Crypto.com launches CRO-centric DeFi Swap as competition builds up

Crypto.com launches CRO-centric DeFi Swap as competition builds up Crypto.com launches CRO-centric DeFi Swap as competition builds up

Photo by James Lee on Unsplash

Hong Kong-based crypto exchange and wallet provider Crypto.com announced its new DeFi Swap service for all users, as per an announcement today.

Centralized exchanges are starting to take note of the burgeoning DeFi industry. Sky-high yields provided by protocols like SushiSwap and Yearn Finance have caused a massive migration of liquidity from traditional crypto exchanges to DeFi.

But not one to be left behind, exchanges are coming out with their own products. While Binance launched its Binance Pool earlier this week, Crypto.com came out with its DeFi Swap Service on Friday.

DeFi Swap is now live on Ethereum Mainnet!

? swap & farm #DeFi coins

? provide liquidity to earn Triple Yield

? 14,000,000 $CRO launch incentive

? stake #CRO to get up to 20x higher yieldStart here: https://t.co/Qk3XKx1hJw

Details: https://t.co/a1Z9lBLZOi pic.twitter.com/unb43RJRkh

— Crypto.com (@cryptocom) September 11, 2020

A CRO farming DeFi Swap

As per details, the DeFi Swap is based on the Ethereum mainnet and allows users to farm tokens by contributing to liquidity pools in three ways:

- Swap Fee Sharing: LP’s will be rewarded by sharing 0.3% of the trading volume of respective liquidity pools.

- CRO DeFi Yield: for LP’s who also stake CRO: LP’s can stake CRO to boost their yield by up to 20x and harvest the daily yield in as little as 30 days.

- Bonus LP Yield: for LP’s of selected pools: LPs will receive tokens redeemable for additional coins of participating DeFi projects

Users can use any compatible wallet to engage with the protocol, such as MetaMask. Crypto.com will also launch its own DeFi Wallet in the coming days, creating value for its own ecosystem in that manner.

For starters, Crypto.com will guarantee a minimum reward pool of 14,000,000 CRO for the first 14 days (1,000,000 CRO per day). At launch, users can swap between any two supported tokens including both CeFi and DeFi tokens, such as Wrapped Ether, Tether, DAI, Chainlink, Compound, and Crypto.com Coin.

To quell any concerns around potential users, Crypto.com said that DeFi Swap is a fork of Uniswap V2, and has in turn been audited by Crypto.com’s security team and blockchain researchers at SlowMist, a third-party blockchain security service.

Managed by Crypto.com

DeFi Swap is open-source and all community proposals are welcome for the betterment of the application. But as such, Crypto.com will act as the maintainer of the underlying code and will actively contribute towards its development.

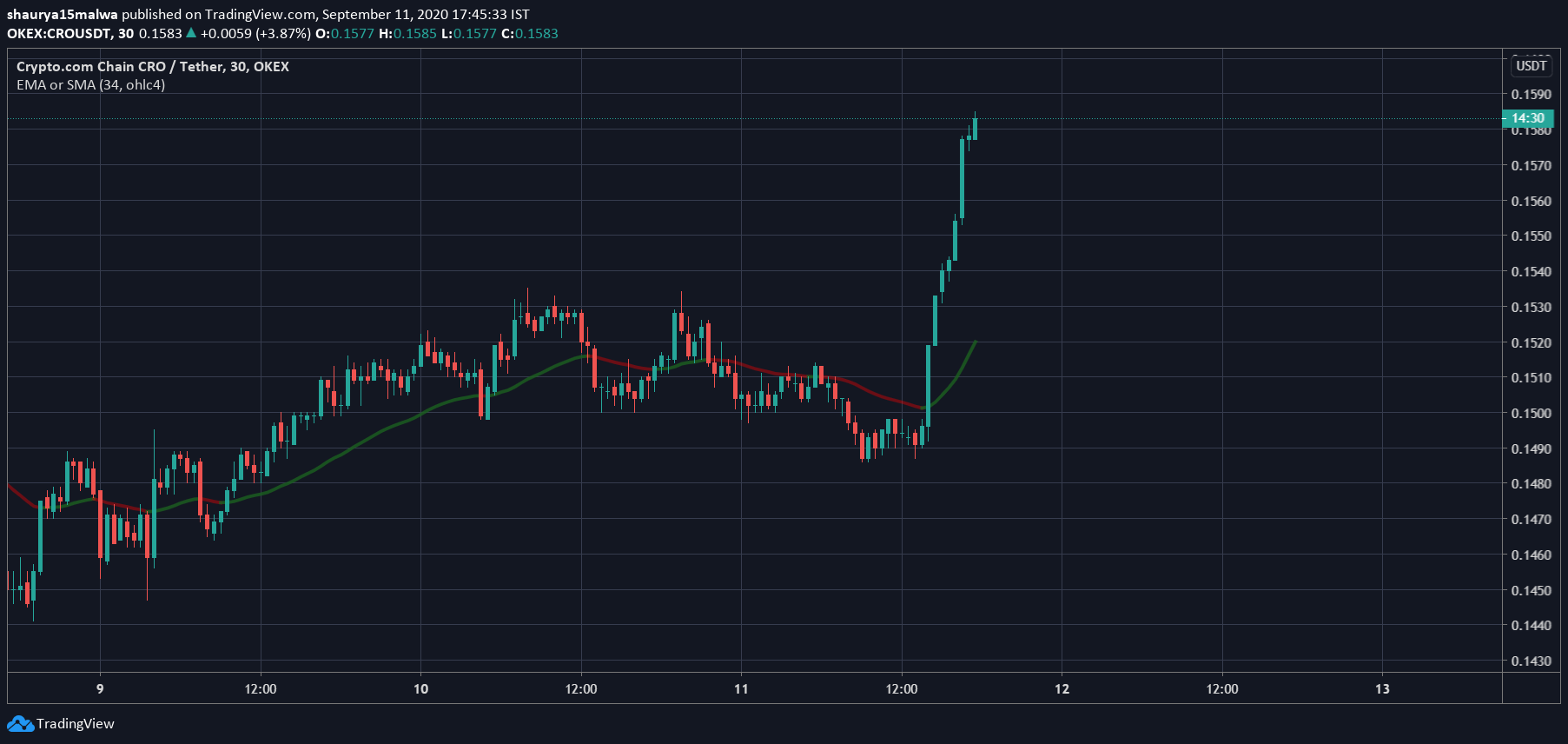

Meanwhile, Crypto.com’s CRO tokens experienced an immediate price surge on the announcement:

The tokens went up almost 10% as traders presumably picked up CRO for the purpose of earning yields on their investment and engaging with the protocol.

CryptoQuant

CryptoQuant