Bitfinex Bitcoin whale hints recent BTC rally to $9,850 is manipulated and unsustainable

Bitfinex Bitcoin whale hints recent BTC rally to $9,850 is manipulated and unsustainable Bitfinex Bitcoin whale hints recent BTC rally to $9,850 is manipulated and unsustainable

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Joe007, a well-known whale who trades with massive size, hinted that the recent Bitcoin rally to $9,800 is manipulated.

According to the Bitfinex Leaderboard, Joe007 has traded $68 million in volume in the past week alone.

Why is the Bitcoin upsurge manipulated?

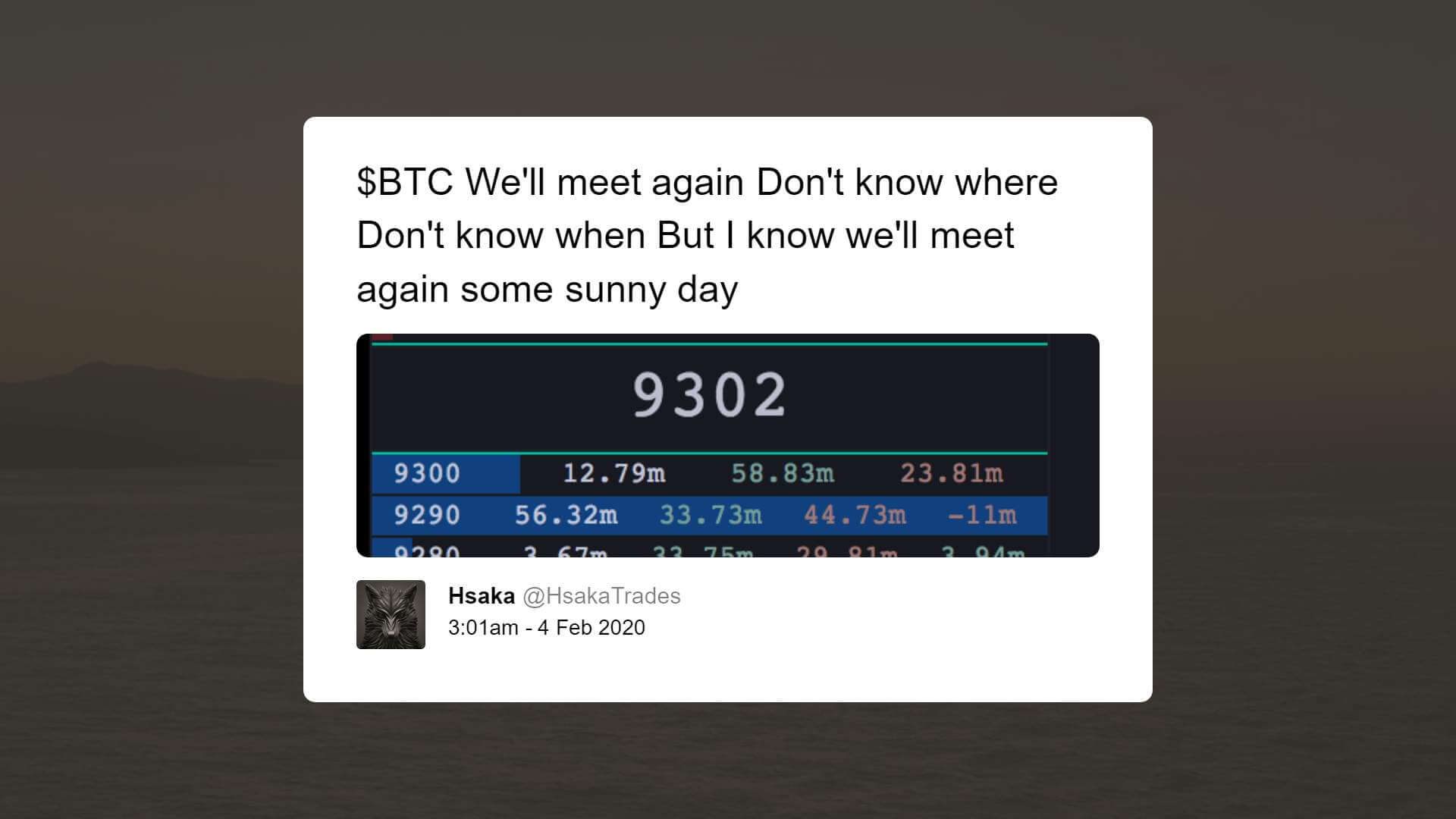

Ever since the Bitcoin price was at around $8,300, major platforms like BitMEX would see so-called “spoof orders” show up. A spoof order refers to a temporary large order, usually an unusually big buy order, to uplift the market and lead a short-term price spike.

Every time the Bitcoin price was testing an important support level, a big spoof order emerged and further pushed the market upwards.

When asked about the spoof orders pushing the market up significantly in a short time frame, Joe007 said the market never learns.

The trader said:

“Because the people don’t think for themselves, don’t bother to collect and analyze primary sources, and just try to outrun the (mostly imaginary) herd. Which manipulators use to their full advantage.”

Earlier in the week, Joe007 suggested that there is not enough fiat inflow into the bitcoin market to describe the recent upsurge as an organic price movement.

But it doesn’t necessarily mean the BTC rally will stop

Even if the basis of the rally was based on manipulation with large spoof orders, it does not mean the rally cannot be sustained for a longer period.

Historically, both pullbacks and rallies have lasted longer than the expectations of analysts, and a market top could drag on before it begins to correct. Moreover, manipulation from whales could help drive a fake rally but if retail investors begin to enter in the midst of it, it can quickly turn into a real rally in the medium-term.

Joe007 noted:

“Cryptogamblers keep tens of billions of notional value in shitcoins and somehow still expect someone to pump them up 1000%+. Where do you think the money coming from to ensure your mad gains? There doesn’t seem to be enough fiat inflow to pump BTC even.”

The narrative around the cryptocurrency market currently revolves around the highly anticipated bitcoin block reward halving that is set to occur in May.

As such, the possibility that an attempt to manipulate the market into a short-term upsurge by whales could actually turn into an organic rally still exists.

For the most part, the recent rally of bitcoin to $9,850 has been front-run by altcoins with major cryptocurrencies like Ethereum and Bitcoin Cash surging by almost 50 percent.

From their record highs, Ethereum and Bitcoin Cash remain down by 84 percent and 88.4 percent respectively. As such, until the Bitcoin price cleanly breaks out of $10,000, where most of the large spot sell orders are placed, it would be early to call the start of an actual altcoin season.

Farside Investors

Farside Investors