Ethereum price surges past $400 on news of ETH 2.0 contract release

Ethereum price surges past $400 on news of ETH 2.0 contract release Ethereum price surges past $400 on news of ETH 2.0 contract release

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ethereum’s price ended its stagnation phase today after news broke regarding the deployment of the ETH 2.0 contract address that has been highly anticipated for many months.

Before the contract deployment, ETH’s price was stagnant around $380, with it instantly seeing a 10% surge after traders caught wind of the development.

Ethereum 2.0 is set to help resolve the scalability issues that have plagued the network as of late and help incubate further utility and spur both user and developer adoption.

Clearly, traders view this network upgrade as a bullish development.

From a technical perspective, one benefit that ETH 2.0 provides to Ethereum’s price action is the staking feature expected to lock up a significant amount of the token’s circulating supply, which will contribute to it seeing further upside.

While looking at the contract’s deposit address, it appears that there’s already nearly $2 million worth of the cryptocurrency locked, showing serious demand for ETH 2.0 nodes.

Ethereum 2.0 deployer launches, sends ETH past $400

At the time of writing, Ethereum is trading up roughly 4 percent at its current price of $402. This marks a notable surge from its recent lows of $380 that were set earlier today.

The break above $400 is technically significant, as it could spark a rally that allows ETH to gain some ground against Bitcoin, which has been far outperforming all altcoins over the past few weeks.

This upswing’s impetus was the ETH 2.0 deposit contract’s deployment, signaling that the highly anticipated network upgrade will come about in the near-term.

The deployment of this contract was announced in a recent blog post that came about minutes before the price surge that allowed it to reclaim the crucial $400 region.

ETH 2.0 already sees inflows of tokens for staking

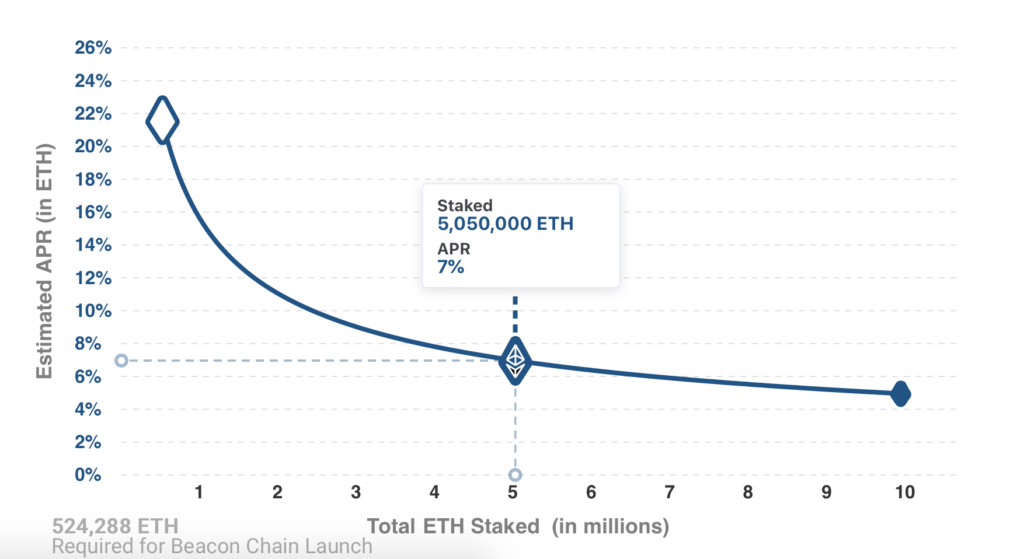

Staking is one of the hallmarks of the 2.0 upgrade, which will allow investors to deposit a minimum of 32 ETH into a validator and earn network rewards.

These rewards are expected to be somewhere around 6-20 percent per year but will vary based on how many validators are running and how heavily used the Ethereum network is.

Currently, a total of 4,837 ETH has been staked, and the number is continuously growing.

A total of 524,288 Ethereum needs to be staked for the 2.0 network to be launch, which totals at 16,384 validators.

The countdown to the Beacon Chain launch is now on, and Ethereum’s price may begin rising in anticipation of the final rollout.

Ethereum Market Data

At the time of press 12:03 pm UTC on Nov. 5, 2020, Ethereum is ranked #2 by market cap and the price is up 5.84% over the past 24 hours. Ethereum has a market capitalization of $45.73 billion with a 24-hour trading volume of $14.51 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 12:03 pm UTC on Nov. 5, 2020, the total crypto market is valued at at $416.5 billion with a 24-hour volume of $114.18 billion. Bitcoin dominance is currently at 65.22%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant