Ethereum lab ConsenSys announces staking service ahead of ETH 2.0

Ethereum lab ConsenSys announces staking service ahead of ETH 2.0 Ethereum lab ConsenSys announces staking service ahead of ETH 2.0

Image by Peter Patel from Pixabay

Development and demand for staking applications are booming ahead of Ethereum’s ETH 2.0 update, which sees the latter shift to a Proof-of-Stake consensus algorithm.

Popular crypto-exchange and wallets alike have expressed launching a stake pool in some form or another, but a new ConsenSys development is, perhaps, the biggest ever pilot in terms of providing staking-as-a-service.

Making staking inclusive

ConsenSys, the self-styled Ethereum venture lab, announced Tuesday the launch of a staking-as-a-service pilot project — under its CodeFi brand that supports the development of DeFi-focussed commercial applications.

.@binance, @cryptocom, @DARMACapital, @HuobiWallet, @realMatrixport, and @TrustologyIO join @ConsenSysCodefi Staking Pilot Program, for early access to an Ethereum 2.0 staking solution. #CodefiStaking

— ConsenSys (@Consensys) June 16, 2020

Onboard are six high-profile crypto-companies; Binance, Crypto.com, Huobi, investment fund DARMA, Matrixport, and Trustology.

In a tweet, Codefi said it provides a “white-label institutional-grade API,” with easy and efficient access to the Ethereum 2.0 network for enabling enterprises to engage with the “next phase” of the network.

Ethereum’s upcoming staking protocol is seen by many as a new paradigm in cryptocurrencies. Technologists see it as a more scalable, secure platform that would support millions of DeFi applications, while investors seek passive returns from the rewards distributed to validator nodes.

As CryptoSlate reported in May, industry observers expect returns of up to 7 percent, even 9 percent, from a single validator node. This is better than most traditional bank interests or bond payouts — which could, theoretically, place Ethereum alongside conventional financial products.

Excited to support

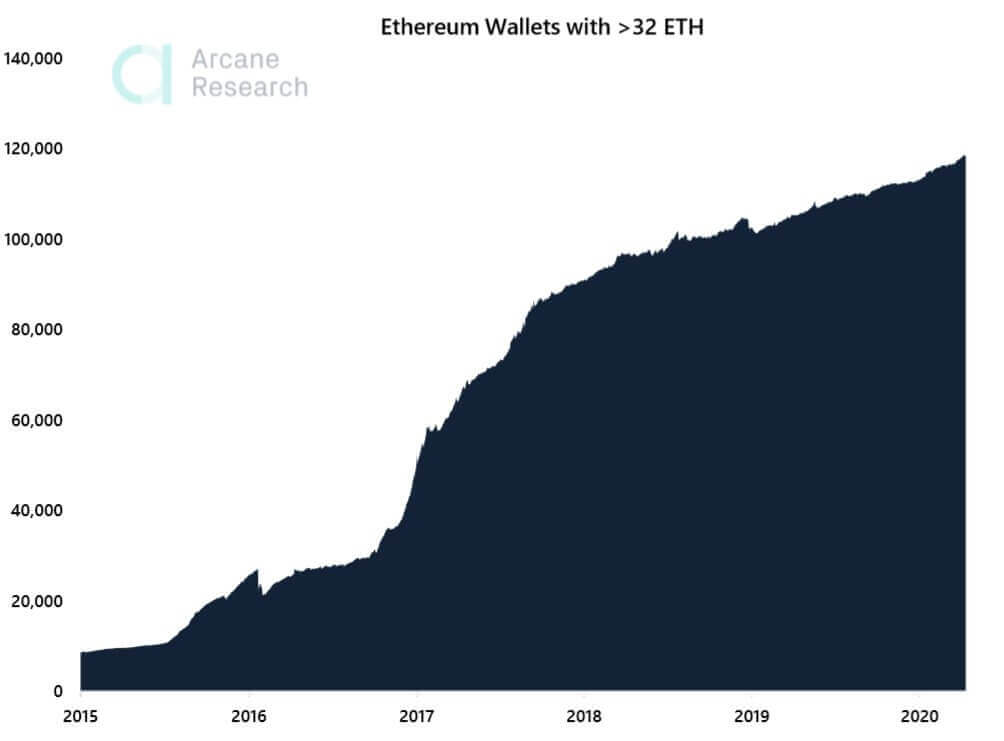

To start a validator node, one needs a minimum of 32 ETH (about $7,300 at press time). Holders seem to be lapping this up — on-chain analytics firm Arcane Research said last week over 120,000 individual wallets now hold the minimum staking value.

Such metrics ensure network security and indicate unprecedented demand for Ethereum if the wallet holdings are anything to go by.

Setting up nodes is both tricky and requires an elementary knowledge of computer coding. To combat this, firms like Codefi and Bison Trails are building projects to ensure smooth onboarding and inclusivity for all interested network participants.

Meanwhile, the crypto partners seem pumped for the development:

With Ethereum 2.0 around the corner, we are excited to be participating in the Codefi Staking Pilot Program by @Consensys https://t.co/OS4pzTP4Y1

— Crypto.com (@cryptocom) June 16, 2020

Binance CEO Changpeng Zhao spoke in the regard:

“With staking on Binance, users can receive staking rewards without needing to set up nodes, or worrying about minimum staking amounts, time lengths, or any catches. We are “excited to support” the eventual launch of Ethereum 2.0.”

Overall, the six firms gain early access to Codefi’s Ethereum 2.0 staking solution. Partner projects can provide feedback and feature requests, while presumably collaborating for further user-friendly features if required.

Farside Investors

Farside Investors