Bitfinex CTO plays down reports that Tether was in trouble

Bitfinex CTO plays down reports that Tether was in trouble Bitfinex CTO plays down reports that Tether was in trouble

Paolo Ardoino addressed the crypto community on May 12 to reassure investors that Tether was never under threat.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

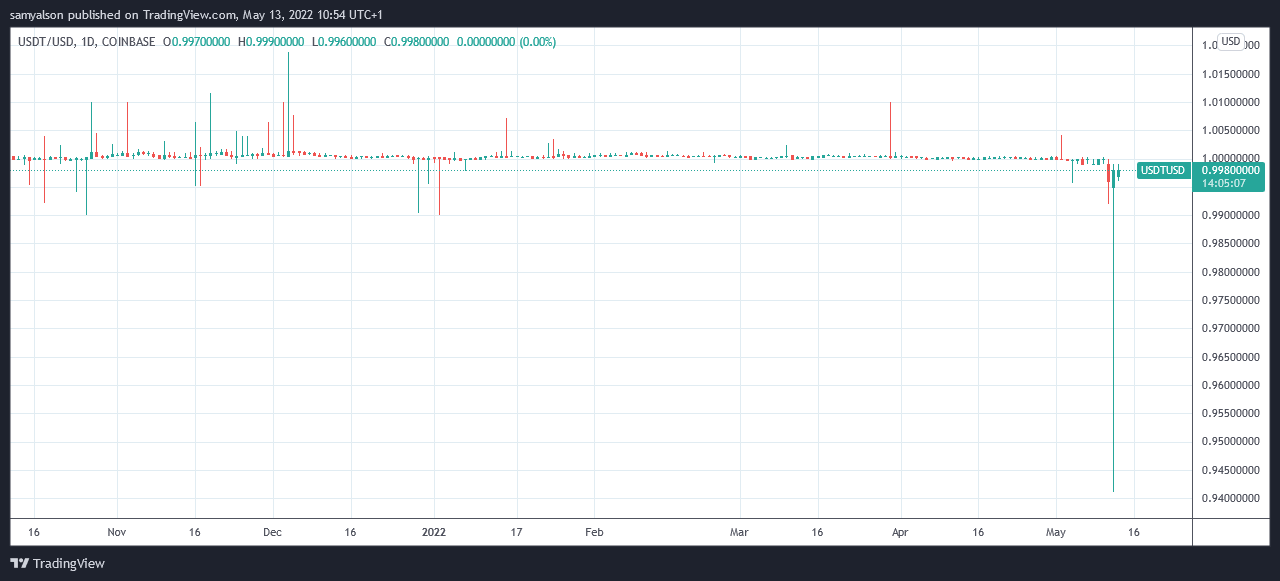

During a Twitter Spaces conversation on May 12, Bitfinex CTO Paolo Ardoino dismissed reports that Tether was in trouble. In the early hours of May 12, USDT had shown signs of de-pegging, as its price dipped as low as $0.9410.

With markets still reeling from Terra UST losing its $1 peg, a similar situation for Tether could have set off a crypto ice age.

Tether is the industry’s biggest stablecoin by market cap and most paired, meaning the majority of liquidity in crypto markets flows through USDT.

Critics say events of this week highlight the fragility of private stablecoins. Given the loss of billions via the UST fiasco, authorities say stricter rules on stablecoins will be coming.

Tether recovers

Ardoino sought to reassure investors, despite the drama, by saying ‘the peg was not broken.’ He referred to the firm’s ability to redeem tokens instead of its price on exchanges.

USDT holders can redeem their tokens, on the Tether website, for $1 per token. Even though exchange prices were sinking, token holders were still able to cash out at face value, minus verification and withdrawal fees,

Ardoino said, on May 12, the firm was sufficiently liquid to redeem $600 million of USDT with no problems. As USDT is a fiat-backed stablecoin, a broken peg refers to the inability to redeem tokens at face value.

“It would have been broken if Tether didn’t honor redemption at $1.”

Soon after the Spaces conversation ended, the price of USDT wicked upwards to close the day at $0.9955, much to the relief of the crypto community.

The incident was another major test of investors’ nerves, which were already heavily frayed following the loss of billions via the Terra ecosystem.

Stablecoins in the spotlight

Commenting on the situation, SEC Commissioner Hester Peirce, speaking in a live panel debate hosted by the Official Monetary and Financial Institutions Forum, said this week’s events had forced regulators to sit up and pay closer attention to stablecoins.

Peirce did not detail what this could mean precisely, only that potential regulation should allow for a ‘trial and error’ framework.

“There are different potential options for approaching stablecoins…and with experimentation, we need to allow room for there to be failure.”

CryptoQuant

CryptoQuant