Bitcoin: should it be your safe word?

Bitcoin: should it be your safe word? Bitcoin: should it be your safe word?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

As the new year dawned, war tensions increased, and investors turned to “safe havens” to protect assets and find speculative alpha. During this time, gold responded strongly; low-yielding US Treasuries did not. This suggests investors are potentially looking for global safe haven refuges untethered to the whims of a singular country’s central bank.

Bitcoin can check this box and does grab attention, with many claiming its short-term price action acting as a safe haven asset. But has it achieved this vaunted global role? Let’s look closer.

As 2020 kicked-in, The Wall Street Journal reported that gold “jumped to its highest level in almost seven years with tensions between U.S. and Iran escalating, the latest example of investors favoring the safe-haven metal to protect against a market downturn.” The article went on to cite CFTC data showing hedge funds and other speculators ramped up bets on gold prices for the third consecutive week, to the highest level in months.

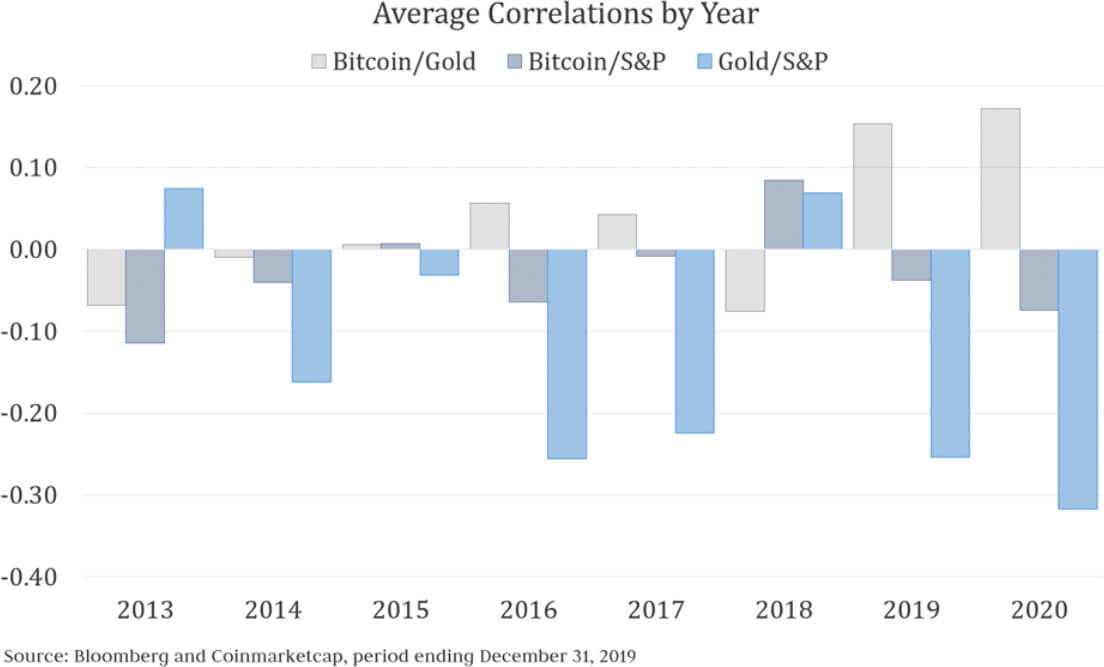

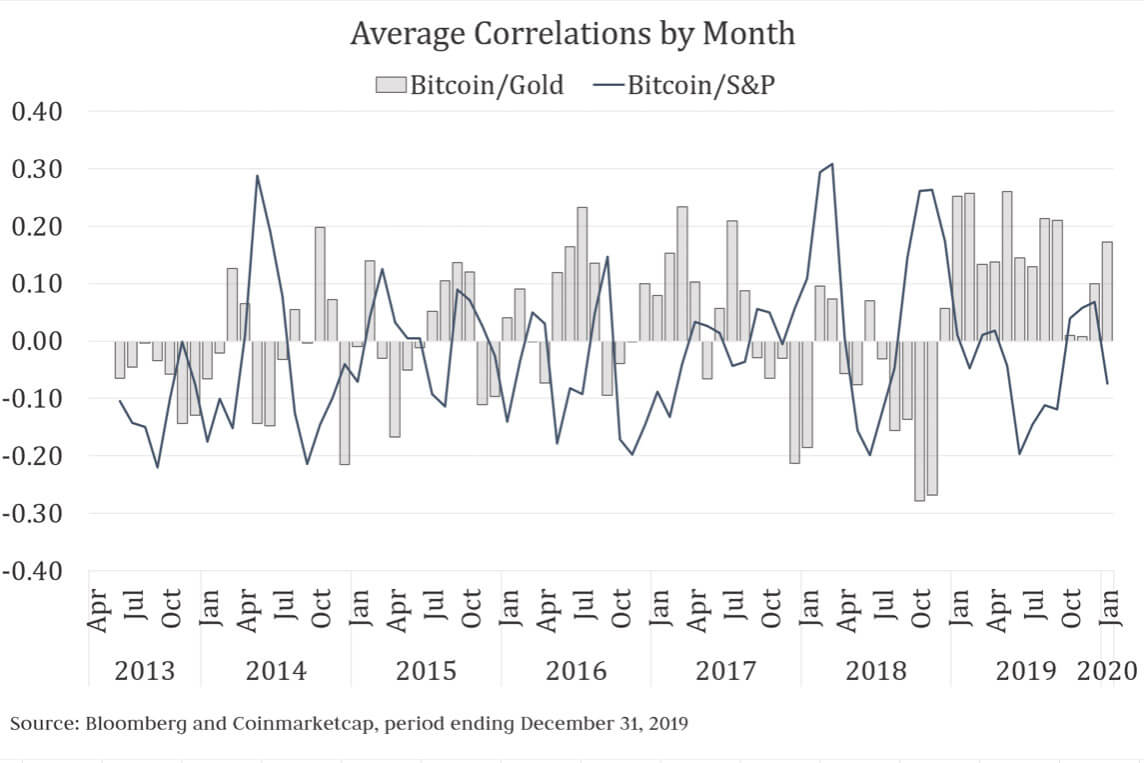

Mirroring the shiny metal and in the same early days of the new decade, Bitcoin achieved $8,300 causing many Bitcoin Bulls to claim “Safe Haven” victory. However, despite this very short-term correlation, the longer-term data has suggested no correlation (or anti-correlation) to the S&P and no long-term correlation to gold.

Although this parallel rise and fall of Bitcoin and gold in the same fundamentals-driven ecosystem suggests a like role for these two asset classes – investors in Bitcoin should be cautious hanging their hat solely on this thesis as with the longest bull market on record Bitcoin (as well as other assets in the age of Modern Monetary Theory) hasn’t been fully stressed tested during prolonged times of economic distress. Bitcoin also has an interesting and often uncertainly evolving regulatory framework that makes it less of a safe haven in its current form — largely because it’s not as efficiently priced due to lack of access from large household name institutions.

Safe havens provide refuge or security. Safe-haven assets ideally are uncorrelated or negatively correlated to the overall market during periods of distress. They must be liquid as In risk-off scenarios, gold is a tangible, hard asset that’s easily bought and sold at quantity, avoids country-specific currency exposure, and is globally transparently priced, regulated and safely traded in multiple marketplaces amongst sophisticated investors. Gold has also been around for thousands of years with a more certain regulatory status and better-documented history of safe haven and inflation hedge status.

Looking towards Bitcoin there are many properties it shares with Gold that share aspects of a Safe Haven. A finite quantity to be mined and a worldwide distribution network that may not be as sensitive to the whims of one country. The scarce supply and wild trading movements almost echo the recent price action of Rhodium — a much more volatile and rare precious metal than gold. However, there are also many things (not including its youth) that it must overcome to become a true Safe Haven Vehicle.

The market structure right now is largely driven by an unregulated futures exchange allowing users incredible amounts of leverage with minimal insight into the black box of how this centralized risk book is managed. This is not the type of marketplace your mutual fund manager would ever touch. Although it can happen in other markets, the price can be dictated by large cartels of traders that can collude to manipulate prices.

Unlike gold, given the fragmented and evolving regulatory status, this isn’t as easy for the market to police and ultimately mitigate. Furthermore, the standard deviation of moves is still large meaning if the trade works, it will really work… and if it doesn’t it could be very damaging. This liquidity struggle is because many of the nascent market participants will pull or massively degrade their liquidity during times of volatility – when investors need it the most. This happens in every market, but specifically to Bitcoin, the fundamental buyers are largely traders and speculators – acting as a foil to gold whereby over 50 percent of the mined product every year goes to Jewelry production.

We also need to be careful myopically looking at this from a solely US perspective. What might be considered a safe haven in countries with Capital Controls, rampant double-digit inflation, etc. might not be purely a safe haven to investors in jurisdictions that have more stable financial regimes. We’ve seen similar bumps in Bitcoin price during localized periods of distress. While we can’t count this out, the protective bid that it offers will be much smaller than those of large institutions transacting in an effort to hedge trillions of dollars of invested capital.

Bitcoin, in its infancy, is still trying to find its place in the world. While it has many Safe Haven-type properties, it is still largely a vehicle of speculation. I’m certainly not saying it will never become a safe haven and/or that people should avoid researching this asset altogether. What I am however suggesting is that short term correlations should not be used as a basis for panic buying an asset.

When positioning one’s portfolio for the future it’s important to learn as much as possible about fundamentals, valuations, and catalysts. While Gold and Bitcoin share some similar traits, the use cases, catalyst differentials and ultimate status within large systemic institutions should be considered more than short term trading movements. I’m hopeful that as Bitcoin continues to grow-up and evolve it will check more of these boxes, but in the short term, it’s only a small piece of my portfolio, allocated in-line with the types of other assets that wouldn’t surprise me to check one day and be -50 percent or up 100 percent.

That seems far more exciting than safe.

Deribit

Deribit