holdings of the trust are approaching 3m ETH. The holdings of ETHE sits at 2.5% of the total circulating ETH supply.”

Considering that analysts view other large-cap cryptocurrencies as a higher-risk play on Bitcoin, the rising inflow into Ethereum is another sign of overall institutional confidence.

Bitcoin Market Data

At the time of press 3:14 pm UTC on Oct. 19, 2021, Bitcoin is ranked #1 by market cap and the price is up 1.81% over the past 24 hours. Bitcoin has a market capitalization of $361.49 billion with a 24-hour trading volume of $26.05 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 3:14 pm UTC on Oct. 19, 2021, the total crypto market is valued at at $567.98 billion with a 24-hour volume of $108.37 billion. Bitcoin dominance is currently at 63.63%. Learn more about the crypto market ›