Cardano trader loses $45 million after ADA plunges 22%

Cardano trader loses $45 million after ADA plunges 22% Cardano trader loses $45 million after ADA plunges 22%

Someone betting on the rise of the high-speed blockchain’s token ended up with an expensive bill.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

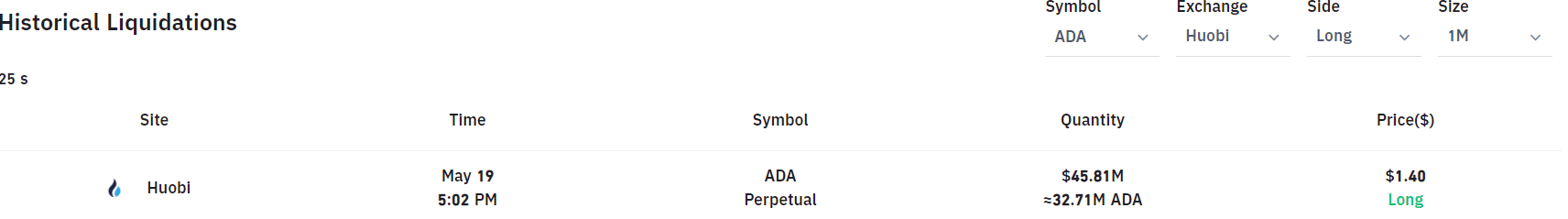

A single Cardano (ADA) trade worth over $45 million was liquidated today as the token fell along with the rest of the crypto market, data from markets tool Bybt shows. Such figures for an altcoin trade are rare (compared to Bitcoin).

ADA trader takes on a big loss

‘Liquidations,’ for the uninitiated, occur when traders borrow excess capital from brokerages/exchanges (i.e., ‘margin’ or trading futures) to place bigger bets on the assets they trade.

They pay a fixed fee for doing so, while exchanges close out these positions at a predetermined price—when the trader’s collateral is equal to the loss on that position. Such a trade is then said to be liquidated.

And amidst all the euphoria from last week, traders likely borrowed in excess of what their books would allow and contributed to what became an overheated, overleveraged market.

Today was unlucky for one such trader. The $45 million liquidation order occurred on crypto exchange Huobi and belonged to a single entity, which could either be a wealthy individual or a trading firm placing big bets on the rise of ADA.

Further analysis shows the order was part of over $67 million worth of ADA trades that got liquidated on Huobi alone, with $65 million of those being ‘long’ positions (or traders betting on higher prices).

The amount was twice those of ADA liquidations on Binance ($37 million), and nearly five times more than Bybit ($12 million). Over $127 million worth of ADA was liquidated on several crypto exchanges overall, with 90% of those being ‘long’ trades.

Big, bad liquidations

ADA has, as such, risen over 8,000% over the past year and 30% in the past month alone amidst the hype around its upcoming smart contracts and the big adoption for Cardano in Africa, leading to many investing in the world’s sixth-largest cryptocurrency.

Meanwhile, despite being a $45 million liquidation, a Bitcoin trader took the cake for the highest liquidation overall. Data shows a Bitcoin trader on Huobi with the value of a staggering $67 million was liquidated after the asset temporarily fell under $30,000.

The dump accounted for over $8.59 billion worth of liquidations at the time of writing, with over $3.62 billion of that coming from Bitcoin alone. Even Dogecoin traders made their mark today—losing $225 million in DOGE punts.

Deribit

Deribit