CNBC host Jim Cramer claims Bitcoin is being “manipulated up”

CNBC host Jim Cramer claims Bitcoin is being “manipulated up” CNBC host Jim Cramer claims Bitcoin is being “manipulated up”

The Mad Money host made the comment in response to whether recent distresses to traditional banks offer an investment case for Bitcoin.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Despite Bitcoin (BTC) price surging +10.34 in the last 24 hours, Jim Cramer claimed that BTC is being “manipulated up.”

On the heels of bailouts of SVB and Signature — two major lenders in the U.S. — Cramer says that there is no foreseeable use case for Bitcoin.

In response to a question on whether stress on the banking system and the federal reserve strengthens the investment case for BTC, Cramer responded:

“No. Bitcoin went up today, and I could argue that now it can’t be held in banks. Bitcoin is a strange animal, I will say. Point blank, I think it’s being manipulated up. It was being manipulated the whole time by Sam Bankman-Fried. So please don’t assume, therefore, that it’s not still being manipulated. And I would sell my bitcoin right into this rally.

Cramer’s previous support for Silicon Valley Bank

Cramer recently supported was Silicon Valley Bank (SVB), telling viewers of his show ‘Mad Money’ last month to buy stock in the now defunct bank.

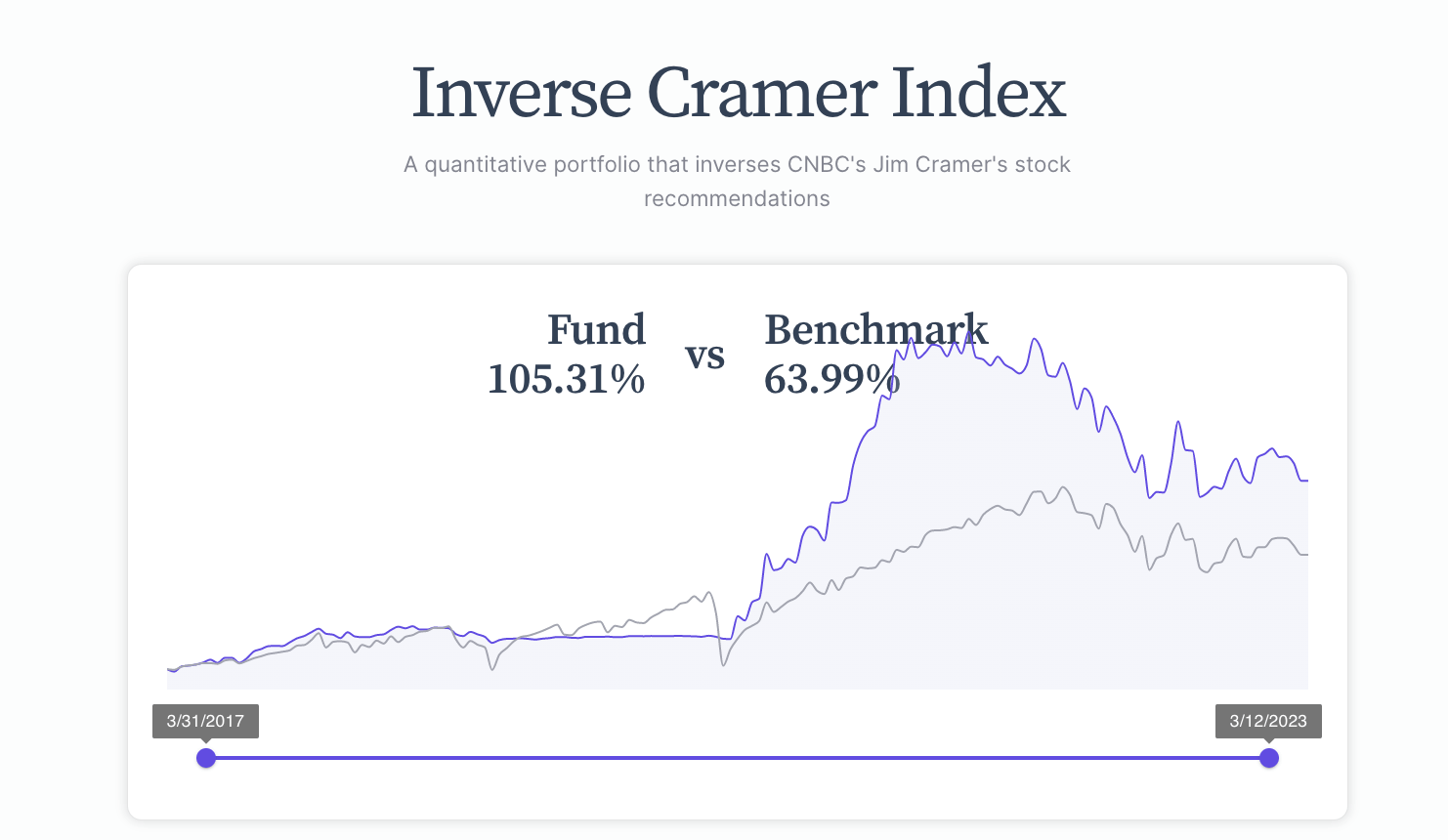

However, Cramer has been known to make an inverse call — even spawning several memes and even indexes based on picking the opposite of what Cramer recommends.

Quantbase’s Inverse Cramer Index is up 105.31% vs. benchmark since it’s launch March 31, 2017.

Bitcoin’s inverse Cramer surge

Following the announcement by U.S. authorities that deposits in failed banks would be protected, BTC price surged to nearly $25,000 — representing a 20% increase since Friday’s lows. The price rise caused a rally among major cryptocurrencies and crypto-related companies.

However, the collapse of these banks is anticipated to result in a significant slowdown in Fed rate hikes, and it is now considered unlikely that there will be any further rate hikes.