Bitwise “increasingly bullish” on intermediate outlook for crypto, cites real money inflows

Bitwise “increasingly bullish” on intermediate outlook for crypto, cites real money inflows Bitwise “increasingly bullish” on intermediate outlook for crypto, cites real money inflows

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Bitcoin price has made a V-shape recovery from $3,600, following a capitulation-esque fall on March 12. Since then, the crypto market has recovered rapidly, similar to gold in previous crises, cryptocurrencies could perform strongly in the medium to long-term.

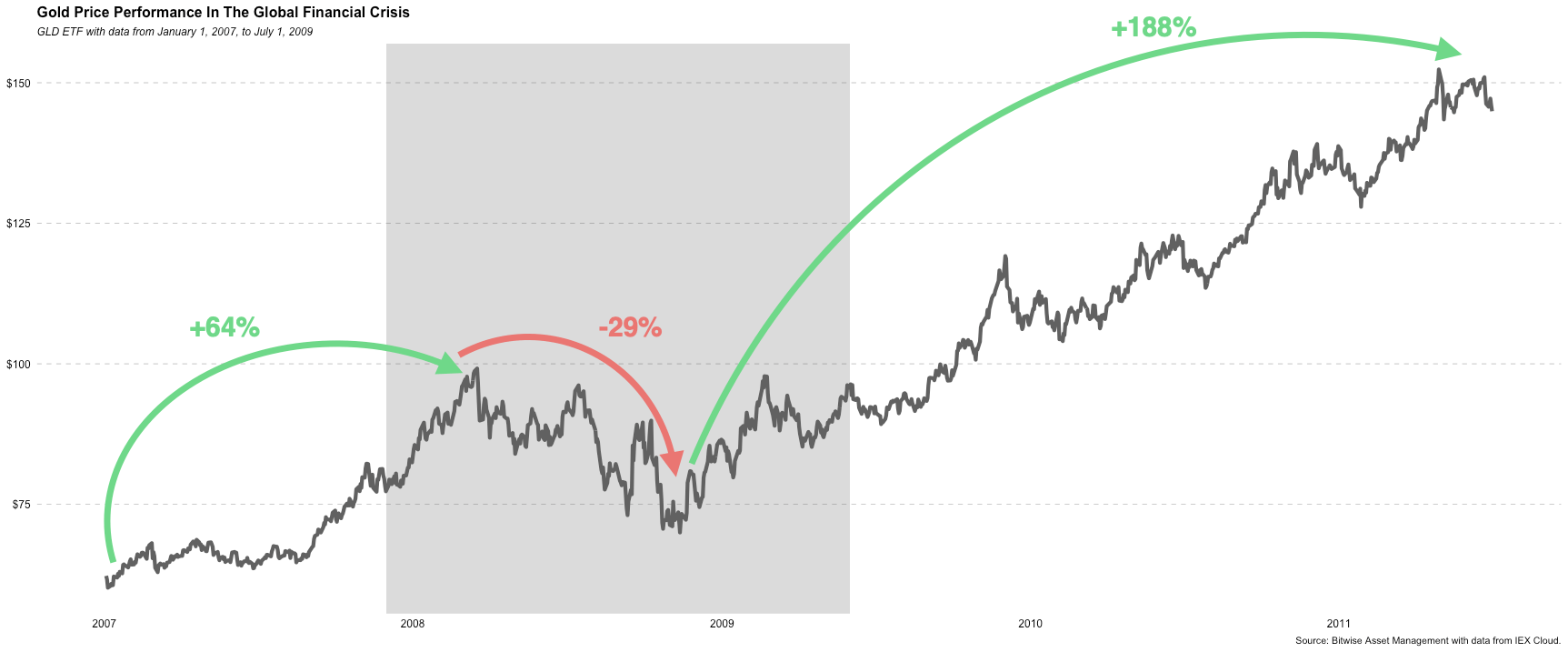

As CryptoSlate previously reported, gold demonstrated a close correlation with stocks in the early days of past financial crises. As time passed, gold broke out of the correlation, ultimately outperforming stocks.

Bitwise Global Head of Research Matt Hougan said in a letter to investors that crypto may see a similar pattern as gold, which makes the medium to long-term trend of the asset class highly optimistic.

Real demand, real buyers in crypto

In 2008, after the subprime mortgage crisis swept across the U.S. causing financial wreckage, all asset classes plunged in a short period of time.

In the next 12 months that followed, the price of gold increased sharply, making 2009 to 2011 the best performing years in gold’s history.

Hougan wrote:

“Toward that end, we are reminded of what happened to gold following the 2008 crisis. Although the initial deflationary impact of that crisis drove gold prices down sharply, prices rebounded rapidly in 2009 and beyond as the government’s response to the crisis rippled through the system. In fact, 2009-2011 was one of the strongest three-year return periods in gold’s history.”

Bitcoin has seen a fast-forwarded version of gold’s swift recovery in the 2000s. When the U.S. equities market was still struggling to rebound, BTC began to see a firm recovery from $3,600. Within less than a month and a half, its price rose by more than two-fold.

Based on the historical performance of gold in the aftermath of crises and the rising perception of Bitcoin as digital gold, Hougan said that Bitwise Asset Management remains increasingly bullish on the intermediate and long-term outlook for crypto.

He wrote:

“It is chiefly for this reason that we are increasingly bullish on the intermediate- and long-term outlook for crypto. We are in unprecedented times, seeing anomalous and unexpected developments in financial markets, including gold, and witnessing extraordinary fiscal and monetary responses to the coronavirus pandemic. In such an environment, a small allocation to crypto in a diversified portfolio seems increasingly prudent. We are hearing this from clients, and seeing it in our inflows.”

Recovery is backed by actual retail demand

The shift in the volume of major crypto assets from futures exchanges to spot trading platforms in recent weeks has shown that the market downturn was actively bought by retail traders, rather than by existing traders in the futures market using high leverage or debt to push up the market.

The fast rebound of crypto assets, which many existing investors in the cryptocurrency market did not anticipate, could solidify the image of cryptocurrencies as a potential store of value and safe haven over the long-run.

Farside Investors

Farside Investors