Bitcoin blasts through $32,300: What do analysts think about BTC in Q1 2021?

Bitcoin blasts through $32,300: What do analysts think about BTC in Q1 2021? Bitcoin blasts through $32,300: What do analysts think about BTC in Q1 2021?

Photo by Ray Hennessy on Unsplash

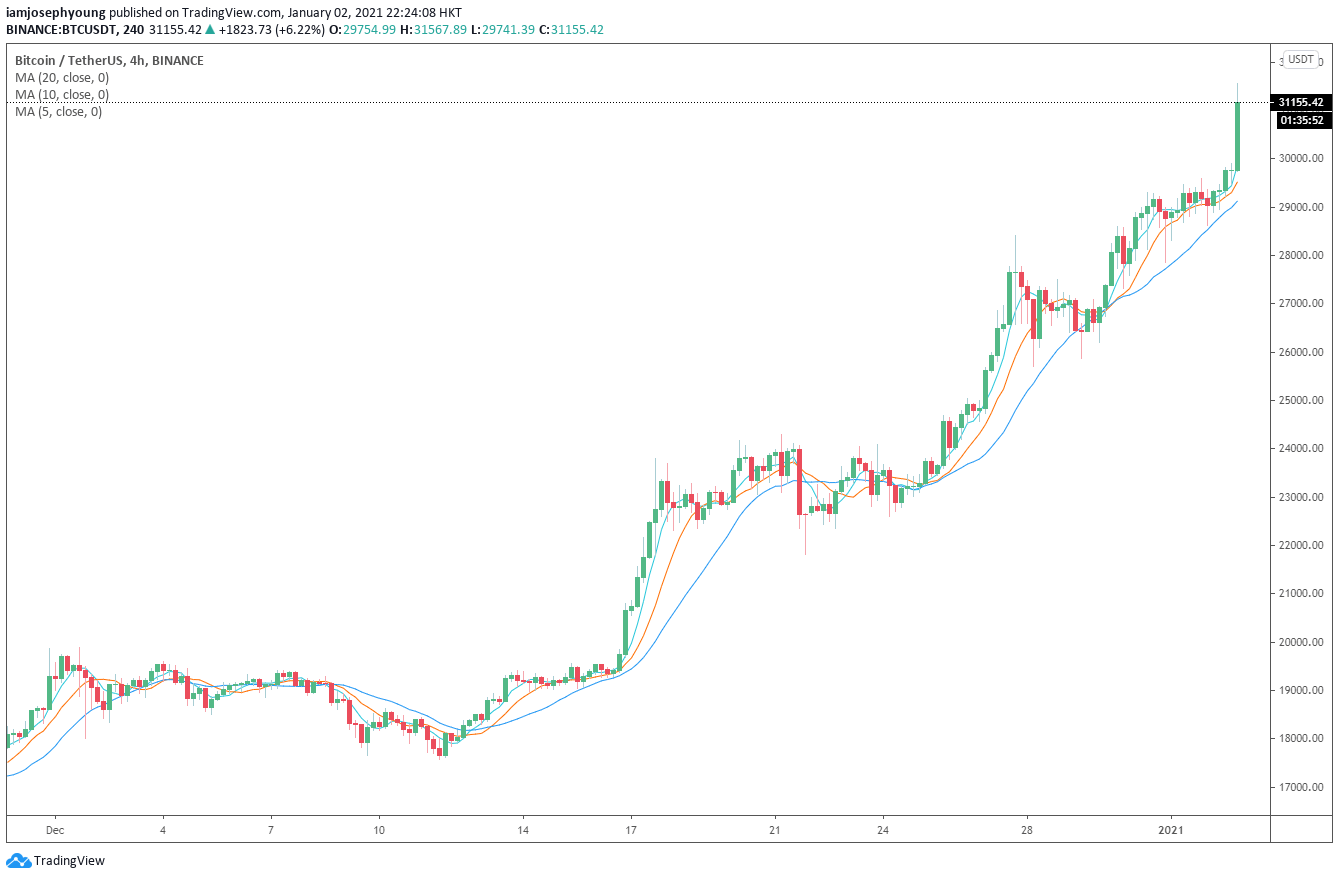

The price of Bitcoin has surpassed $32,300 on Coinbase, reaching a new all-time high after blasting past $32,000.

Following BTC’s surprisingly strong rally, analysts believe the momentum of Bitcoin is sufficient to see another leg up.

Analyst: Bitcoin could be heading to $47,000 next

According to trader and technical analyst Nik Patel, Bitcoin could be heading to $47,000 in the near term.

Patel explained that a potential scenario for Bitcoin would be to rise to around $47,000, pull back to $29,000, and see another major rally. He said:

“Potential scenario if price plays out like the previous cycle, Broke straight through the 1.618 extension into 2.618 at $3k before finding resistance, which would be $47k now (confluence with $1trn market cap). 39% drop from there would take us back to $29k before moon.”

Michael van de Poppe, a full-time trader at the Amsterdam Stock Exchange, similarly said that Bitcoin is not overvalued at $30,000.

The trader emphasized that “many people” are doubting whether Bitcoin is overpriced, and 2021 would demonstrate the strength of BTC’s momentum. He wrote:

“$30,000 reached, while many people are still arguing that #Bitcoin is overvalued. It’s not and this year will show the actual strength of $BTC. Good part; $ETH is also showing indications of strength as it reached a new high. Great year for crypto.”

The $30,000 price level has always been a major psychological level for the Bitcoin price. As such, there were large sell orders filed in the $29,900 to $30,000 range.

But, as the price of Bitcoin began to increase with large buy orders in the spot market, the sell wall eventually weakened.

This trend coincided with the mass liquidation of short contracts, causing BTC to surge rapidly within a short time frame.

What could push BTC further in 2021?

A pseudonymous analyst noted that institutional investors, like Guggenheim, are not ready to invest in Bitcoin despite showing interest in it.

In December, Guggenheim reserved the right to purchase a portion of the Grayscale Bitcoin Trust to gain exposure to BTC.

However, the analyst said that the deal is not effective with the U.S. Securities and Exchange Commission. The analyst explained:

“As BTC nears 30k, Guggenheim is still not effective with the SEC. That means they’ve been on the sidelines this entire run. This must be very frustrating, having identified BTC as a potential investment much lower, then doing all the internal research. They’re not alone.”

There could be more institutional investors, like Guggenheim, who are still sitting on the sidelines to gain exposure to Bitcoin.

If these institutions continue to enter into the Bitcoin market in the first quarter, it could serve as a new catalyst for BTC in the foreseeable future.

Bitcoin Market Data

At the time of press 4:12 pm UTC on Jan. 2, 2021, Bitcoin is ranked #1 by market cap and the price is up 8.72% over the past 24 hours. Bitcoin has a market capitalization of $592.81 billion with a 24-hour trading volume of $47.13 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:12 pm UTC on Jan. 2, 2021, the total crypto market is valued at at $826.47 billion with a 24-hour volume of $181.24 billion. Bitcoin dominance is currently at 71.72%. Learn more about the crypto market ›

Farside Investors

Farside Investors